You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How soon until Bitcoin crashes?

- Thread starter Liar Loan

- Start date

NEW -> Contingent Buyer Assistance Program

Cryptography and distributed ledger technology is a lot more difficult to comprehend (let alone implement) than HTML

Also, I think we tend to look back at the internet as happening a lot faster than it actually did. When we could first access the internet (say 94-95) it was nothing more than a bunch of chat rooms. That was it, literally...chat rooms. That lasted for about 2-3 years before we saw better applications come online, such as fantasy baseball on the internet, etc. The dot-com boom followed. We are currently in the equivalent of 1994.

"The growth of the Internet will slow drastically, as the flaw in ?Metcalfe?s law??which states that the number of potential connections in a network is proportional to the square of the number of participants?becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet?s impact on the economy has been no greater than the fax machine?s.?

- Paul Krugman 1998

It's a good thing he has his job shilling for the Democrat party because he's made some atrocious calls over the years.

Yeah I get it, I was there using "pine" as my first email program (not sure many remember what that was).

But internet did make things easier -- the protocol layer was the part which made things run smoothly and the application layer which came later made everything bloated and clunky (the grossest iteration of that is companies like facebook and google that are nothing but centralized aggregators)

Whereas bitcoin is all about the protocol layer itself and here is where I have problems -- the protocol layer is an energy and efficiency hog. maybe that will change. but the need to update the entire blockchain each time which is what creates trust without centralized -- also limits its bandwidth.

And as to Krugman, history is littered with people making wrong predictions all the time, he is just a good punching bag for people on the right . Here are just a few a quick google search would reveal --

"I think there is a world market for maybe five computers."

Thomas Watson, president of IBM, 1943

"Television won't be able to hold on to any market it captures after the first six months. People will soon get tired of staring at a plywood box every night."

Darryl Zanuck, executive at 20th Century Fox, 1946

"Nuclear-powered vacuum cleaners will probably be a reality within ten years."

Alex Lewyt, president of Lewyt vacuum company, 1955

"There is no reason anyone would want a computer in their home."

Ken Olsen, founder of Digital Equipment Corporation, 1977

"Almost all of the many predictions now being made about 1996 hinge on the Internet's continuing exponential growth. But I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse."

Robert Metcalfe, founder of 3Com, 1995

"Apple is already dead."

Nathan Myhrvold, former Microsoft CTO, 1997

"Two years from now, spam will be solved."

Bill Gates, founder of Microsoft, 2004

Funny quotes...haha.

Just like the internet, it all starts with something silly and evolves into much morehttps://www.cryptokitties.co/

Not going to try and convince you about how awesome the future will be with the blockchain...haha...too much work, and I think you should come to your own conclusions.

And about Dr. Krugman, he should be considered a good punching bag for those of all political stripes.

I did some digging on this for my own benefit and came to the conclusion that what makes the blockchain secure is also what makes it inefficient

the so-called mathematical puzzles being solved are nothing but millions and millions of guessing games being played to get to the next hash outcome. But that onerous and laborious process is also what makes blockchain " unhackable " for a single entity

If they were to make it more efficient to speed it up, then it is possible someone can find a way to optimize it (in other words " hack it ") and right there the integrity of the entire blockchain collapses.

You cant have one without the other . And this is why you have these computers wasting away power equivalent of small countries energy consumption 24 / 7. .... it is simply not scalable without also making it open to hacking attacks .

From what I understand, the "puzzles" were easier to begin with. As people threw more processing power at them, from CPUs to GPUs and now FPGA and finally ASIC... and more people mined, the time to guess the new hash has to be recalculated so that the time to produce new coins doesn't exhaust the limit before it's due (there is supposed to be a cap of 21 million bitcoin by around 2024).

So my concern isn't the security of it, it's the question of the initial start of it and who benefited most. Almost like a Ponzi (or even MLM) where the people at the top can reap all the rewards.

While decentralized currency is ideal in that no one entity controls it, the other problem, as we have seen, is there is no system to keep volatile valuation in check. At least with stocks, value is based on the profitability and performance of a company combined with demand, but for bitcoin... it's just demand and that's scary to me. Maybe it's like futures or VIX (USC's currency) but that's also why I don't get into those things either.

What I'm more interested in is the use of blockchain technology as a database and how it can be applied in other areas.

He is one crazy dude. I watched him in the Libertarian debates for president and he was definitely the comedic relief. It doesn't surprise me at all that he is a Bitcoin enthusiast because he basically believes there should be no governments. I think he was also wanted for murder in South America, but he claims it was all a big misunderstanding.

Now's your chance.. The greatest bubble of all time just dropped below $8,500 on news that Google will no longer allow advertising of cryptocurrencies. There is also rumor of more Chinese regulation coming down the pipe.

Just like I previously said in my previous posts regarding the crackdown.

fortune11 said:Following this crypto and blockchain craze for some time now and while I get the concept , still cant get my arms around why is it not taking off yet .

I mean if this thing was really that useful, you would see geeks and techies quietly installing this technology and putting it to work stealthily just to get stuff done. I saw it happen all the time back int he 90s with internet tech.

All I see is big announcements and launches and consortium this and consortium that and ICOs and what not - exactly the type of stuff that should not be happening and feels more like a "check the box " thing so many CTOs can make their bosses go away and tell their boards, hey we are also cool with this stuff.

mining etc cost thousands of $$ in money and their is no intrinsic value - so unless someone , somewhere is getting very good returns on their investment with this thing, feels very flaky.

I am not the type to be dismissive of new things automatically but I would have liked to see more "underground " progress here in terms of applicability , which I just don't. Maybe someone can educate me.

Cryptography and distributed ledger technology is a lot more difficult to comprehend (let alone implement) than HTML

Also, I think we tend to look back at the internet as happening a lot faster than it actually did. When we could first access the internet (say 94-95) it was nothing more than a bunch of chat rooms. That was it, literally...chat rooms. That lasted for about 2-3 years before we saw better applications come online, such as fantasy baseball on the internet, etc. The dot-com boom followed. We are currently in the equivalent of 1994.

"The growth of the Internet will slow drastically, as the flaw in ?Metcalfe?s law??which states that the number of potential connections in a network is proportional to the square of the number of participants?becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet?s impact on the economy has been no greater than the fax machine?s.?

- Paul Krugman 1998

Liar Loan

Well-known member

Halos said:"The growth of the Internet will slow drastically, as the flaw in ?Metcalfe?s law??which states that the number of potential connections in a network is proportional to the square of the number of participants?becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet?s impact on the economy has been no greater than the fax machine?s.?

- Paul Krugman 1998

It's a good thing he has his job shilling for the Democrat party because he's made some atrocious calls over the years.

Halos said:fortune11 said:Following this crypto and blockchain craze for some time now and while I get the concept , still cant get my arms around why is it not taking off yet .

I mean if this thing was really that useful, you would see geeks and techies quietly installing this technology and putting it to work stealthily just to get stuff done. I saw it happen all the time back int he 90s with internet tech.

All I see is big announcements and launches and consortium this and consortium that and ICOs and what not - exactly the type of stuff that should not be happening and feels more like a "check the box " thing so many CTOs can make their bosses go away and tell their boards, hey we are also cool with this stuff.

mining etc cost thousands of $$ in money and their is no intrinsic value - so unless someone , somewhere is getting very good returns on their investment with this thing, feels very flaky.

I am not the type to be dismissive of new things automatically but I would have liked to see more "underground " progress here in terms of applicability , which I just don't. Maybe someone can educate me.

Cryptography and distributed ledger technology is a lot more difficult to comprehend (let alone implement) than HTML

Also, I think we tend to look back at the internet as happening a lot faster than it actually did. When we could first access the internet (say 94-95) it was nothing more than a bunch of chat rooms. That was it, literally...chat rooms. That lasted for about 2-3 years before we saw better applications come online, such as fantasy baseball on the internet, etc. The dot-com boom followed. We are currently in the equivalent of 1994.

"The growth of the Internet will slow drastically, as the flaw in ?Metcalfe?s law??which states that the number of potential connections in a network is proportional to the square of the number of participants?becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet?s impact on the economy has been no greater than the fax machine?s.?

- Paul Krugman 1998

Yeah I get it, I was there using "pine" as my first email program (not sure many remember what that was).

But internet did make things easier -- the protocol layer was the part which made things run smoothly and the application layer which came later made everything bloated and clunky (the grossest iteration of that is companies like facebook and google that are nothing but centralized aggregators)

Whereas bitcoin is all about the protocol layer itself and here is where I have problems -- the protocol layer is an energy and efficiency hog. maybe that will change. but the need to update the entire blockchain each time which is what creates trust without centralized -- also limits its bandwidth.

And as to Krugman, history is littered with people making wrong predictions all the time, he is just a good punching bag for people on the right . Here are just a few a quick google search would reveal --

"I think there is a world market for maybe five computers."

Thomas Watson, president of IBM, 1943

"Television won't be able to hold on to any market it captures after the first six months. People will soon get tired of staring at a plywood box every night."

Darryl Zanuck, executive at 20th Century Fox, 1946

"Nuclear-powered vacuum cleaners will probably be a reality within ten years."

Alex Lewyt, president of Lewyt vacuum company, 1955

"There is no reason anyone would want a computer in their home."

Ken Olsen, founder of Digital Equipment Corporation, 1977

"Almost all of the many predictions now being made about 1996 hinge on the Internet's continuing exponential growth. But I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse."

Robert Metcalfe, founder of 3Com, 1995

"Apple is already dead."

Nathan Myhrvold, former Microsoft CTO, 1997

"Two years from now, spam will be solved."

Bill Gates, founder of Microsoft, 2004

fortune11 said:Halos said:fortune11 said:Following this crypto and blockchain craze for some time now and while I get the concept , still cant get my arms around why is it not taking off yet .

I mean if this thing was really that useful, you would see geeks and techies quietly installing this technology and putting it to work stealthily just to get stuff done. I saw it happen all the time back int he 90s with internet tech.

All I see is big announcements and launches and consortium this and consortium that and ICOs and what not - exactly the type of stuff that should not be happening and feels more like a "check the box " thing so many CTOs can make their bosses go away and tell their boards, hey we are also cool with this stuff.

mining etc cost thousands of $$ in money and their is no intrinsic value - so unless someone , somewhere is getting very good returns on their investment with this thing, feels very flaky.

I am not the type to be dismissive of new things automatically but I would have liked to see more "underground " progress here in terms of applicability , which I just don't. Maybe someone can educate me.

Cryptography and distributed ledger technology is a lot more difficult to comprehend (let alone implement) than HTML

Also, I think we tend to look back at the internet as happening a lot faster than it actually did. When we could first access the internet (say 94-95) it was nothing more than a bunch of chat rooms. That was it, literally...chat rooms. That lasted for about 2-3 years before we saw better applications come online, such as fantasy baseball on the internet, etc. The dot-com boom followed. We are currently in the equivalent of 1994.

"The growth of the Internet will slow drastically, as the flaw in ?Metcalfe?s law??which states that the number of potential connections in a network is proportional to the square of the number of participants?becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet?s impact on the economy has been no greater than the fax machine?s.?

- Paul Krugman 1998

Yeah I get it, I was there using "pine" as my first email program (not sure many remember what that was).

But internet did make things easier -- the protocol layer was the part which made things run smoothly and the application layer which came later made everything bloated and clunky (the grossest iteration of that is companies like facebook and google that are nothing but centralized aggregators)

Whereas bitcoin is all about the protocol layer itself and here is where I have problems -- the protocol layer is an energy and efficiency hog. maybe that will change. but the need to update the entire blockchain each time which is what creates trust without centralized -- also limits its bandwidth.

And as to Krugman, history is littered with people making wrong predictions all the time, he is just a good punching bag for people on the right . Here are just a few a quick google search would reveal --

"I think there is a world market for maybe five computers."

Thomas Watson, president of IBM, 1943

"Television won't be able to hold on to any market it captures after the first six months. People will soon get tired of staring at a plywood box every night."

Darryl Zanuck, executive at 20th Century Fox, 1946

"Nuclear-powered vacuum cleaners will probably be a reality within ten years."

Alex Lewyt, president of Lewyt vacuum company, 1955

"There is no reason anyone would want a computer in their home."

Ken Olsen, founder of Digital Equipment Corporation, 1977

"Almost all of the many predictions now being made about 1996 hinge on the Internet's continuing exponential growth. But I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse."

Robert Metcalfe, founder of 3Com, 1995

"Apple is already dead."

Nathan Myhrvold, former Microsoft CTO, 1997

"Two years from now, spam will be solved."

Bill Gates, founder of Microsoft, 2004

Funny quotes...haha.

Just like the internet, it all starts with something silly and evolves into much morehttps://www.cryptokitties.co/

Not going to try and convince you about how awesome the future will be with the blockchain...haha...too much work, and I think you should come to your own conclusions.

And about Dr. Krugman, he should be considered a good punching bag for those of all political stripes.

irvinehomeowner

Well-known member

The idea of the blockchain and shared ledgers is great... what is suspect is the mining of coins and how those who got in first... or even created the first bitcoin were able to do so with less effort than today.

My spider sense also tingles when we don't really know who invented bitcoin and how much currency they have to begin with.

And like IPOs, there are so many ICOs going on... it's hard to tell what is legit or not.

I like the idea of the blockchain... just not this currency tied to it.

My spider sense also tingles when we don't really know who invented bitcoin and how much currency they have to begin with.

And like IPOs, there are so many ICOs going on... it's hard to tell what is legit or not.

I like the idea of the blockchain... just not this currency tied to it.

irvinehomeowner said:The idea of the blockchain and shared ledgers is great... what is suspect is the mining of coins and how those who got in first... or even created the first bitcoin were able to do so with less effort than today.

My spider sense also tingles when we don't really know who invented bitcoin and how much currency they have to begin with.

And like IPOs, there are so many ICOs going on... it's hard to tell what is legit or not.

I like the idea of the blockchain... just not this currency tied to it.

I did some digging on this for my own benefit and came to the conclusion that what makes the blockchain secure is also what makes it inefficient

the so-called mathematical puzzles being solved are nothing but millions and millions of guessing games being played to get to the next hash outcome. But that onerous and laborious process is also what makes blockchain " unhackable " for a single entity

If they were to make it more efficient to speed it up, then it is possible someone can find a way to optimize it (in other words " hack it ") and right there the integrity of the entire blockchain collapses.

You cant have one without the other . And this is why you have these computers wasting away power equivalent of small countries energy consumption 24 / 7. .... it is simply not scalable without also making it open to hacking attacks .

irvinehomeowner

Well-known member

fortune11 said:irvinehomeowner said:The idea of the blockchain and shared ledgers is great... what is suspect is the mining of coins and how those who got in first... or even created the first bitcoin were able to do so with less effort than today.

My spider sense also tingles when we don't really know who invented bitcoin and how much currency they have to begin with.

And like IPOs, there are so many ICOs going on... it's hard to tell what is legit or not.

I like the idea of the blockchain... just not this currency tied to it.

I did some digging on this for my own benefit and came to the conclusion that what makes the blockchain secure is also what makes it inefficient

the so-called mathematical puzzles being solved are nothing but millions and millions of guessing games being played to get to the next hash outcome. But that onerous and laborious process is also what makes blockchain " unhackable " for a single entity

If they were to make it more efficient to speed it up, then it is possible someone can find a way to optimize it (in other words " hack it ") and right there the integrity of the entire blockchain collapses.

You cant have one without the other . And this is why you have these computers wasting away power equivalent of small countries energy consumption 24 / 7. .... it is simply not scalable without also making it open to hacking attacks .

From what I understand, the "puzzles" were easier to begin with. As people threw more processing power at them, from CPUs to GPUs and now FPGA and finally ASIC... and more people mined, the time to guess the new hash has to be recalculated so that the time to produce new coins doesn't exhaust the limit before it's due (there is supposed to be a cap of 21 million bitcoin by around 2024).

So my concern isn't the security of it, it's the question of the initial start of it and who benefited most. Almost like a Ponzi (or even MLM) where the people at the top can reap all the rewards.

While decentralized currency is ideal in that no one entity controls it, the other problem, as we have seen, is there is no system to keep volatile valuation in check. At least with stocks, value is based on the profitability and performance of a company combined with demand, but for bitcoin... it's just demand and that's scary to me. Maybe it's like futures or VIX (USC's currency) but that's also why I don't get into those things either.

What I'm more interested in is the use of blockchain technology as a database and how it can be applied in other areas.

All aboard!

Bitcoin Price Will Hit $1 Million by 2020 Says John McAfee

How high can cryptocurrency mania go? Bitcoin bull and anti-virus software pioneer John McAfee has revised his earlier prediction with a claim that bitcoin's price could hit $1 million by the end of 2020.

On July 17, 2017, McAfee made a big claim. He predicted that 1 bitcoin will be worth $5,000 per token by the end of 2017. Bitcoin's price hit a high of $19,303.74 on December 17, 2017 and closed the year at $12,629.81.

Using the same prediction model, McAfee previously claimed that bitcoin will hit $500,000 by the end of 2020. Since BTC prices surged much faster in 2017 than he had projected, McAfee revised his claim upward to $1 million by 2020.

https://www.investopedia.com/news/mcafee-tracker-predicts-1-bitcoin1m-2020/

Liar Loan

Well-known member

Kings said:All aboard!

Bitcoin Price Will Hit $1 Million by 2020 Says John McAfee

How high can cryptocurrency mania go? Bitcoin bull and anti-virus software pioneer John McAfee has revised his earlier prediction with a claim that bitcoin's price could hit $1 million by the end of 2020.

On July 17, 2017, McAfee made a big claim. He predicted that 1 bitcoin will be worth $5,000 per token by the end of 2017. Bitcoin's price hit a high of $19,303.74 on December 17, 2017 and closed the year at $12,629.81.

Using the same prediction model, McAfee previously claimed that bitcoin will hit $500,000 by the end of 2020. Since BTC prices surged much faster in 2017 than he had projected, McAfee revised his claim upward to $1 million by 2020.

https://www.investopedia.com/news/mcafee-tracker-predicts-1-bitcoin1m-2020/

He is one crazy dude. I watched him in the Libertarian debates for president and he was definitely the comedic relief. It doesn't surprise me at all that he is a Bitcoin enthusiast because he basically believes there should be no governments. I think he was also wanted for murder in South America, but he claims it was all a big misunderstanding.

Liar Loan

Well-known member

aquabliss said:Buy at $8.5k, sell at $11k. Rinse, Wash, Repeat.

Now's your chance.. The greatest bubble of all time just dropped below $8,500 on news that Google will no longer allow advertising of cryptocurrencies. There is also rumor of more Chinese regulation coming down the pipe.

Liar Loan

Well-known member

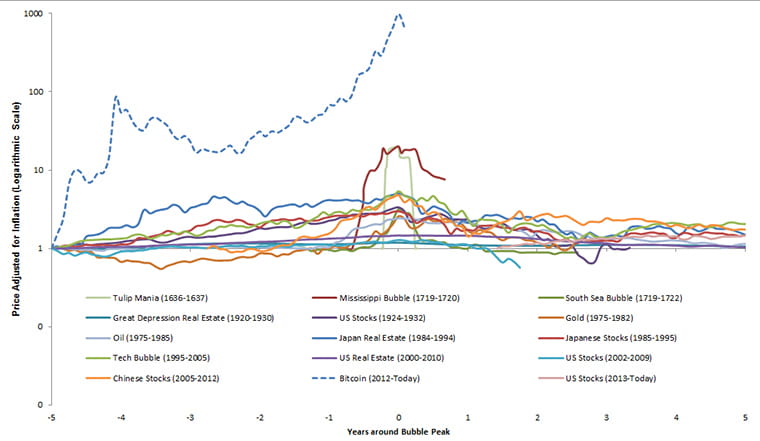

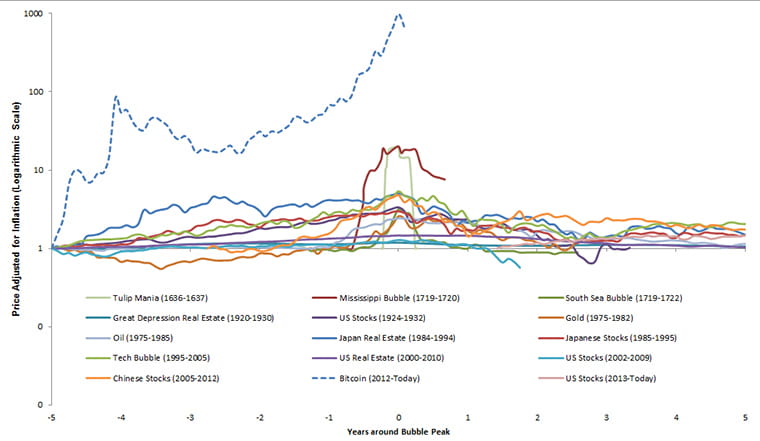

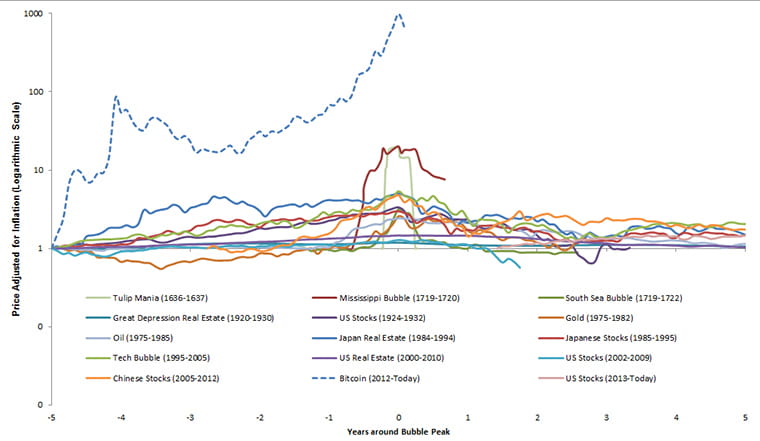

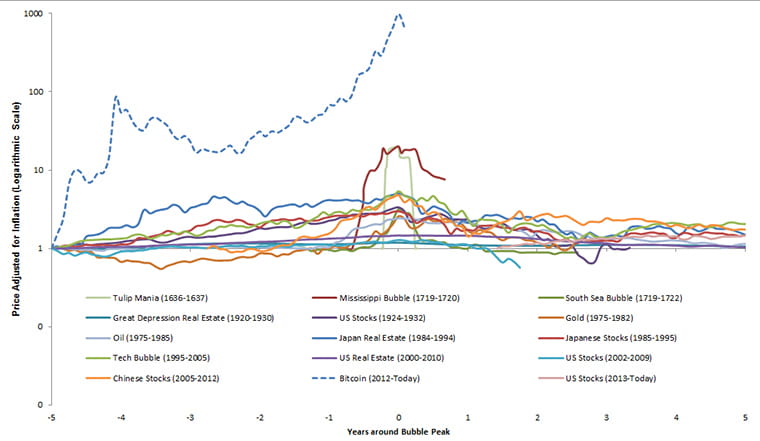

Bitcoin?s bubble behaviour

The hyperbolic price movements of bitcoin since its early 2009 inception have been very bubble-like in nature. When one compares bitcoin?s five-year price momentum (adjusted for inflation) against that of previous asset bubbles, bitcoin dwarfs the runners-up ? the Mississippi bubble of 1720 and the Amsterdam Tulip Mania of 1637. And among more recent examples, bitcoin far surpasses the IT bubble of the 1990s and the Japan bubble of the 1980s.

Moreover, bitcoin ticks all of the boxes that we consider to be essential criteria of any asset bubble:

-?New-era? thinking. Bitcoin is perceived to be an entirely new kind of currency and a monetary innovation in the internet age.

-Overtrading. Trading volumes have increased by almost fivefold in the last five years, according to BIS data.

-Ultra-easy monetary conditions. Accommodative policy is still in place globally, despite a series of rate hikes by the US Federal Reserve.

-A lack of financial regulation. The ?Wild West? bitcoin environment is only gradually being addressed by regulators around the world.

-The launch of related financial instruments. New products related to the bubbling asset class are popping up ? from CBOE and CME futures contracts to the launch of ?ICOs? (initial coin offerings).

-Rising leverage. Not only has private-sector leverage increased to record highs globally, but leveraged speculation in bitcoin is increasing.

-Swindles. Bitcoin has become the instrument of choice for many criminals, thanks to its ability to exist entirely outside of traditional banking channels.

-Significant overvaluation. Many other asset classes are pricey in today?s market, but bitcoin?s valuation seems to be without peer.

This brings us to a key question: what is the fair value of a bitcoin? In our view, its intrinsic value must be zero: a bitcoin is a claim on nobody ? in contrast to, for instance, sovereign bonds, equities or paper money ? and it does not generate any income stream. Admittedly, one could make the same argument about gold, but gold has been widely accepted by humankind as a thing of value for more than two-and-a-half thousand years ? compared to less than a decade for bitcoin.

Not a currency ? and not ESG-friendly

So if bitcoin is flawed enough not to be considered a proper asset class, can it at least serve the purpose of being a currency? We believe the answer is no for several reasons:

-First, given the high cost of conducting transactions in bitcoin, it could only be used for paying big-ticket items.

-Second, given bitcoin?s tremendous price volatility, it does not qualify as a numeraire ? a commonly accepted benchmark used to assign value to goods and services.

-Third, considering all the arguments we have previously presented, it seems all but impossible to use bitcoin as a store of value.

https://www.allianzgi.com/en/home/insights/investment-themes-and-strategy/beyond-the-bitcoin-bubble

The hyperbolic price movements of bitcoin since its early 2009 inception have been very bubble-like in nature. When one compares bitcoin?s five-year price momentum (adjusted for inflation) against that of previous asset bubbles, bitcoin dwarfs the runners-up ? the Mississippi bubble of 1720 and the Amsterdam Tulip Mania of 1637. And among more recent examples, bitcoin far surpasses the IT bubble of the 1990s and the Japan bubble of the 1980s.

Moreover, bitcoin ticks all of the boxes that we consider to be essential criteria of any asset bubble:

-?New-era? thinking. Bitcoin is perceived to be an entirely new kind of currency and a monetary innovation in the internet age.

-Overtrading. Trading volumes have increased by almost fivefold in the last five years, according to BIS data.

-Ultra-easy monetary conditions. Accommodative policy is still in place globally, despite a series of rate hikes by the US Federal Reserve.

-A lack of financial regulation. The ?Wild West? bitcoin environment is only gradually being addressed by regulators around the world.

-The launch of related financial instruments. New products related to the bubbling asset class are popping up ? from CBOE and CME futures contracts to the launch of ?ICOs? (initial coin offerings).

-Rising leverage. Not only has private-sector leverage increased to record highs globally, but leveraged speculation in bitcoin is increasing.

-Swindles. Bitcoin has become the instrument of choice for many criminals, thanks to its ability to exist entirely outside of traditional banking channels.

-Significant overvaluation. Many other asset classes are pricey in today?s market, but bitcoin?s valuation seems to be without peer.

This brings us to a key question: what is the fair value of a bitcoin? In our view, its intrinsic value must be zero: a bitcoin is a claim on nobody ? in contrast to, for instance, sovereign bonds, equities or paper money ? and it does not generate any income stream. Admittedly, one could make the same argument about gold, but gold has been widely accepted by humankind as a thing of value for more than two-and-a-half thousand years ? compared to less than a decade for bitcoin.

Not a currency ? and not ESG-friendly

So if bitcoin is flawed enough not to be considered a proper asset class, can it at least serve the purpose of being a currency? We believe the answer is no for several reasons:

-First, given the high cost of conducting transactions in bitcoin, it could only be used for paying big-ticket items.

-Second, given bitcoin?s tremendous price volatility, it does not qualify as a numeraire ? a commonly accepted benchmark used to assign value to goods and services.

-Third, considering all the arguments we have previously presented, it seems all but impossible to use bitcoin as a store of value.

https://www.allianzgi.com/en/home/insights/investment-themes-and-strategy/beyond-the-bitcoin-bubble

Liar Loan

Well-known member

Congressional hearing on cryptocurrencies devolves into bitcoin bash fest

https://www.cnbc.com/2018/03/14/con...bitcoin-bash-fest.html?recirc=taboolainternalA House Financial Services subcommittee met Wednesday in what was supposed to be an overview of the cryptocurrency landscape. The two-hour hearing raised more questions than answers, and shined a light on some Congress members' deep skepticism around digital currency.

"Cryptocurrencies are a crock," Rep. Brad Sherman (D-Calif.) said to kick off his opening remarks. "They allow a few dozen men in my district to sit in their pajamas all day and tell their wives they're going to be millionaires."

Sherman accused the cryptocurrency community of using the term ICO to "lie to the public and convey the image that is like an IPO."

"They stole the intellectual property and trademark of legitimate investing and applied it to a fixed, fraudulent gambling scheme of no social benefit," Sherman said.

Huizenga referenced a soon-to-be published study of the ICO market by MIT professor Christian Catalini, which estimates that $270 million to $317 million of the money raised by coin offerings has "likely gone to fraud or scams."

Kings said:The IRS is going to have a field day with crypto traders that think they can get away with making 5-6 figure sums and not giving Uncle Sam his share.

Just like I previously said in my previous posts regarding the crackdown.

marmott

Active member

That for example: https://www.reddit.com/r/personalfinance/comments/84huks/i_just_discovered_that_i_owe_the_irs_50k_that_i/

Coinbase finally released a tax tool to help with filling taxes.

Coinbase finally released a tax tool to help with filling taxes.