You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How soon until Bitcoin crashes?

- Thread starter Liar Loan

- Start date

NEW -> Contingent Buyer Assistance Program

That's not true. The full faith and credit of the US is extremely valuable.

Think of it this way. If government currencies didn't exist and they were all privately created, would you rather use a currency created by Warren Buffett, or the currency of some 21 year old tech bro that lives in a filthy dorm in San Francisco? Who would be more likely to dilute the currency for personal gain?

Our current money system may go through some major changes when AI/automation replace majority of human workforce. People will be under-deployed and be on universal basic income. I have a suspicion that the basic income may not be paid entirely in dollars. Part or whole might be stamp scrip or local social currency that expires after 60-180 days and must be spent (to prevent hoarding).

To me Bitcoin is like a fast moving roller coaster, versus real estate is a slower moving roller coaster. Between the two I choose real estate because it's physical property.

Liar, regarding Bitcoin, one thing to keep in mind is that every other coin is valued against the value of BTC. In fact, I cannot even buy the other alt-coins without first buying Bitcoin or Ethereum, and trading for the other alt-coins. Bitcoin dominance has dissipated a bit, but if you look at the charts of any other coin, it is a mirror image of Bitcoin. When Bitcoin crashes, they all crash and vice-versa on the way up.

That will change someday, and in other countries they can in-fact purchase other coins with Fiat (no need to trade BTC for them)...but as it stands the main value in Bitcoin is that you have to acquire it to trade for other coins.

You download Coinbase yet? Haha

Nice...yeah I heard about Robinhood...no fees is fantastic! Good luck, and remember to buy when the price is going down...not going up.

Keep us posted on your experience in crypto...you're in for a wild ride.

It wouldn't work that way in reality.

It would go back to the barter and trade days. Don't you watch post apocalyptic movies? Drinkable water would become the new bitcoin.

Man you are beyond me...I don't even know what you're referring to. But would love to know...I'm curious whenever I hear the word "leverage"..haha.

Funny that you mention xrp...that was one of my best trades to date. I can remember the price going parabolic, and checking on my phone while running errands. I was starting to panic, and had to rush home to sell as I knew it was in total melt-up mode, and would reverse quickly

It has worked that way in the past.

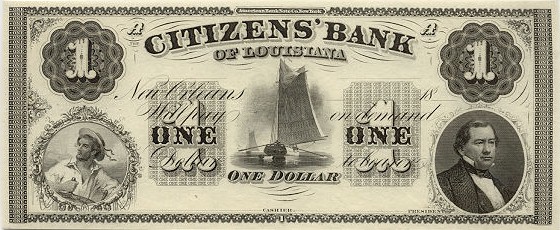

https://en.wikipedia.org/wiki/Private_currency#Private_bank_notes

In the United States, the Free Banking Era lasted between 1837 and 1866, when almost anyone could issue paper money. States, municipalities, private banks, railroad and construction companies, stores, restaurants, churches and individuals printed an estimated 8,000 different types of money by 1860. If an issuer went bankrupt, closed, left town, or otherwise went out of business, the note would be worthless.

I don't think it would work that way if the meteor/zombie virus/nuclear warhead hit today.

A value system would need to be established locally/regionally/countrywide and that would have to be based on goods that have utility value initially.

A new paper currency system would not emerge until much later.

But I forget you don't watch much TV so you may not watch Fear The Walking Dead or any Mad Max movie.

I haven't seen either of those, but yeah in the event of societal breakdown either barter and trade, or precious metals would be the default.

irvinehomeowner

Well-known member

Isn't all currency vaporware nowadays?

US Dollar not backed by anything anymore... I miss the days of trading goats for chickens... or sheep for wood.

US Dollar not backed by anything anymore... I miss the days of trading goats for chickens... or sheep for wood.

Liar Loan

Well-known member

irvinehomeowner said:Isn't all currency vaporware nowadays?

US Dollar not backed by anything anymore... I miss the days of trading goats for chickens... or sheep for wood.

That's not true. The full faith and credit of the US is extremely valuable.

Think of it this way. If government currencies didn't exist and they were all privately created, would you rather use a currency created by Warren Buffett, or the currency of some 21 year old tech bro that lives in a filthy dorm in San Francisco? Who would be more likely to dilute the currency for personal gain?

momopi

Well-known member

irvinehomeowner said:Isn't all currency vaporware nowadays?

US Dollar not backed by anything anymore... I miss the days of trading goats for chickens... or sheep for wood.

Our current money system may go through some major changes when AI/automation replace majority of human workforce. People will be under-deployed and be on universal basic income. I have a suspicion that the basic income may not be paid entirely in dollars. Part or whole might be stamp scrip or local social currency that expires after 60-180 days and must be spent (to prevent hoarding).

To me Bitcoin is like a fast moving roller coaster, versus real estate is a slower moving roller coaster. Between the two I choose real estate because it's physical property.

morekaos

Well-known member

Well I won't get into the debate about whether it's replacing this or that...just that trading cryptocurrency is a lot of fun, and most definitely isn't going away anytime soon. The amount of liquidity on the buy and sell side is amazing for the top coins.

You don't have to buy a full Bitcoin, or Ethereum...you can put in $500 (or even less) to start on Coinbase, transfer that coin (or fraction of your coin) to Binance, and start trading the myriad of coins/tokens on the exchange. It really is a great hobby, with lots of characters and personalities in the space. And who knows, maybe you can make some money. The hardest part is selling as it's going up, as you don't want to miss out on further gains...and vice-versa, equally hard to buy when it's crashing...but that is the way to play it. Volatility is insane, but if you can do the opposite of what your emotions tell you, you will definitely do okay.

The best part is the community has as much fun going down as it does going up, and always manages to keep a sense of humor.

https://www.youtube.com/watch?v=uocHIz2W_-E&t=308s

You don't have to buy a full Bitcoin, or Ethereum...you can put in $500 (or even less) to start on Coinbase, transfer that coin (or fraction of your coin) to Binance, and start trading the myriad of coins/tokens on the exchange. It really is a great hobby, with lots of characters and personalities in the space. And who knows, maybe you can make some money. The hardest part is selling as it's going up, as you don't want to miss out on further gains...and vice-versa, equally hard to buy when it's crashing...but that is the way to play it. Volatility is insane, but if you can do the opposite of what your emotions tell you, you will definitely do okay.

The best part is the community has as much fun going down as it does going up, and always manages to keep a sense of humor.

https://www.youtube.com/watch?v=uocHIz2W_-E&t=308s

nosuchreality

Well-known member

Liar, i disagree with your analysis however not your conclusion. Im not convinved bitcoin needs new blood to remain or gain. Bitcoin is about circumventing government controls, taxes and and tracking. Just like Amazon's original model was really driven by predatory pricing and tax avoidance by consumers. Our airbnb, uber and lyft sidesteppjng city and county ordinances.

Are there enough countries and people wanting to move money without wating to prove its origin, deal with transfer rules, etc to keep it going

For Joe Nonwhale, its really a question of who will gouge you more: the blackmarket, the banks or the government?

Are there enough countries and people wanting to move money without wating to prove its origin, deal with transfer rules, etc to keep it going

For Joe Nonwhale, its really a question of who will gouge you more: the blackmarket, the banks or the government?

Liar Loan said:So Halos are you expecting this crash to reach an 80% loss before bottoming? It looks like that's what happened in 2014.

Also, looking at your second chart, the launch of Coinbase was the catalyst for the current run of Bitcoin. It's what allowed so many clueless speculators to jump into the market without many technical hurdles to deal with. It would be like the launch of the New York Stock Exchange for stock investors, or the advent of online trading in the 90's which contributed to the tech bubble.

The only way Bitcoin goes up from here is if new blood enters the market, creating more demand than supply. Do you expect another market changing event like the launch of Coinbase to be the catalyst this time?

this is a must read article for anyone looking to understand the potential of blockchain and why things will never be the same again, bitcoin crash notwithstanding .

Beyond the Bitcoin Bubble

Yes, it?s driven by greed ? but the mania for cryptocurrency could wind up building something much more important than wealth.

https://www.nytimes.com/2018/01/16/magazine/beyond-the-bitcoin-bubble.html

Beyond the Bitcoin Bubble

Yes, it?s driven by greed ? but the mania for cryptocurrency could wind up building something much more important than wealth.

https://www.nytimes.com/2018/01/16/magazine/beyond-the-bitcoin-bubble.html

Liar Loan said:Halos said:There are so many angles to cryptocurrency, one of them is the ability for Chinese to launder their money via crypto. If you believe Bitcoin is going to zero, you also need to believe that capital controls in China will work.

A lot of people will FOMO hard again as the price climbs (as it is now) and panic buy. We'll blow past 20K this year no problem. It may go down again to 5K, or we could see 12K by Monday...who knows but the long term trend is not Bitcoin going to zero.

I don't necessarily think the value is going to zero. It will continue to have value as a black market transaction system. If world governments somehow find a way to de-anonymize the data, then I could see it going to zero because at that point the bad actors will move on to other "currencies".

However, as an investor I think Bitcoin has zero intrinsic value. There's no cashflow and no value as a commodity. Most buyers couldn't even explain what it is you own when purchasing bitcoin.

It's also not scarce as the blockchain is open source and there are currently at least 2,000 cryptocurrencies in existence. Bitcoin may not go to zero but 99.9% of the other currencies that people are speculating on will.

All that said, you could be right about the short term prospects. If enough people believe the price will reach $20,000 this year, then it will. The investing thesis for bitcoin is one of faith in its future prospects.

It's also possible that this is the end of the road as a lot of people got burned buying in December and lost their shorts in the recent crash. How much remaining FOMO exists is hard to say.

Liar, regarding Bitcoin, one thing to keep in mind is that every other coin is valued against the value of BTC. In fact, I cannot even buy the other alt-coins without first buying Bitcoin or Ethereum, and trading for the other alt-coins. Bitcoin dominance has dissipated a bit, but if you look at the charts of any other coin, it is a mirror image of Bitcoin. When Bitcoin crashes, they all crash and vice-versa on the way up.

That will change someday, and in other countries they can in-fact purchase other coins with Fiat (no need to trade BTC for them)...but as it stands the main value in Bitcoin is that you have to acquire it to trade for other coins.

You download Coinbase yet? Haha

aquabliss said:Robinhood is going to have crypto trading soon, I signed up but they don?t tell you how long the wait is... I?ll give it a try once it?s commission free on Robinhood.

Nice...yeah I heard about Robinhood...no fees is fantastic! Good luck, and remember to buy when the price is going down...not going up.

Keep us posted on your experience in crypto...you're in for a wild ride.

Power Ledger is exploding right now...must be the news about them expanding into North America

https://medium.com/power-ledger/pow...enewable-energy-trading-to-north-5e08c57c2009

Or their presentations in Davos

https://medium.com/power-ledger/dr-...ockchain-business-forum-in-davos-783085b20bbb

https://www.forbes.com/sites/jemmagreen/2018/01/24/just-add-crypto/#2b37366150a7

https://medium.com/power-ledger/pow...enewable-energy-trading-to-north-5e08c57c2009

Or their presentations in Davos

https://medium.com/power-ledger/dr-...ockchain-business-forum-in-davos-783085b20bbb

https://www.forbes.com/sites/jemmagreen/2018/01/24/just-add-crypto/#2b37366150a7

irvinehomeowner

Well-known member

Liar Loan said:Think of it this way. If government currencies didn't exist and they were all privately created, would you rather use a currency created by Warren Buffett, or the currency of some 21 year old tech bro that lives in a filthy dorm in San Francisco? Who would be more likely to dilute the currency for personal gain?

It wouldn't work that way in reality.

It would go back to the barter and trade days. Don't you watch post apocalyptic movies? Drinkable water would become the new bitcoin.

id_rather_be_racing

Active member

Halos - FYI, Bittrex will be rolling out sometime this year USD trading pairs for their alt coins. Until more exchanges offer this (Bitfinex doesn't count since US customers are banned from trading there), BTC will dictate how most coins/tokens move.

I've actually started looking into assigning betas using BTC as the base. You'll be surprised at the results (e.g. XRP behaves like 3x leverage).

I've actually started looking into assigning betas using BTC as the base. You'll be surprised at the results (e.g. XRP behaves like 3x leverage).

id_rather_be_racing said:Halos - FYI, Bittrex will be rolling out sometime this year USD trading pairs for their alt coins. Until more exchanges offer this (Bitfinex doesn't count since US customers are banned from trading there), BTC will dictate how most coins/tokens move.

I've actually started looking into assigning betas using BTC as the base. You'll be surprised at the results (e.g. XRP behaves like 3x leverage).

Man you are beyond me...I don't even know what you're referring to. But would love to know...I'm curious whenever I hear the word "leverage"..haha.

Funny that you mention xrp...that was one of my best trades to date. I can remember the price going parabolic, and checking on my phone while running errands. I was starting to panic, and had to rush home to sell as I knew it was in total melt-up mode, and would reverse quickly

Liar Loan

Well-known member

irvinehomeowner said:Liar Loan said:Think of it this way. If government currencies didn't exist and they were all privately created, would you rather use a currency created by Warren Buffett, or the currency of some 21 year old tech bro that lives in a filthy dorm in San Francisco? Who would be more likely to dilute the currency for personal gain?

It wouldn't work that way in reality.

It would go back to the barter and trade days. Don't you watch post apocalyptic movies? Drinkable water would become the new bitcoin.

It has worked that way in the past.

https://en.wikipedia.org/wiki/Private_currency#Private_bank_notes

In the United States, the Free Banking Era lasted between 1837 and 1866, when almost anyone could issue paper money. States, municipalities, private banks, railroad and construction companies, stores, restaurants, churches and individuals printed an estimated 8,000 different types of money by 1860. If an issuer went bankrupt, closed, left town, or otherwise went out of business, the note would be worthless.

irvinehomeowner

Well-known member

Liar Loan said:irvinehomeowner said:Liar Loan said:Think of it this way. If government currencies didn't exist and they were all privately created, would you rather use a currency created by Warren Buffett, or the currency of some 21 year old tech bro that lives in a filthy dorm in San Francisco? Who would be more likely to dilute the currency for personal gain?

It wouldn't work that way in reality.

It would go back to the barter and trade days. Don't you watch post apocalyptic movies? Drinkable water would become the new bitcoin.

It has worked that way in the past.

I don't think it would work that way if the meteor/zombie virus/nuclear warhead hit today.

A value system would need to be established locally/regionally/countrywide and that would have to be based on goods that have utility value initially.

A new paper currency system would not emerge until much later.

But I forget you don't watch much TV so you may not watch Fear The Walking Dead or any Mad Max movie.

Liar Loan

Well-known member

irvinehomeowner said:Liar Loan said:irvinehomeowner said:Liar Loan said:Think of it this way. If government currencies didn't exist and they were all privately created, would you rather use a currency created by Warren Buffett, or the currency of some 21 year old tech bro that lives in a filthy dorm in San Francisco? Who would be more likely to dilute the currency for personal gain?

It wouldn't work that way in reality.

It would go back to the barter and trade days. Don't you watch post apocalyptic movies? Drinkable water would become the new bitcoin.

It has worked that way in the past.

I don't think it would work that way if the meteor/zombie virus/nuclear warhead hit today.

A value system would need to be established locally/regionally/countrywide and that would have to be based on goods that have utility value initially.

A new paper currency system would not emerge until much later.

But I forget you don't watch much TV so you may not watch Fear The Walking Dead or any Mad Max movie.

I haven't seen either of those, but yeah in the event of societal breakdown either barter and trade, or precious metals would be the default.

Following this crypto and blockchain craze for some time now and while I get the concept , still cant get my arms around why is it not taking off yet .

I mean if this thing was really that useful, you would see geeks and techies quietly installing this technology and putting it to work stealthily just to get stuff done. I saw it happen all the time back int he 90s with internet tech.

All I see is big announcements and launches and consortium this and consortium that and ICOs and what not - exactly the type of stuff that should not be happening and feels more like a "check the box " thing so many CTOs can make their bosses go away and tell their boards, hey we are also cool with this stuff.

mining etc cost thousands of $$ in money and their is no intrinsic value - so unless someone , somewhere is getting very good returns on their investment with this thing, feels very flaky.

I am not the type to be dismissive of new things automatically but I would have liked to see more "underground " progress here in terms of applicability , which I just don't. Maybe someone can educate me.

I mean if this thing was really that useful, you would see geeks and techies quietly installing this technology and putting it to work stealthily just to get stuff done. I saw it happen all the time back int he 90s with internet tech.

All I see is big announcements and launches and consortium this and consortium that and ICOs and what not - exactly the type of stuff that should not be happening and feels more like a "check the box " thing so many CTOs can make their bosses go away and tell their boards, hey we are also cool with this stuff.

mining etc cost thousands of $$ in money and their is no intrinsic value - so unless someone , somewhere is getting very good returns on their investment with this thing, feels very flaky.

I am not the type to be dismissive of new things automatically but I would have liked to see more "underground " progress here in terms of applicability , which I just don't. Maybe someone can educate me.