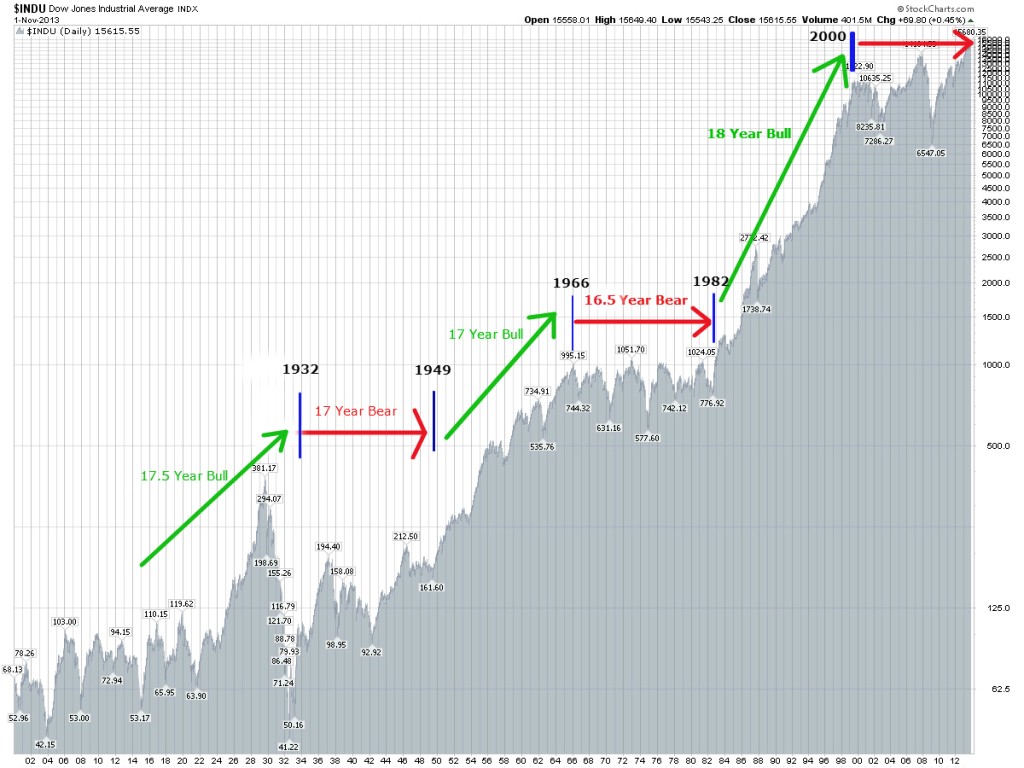

Panda...correlation is not cause. The key is to understand what drove those indicators. The fact that you had x years in between is not a real driver and you had mini jumps all throughout.

Plus, depending on where you slice the data, your 17 year bear, I'd argue that it was a massive 17 year Bull when you look at the ultimate bottom and than eventual run-up in to the 1940's. For example, think about what drove about what overall business trends which resulted in growth, etc. Better you understand that and the better you truly understand what could potentially happen (even than, my thoughts are, too damn tough to predict, only supposed constant is eventual increases and you just have to hope that holds out, if it doesn't, we all have far worse problems).