Peter Thiel, or Brad Sherman....hmm, tough pick ;D

Good overall interview...not just about BTChttps://www.youtube.com/watch?v=tyOblv9qJoQ

Also, I posted the lucky buying opportunity for Irvine residents $8,880...you could of sold at 12K, and made a greater return than you have in the last year in thegrand casino stock market.

Could go down further...but when it goes back up, you'll be kicking yourself for not buying

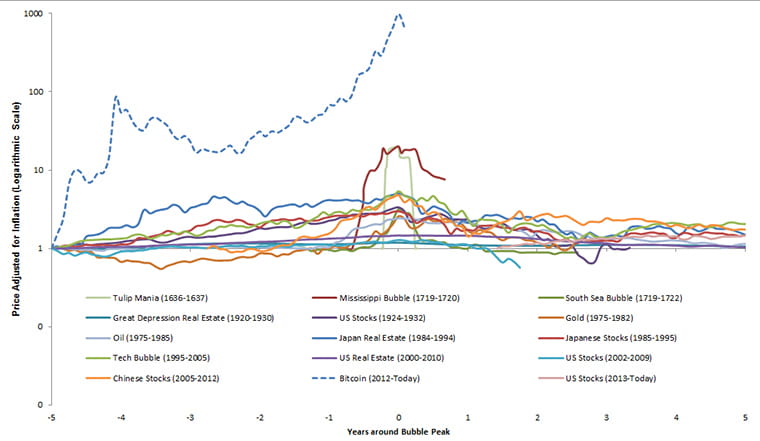

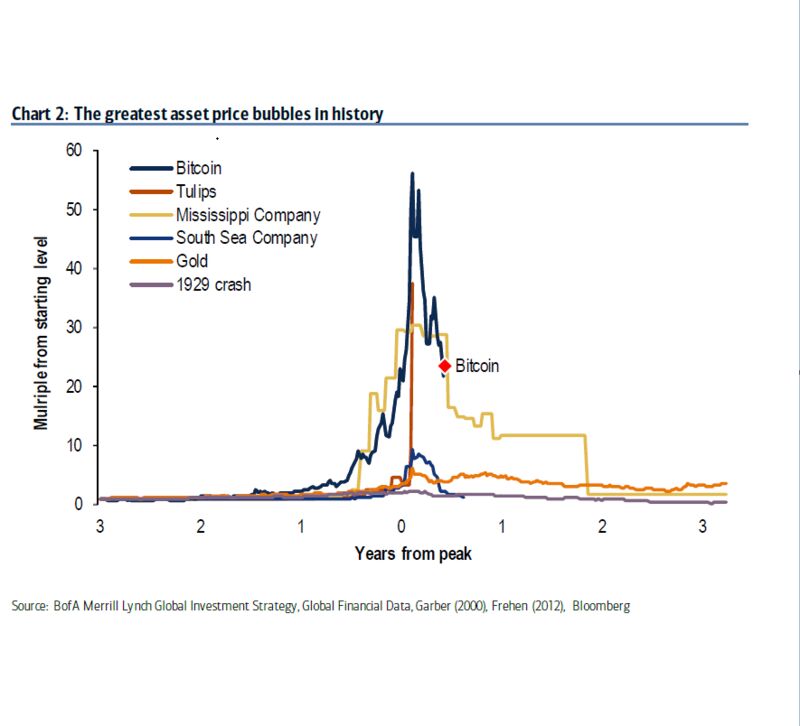

Is it the biggest bubble of all time?http://www.visualcapitalist.com/worlds-money-markets-one-visualization-2017/

Good overall interview...not just about BTChttps://www.youtube.com/watch?v=tyOblv9qJoQ

Also, I posted the lucky buying opportunity for Irvine residents $8,880...you could of sold at 12K, and made a greater return than you have in the last year in the

Could go down further...but when it goes back up, you'll be kicking yourself for not buying

Is it the biggest bubble of all time?http://www.visualcapitalist.com/worlds-money-markets-one-visualization-2017/