morekaos

Well-known member

Man, wish I had a reliable way to short this crap.

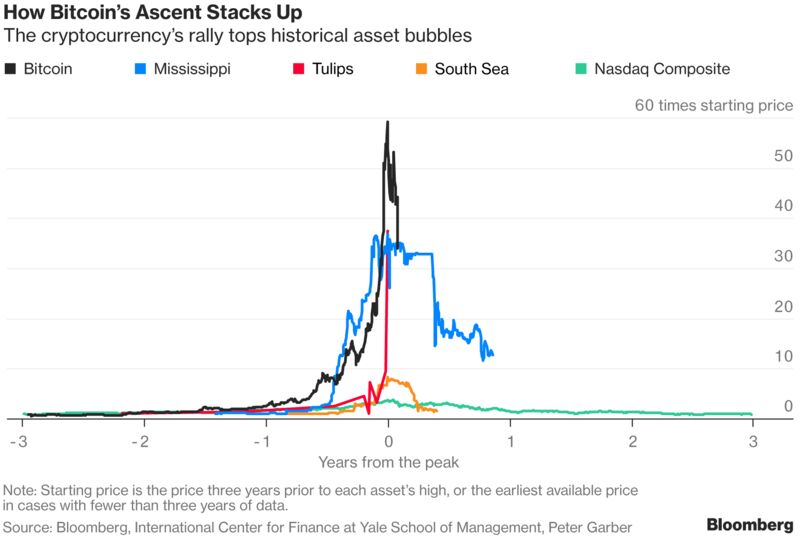

Bitcoin Bulls Walloped by 50% Crash to Below $10,000

Bitcoin's extraordinary price collapse continued in European trading Wednesday, pulling the world's best-known cryptocurrency below the $10,000 mark and wiping billions from the market value of digital alternatives around the world.

Bitcoin prices broke through $10,000 today to trade at about $9,500, according to Coindesk. That marks a stunning 50% crash from highs achieved on Dec. 18.

The slump has not only dragged bitcoin to a six-week low, it's also pulled rivals such as Ripple and Ethereum more than 34% and 43% lower so far this week, taking more than $150 billion from the 'market cap" of the world's three largest cryptocurrencies in just three days, according to coinmarketcap data.

https://www.thestreet.com/story/14451645/1/bitcoin-sheds-70-billion-this-week-as-global-cryptocurrencies-crumble.html?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

Bitcoin Bulls Walloped by 50% Crash to Below $10,000

Bitcoin's extraordinary price collapse continued in European trading Wednesday, pulling the world's best-known cryptocurrency below the $10,000 mark and wiping billions from the market value of digital alternatives around the world.

Bitcoin prices broke through $10,000 today to trade at about $9,500, according to Coindesk. That marks a stunning 50% crash from highs achieved on Dec. 18.

The slump has not only dragged bitcoin to a six-week low, it's also pulled rivals such as Ripple and Ethereum more than 34% and 43% lower so far this week, taking more than $150 billion from the 'market cap" of the world's three largest cryptocurrencies in just three days, according to coinmarketcap data.

https://www.thestreet.com/story/14451645/1/bitcoin-sheds-70-billion-this-week-as-global-cryptocurrencies-crumble.html?puc=yahoo&cm_ven=YAHOO&yptr=yahoo