nosuchreality

Well-known member

Is there a way to override kaos' giant red font?

awgeecdcrez said:morekaos said:Will he end up being right? Said this in July...

?I wouldn?t be surprised to see a nice bounce in gold from this level up to $1400, $1440, but I don?t know if it?s sustainable after that.? His advice to investors: ?Hit the bid? once gold climbs to near $1400... $600 to $800 an ounce is certainly a possibility.?

http://finance.yahoo.com/blogs/daily-ticker/don-t-fooled-sell-gold-1-400-then-113216641.html

Gold is going to take another big smack down, when India leases it's gold and it gets sold on the open market. I do not know the exact time, but it should be soon.

morekaos said:awgeecdcrez said:morekaos said:Will he end up being right? Said this in July...

?I wouldn?t be surprised to see a nice bounce in gold from this level up to $1400, $1440, but I don?t know if it?s sustainable after that.? His advice to investors: ?Hit the bid? once gold climbs to near $1400... $600 to $800 an ounce is certainly a possibility.?

http://finance.yahoo.com/blogs/daily-ticker/don-t-fooled-sell-gold-1-400-then-113216641.html

Gold is going to take another big smack down, when India leases it's gold and it gets sold on the open market. I do not know the exact time, but it should be soon.

This intrigues me but I don't understand how it carries over to a price drop (I'm dumb that way)..

http://www.thehindubusinessline.com/economy/india-looking-at-leasing-gold-bought-from-imf/article5042403.ece

India looking at leasing gold bought from IMF

According to RBI sources, this gold was never brought into the country. It was just a book transfer.

Speaking at the India International Gold Convention in Jaipur last week, Gornall had said the RBI can organise a gold-dollar swap without divesting its holding or incurring any further interest charges.

?By swapping gold for a payable currency, you can benefit by having access to dollars for a period of your choice, while remaining a long-term holder of the gold, as the swap is a transfer of asset for a limited period. You will have bullion bank counter-party risk but this is successfully managed at the RBI, which has the strictest lending criteria of any central bank in the world,? Gornall had argued.

morekaos said:I see your point but I equate the proliferation of cash for gold corner shops to the general public getting in on any get rich quick mania. ie. During the real estate bubble we had everyone and their mother (quite literally) getting an agent license. When "pot" became legal I can recall several people I know opening medicinal shops all over the place (many since closed). This is no different, Most of these storefronts are not Goldman Sachs...they too are Mom and pop operations. Thus an indicator of public sentiment and thus, IMHO, negative.

awgeecdcrez said:

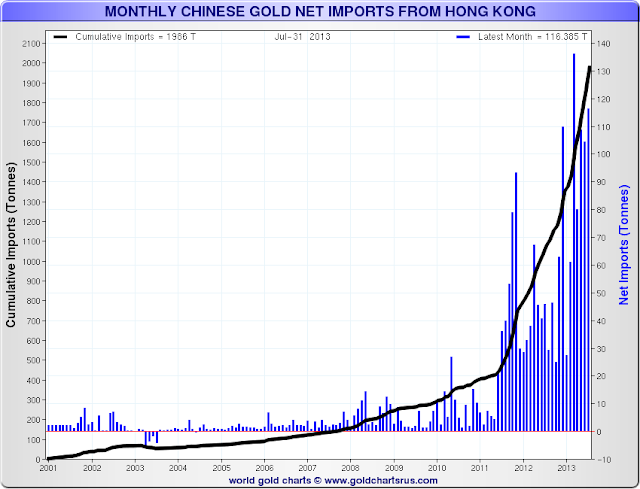

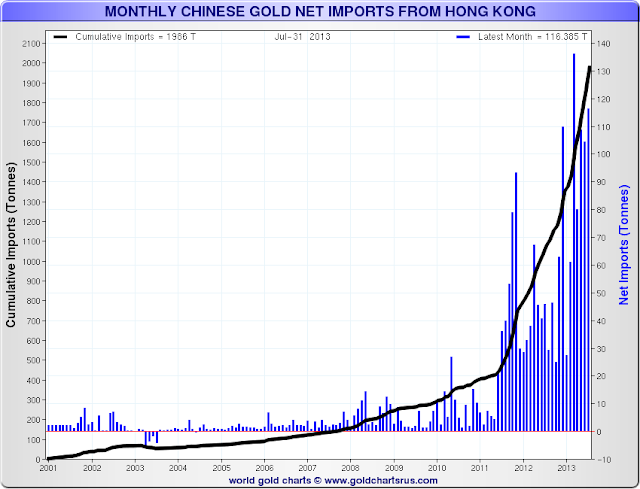

So, ... what do the Chinese know? Are they stupid are something? And if the Chinese are importing, who is exporting? And where did that imported gold come from? Gold production has not increased in the last few years. Except for the last month, because of government import controls, India's imports have increased also. And how are the Chinese paying for all this gold? And what do they plan on doing with it? Are they planning on selling it when it is higher in price? Or what is Chinese culture in regards to gold ownership?

Irvinecommuter said:No one is exporting...gold doesn't actually move...just the ownership of it. People in stable nations like US and in Europe are selling because they realize that the panic was uncalled for....sky not falling.

awgeecdcrez said:Irvinecommuter said:No one is exporting...gold doesn't actually move...just the ownership of it. People in stable nations like US and in Europe are selling because they realize that the panic was uncalled for....sky not falling.

No one is exporting? Huh?!

If no one is exporting, and physical gold does not actually move, then how are China and India importing? Importing is not just some bookkeeping number being changed at a central bank or a commodities exchange. Importing is the actual movement of gold into China and India. People in India and China are buying physical gold that they take home or to a safe deposit box in a bank. When I post those charts of the decreasing number of registered ounces at the COMEX, those are real physical ounces leaving the COMEX. They aren't just paper ounces moved into the 'elegible' category. They are leaving. And actual physical ounces are leaving the LBMA on a consistent basis. It is not just the registered ounces that are decreasing, but the total is decreasing also and faster than just the registered ounces. I post the registered charts because those are the ounces backing up the futures sold on the COMEX. The elegible ounces are not allowed to be sold by the COMEX or by any broker of the COMEX unless they are changed to registered. Presently, there are 56 ounces sold for every registered ounce at the COMEX, and that is a historical high.

You are right that the sky is not falling, and who ever said it was? But the west has been sold a load of bs that their currency is valuable and their central banks can control economic rises and falls.

Irvinecommuter said:awgeecdcrez said:Irvinecommuter said:No one is exporting...gold doesn't actually move...just the ownership of it. People in stable nations like US and in Europe are selling because they realize that the panic was uncalled for....sky not falling.

No one is exporting? Huh?!

If no one is exporting, and physical gold does not actually move, then how are China and India importing? Importing is not just some bookkeeping number being changed at a central bank or a commodities exchange. Importing is the actual movement of gold into China and India. People in India and China are buying physical gold that they take home or to a safe deposit box in a bank. When I post those charts of the decreasing number of registered ounces at the COMEX, those are real physical ounces leaving the COMEX. They aren't just paper ounces moved into the 'elegible' category. They are leaving. And actual physical ounces are leaving the LBMA on a consistent basis. It is not just the registered ounces that are decreasing, but the total is decreasing also and faster than just the registered ounces. I post the registered charts because those are the ounces backing up the futures sold on the COMEX. The elegible ounces are not allowed to be sold by the COMEX or by any broker of the COMEX unless they are changed to registered. Presently, there are 56 ounces sold for every registered ounce at the COMEX, and that is a historical high.

You are right that the sky is not falling, and who ever said it was? But the west has been sold a load of bs that their currency is valuable and their central banks can control economic rises and falls.

In the end: Gold down to to near $1,300...off $75 from Monday.

awgeecdcrez said:Irvinecommuter said:awgeecdcrez said:Irvinecommuter said:No one is exporting...gold doesn't actually move...just the ownership of it. People in stable nations like US and in Europe are selling because they realize that the panic was uncalled for....sky not falling.

No one is exporting? Huh?!

If no one is exporting, and physical gold does not actually move, then how are China and India importing? Importing is not just some bookkeeping number being changed at a central bank or a commodities exchange. Importing is the actual movement of gold into China and India. People in India and China are buying physical gold that they take home or to a safe deposit box in a bank. When I post those charts of the decreasing number of registered ounces at the COMEX, those are real physical ounces leaving the COMEX. They aren't just paper ounces moved into the 'elegible' category. They are leaving. And actual physical ounces are leaving the LBMA on a consistent basis. It is not just the registered ounces that are decreasing, but the total is decreasing also and faster than just the registered ounces. I post the registered charts because those are the ounces backing up the futures sold on the COMEX. The elegible ounces are not allowed to be sold by the COMEX or by any broker of the COMEX unless they are changed to registered. Presently, there are 56 ounces sold for every registered ounce at the COMEX, and that is a historical high.

You are right that the sky is not falling, and who ever said it was? But the west has been sold a load of bs that their currency is valuable and their central banks can control economic rises and falls.

In the end: Gold down to to near $1,300...off $75 from Monday.

In the end? There is no more market for gold? Gold will not be for sale next week or next year? In the end? Your time frame for asset evalulation is five days? Nothing before Monday matters, or anything after today? In the end?

Up 200% since September 2005. In my world, as limited as that may be, September 13, 2013 is certainly not the end.

The average price per ounce of gold is about $500 adjusted for inflation from 1790 through today. June 2005 was the last time gold was at its inflation-adjusted average price. By January 2011, gold prices had risen by 350 percent while inflation increased only 17 percent. A huge spike in price had happened a few decades ago, although for different reasons than the recent surge.

Inflation adjusted gold prices peaked in January 1980 and demand was driven by high inflation, which was caused in part by the country dropping gold as a currency peg in 1974. The Consumer Price Index (CPI) increased by 14 percent on a year-over-year basis the month gold hit its peak. Monetary policy became very restrictive shortly thereafter and this caused inflation to tumble to 3 percent by 1983. In turn, gold crashed back down and ultimately fell to its long-term $500 inflation-adjusted average price.

awgeecdcrez said:morekaos said:I see your point but I equate the proliferation of cash for gold corner shops to the general public getting in on any get rich quick mania. ie. During the real estate bubble we had everyone and their mother (quite literally) getting an agent license. When "pot" became legal I can recall several people I know opening medicinal shops all over the place (many since closed). This is no different, Most of these storefronts are not Goldman Sachs...they too are Mom and pop operations. Thus an indicator of public sentiment and thus, IMHO, negative.

Speaking of Goldman Sachs:

Guess Which Bearish Bank bought a Record Amount of GLD in Q2

http://www.zerohedge.com/news/2013-08-30/guess-which-bearish-bank-bought-record-amount-gld-q2

GOFO went positive today for the first day in 40.

India's central bank is denying that it is considering leasing out it's gold. If India's central bank is anything like our Federal Reserve, the denial is a sure bet that RBI will lease out it's gold soon.

morekaos said:awgeecdcrez said:morekaos said:I see your point but I equate the proliferation of cash for gold corner shops to the general public getting in on any get rich quick mania. ie. During the real estate bubble we had everyone and their mother (quite literally) getting an agent license. When "pot" became legal I can recall several people I know opening medicinal shops all over the place (many since closed). This is no different, Most of these storefronts are not Goldman Sachs...they too are Mom and pop operations. Thus an indicator of public sentiment and thus, IMHO, negative.

Speaking of Goldman Sachs:

Guess Which Bearish Bank bought a Record Amount of GLD in Q2

http://www.zerohedge.com/news/2013-08-30/guess-which-bearish-bank-bought-record-amount-gld-q2

GOFO went positive today for the first day in 40.

India's central bank is denying that it is considering leasing out it's gold. If India's central bank is anything like our Federal Reserve, the denial is a sure bet that RBI will lease out it's gold soon.

Go figure..

Gold to fall to fresh lows on US recovery: Goldman

Goldman expects the gold price to fall to $1,050 in 2014 ? a fall of 20 percent from current prices.

http://www.cnbc.com/id/101039476

awgeecdcrez said:Well, ... it seems that I have done all I can.

So, I will leave you with these thoughts.

What caused the housing bubble? Or the Nasdaq bubble? Or the, (fill in the blank), bubble?

What have the world's central banks done as a result of the latest bubble bursting and the resultant financial mayhem?

If you conclude that the world's central banks are pursuing the same policies now that they did before the consequences, except this time they are pursuing those policies on a much grander scale, then what will be the consequence, if any? If the creation of too much debt was a problem, then the creation of ten times more debt will resolve previous problems?

Is everything gonna be just fine? It is different this time? The Federal Reserve and other central banks can create massive amounts of currency, (debt), without any consequence? Do you think Bernanke or whomever is smart enough to know how to slow down the artificial stimulus in a manner such that an economy built on ever expanding debt will continue to do all right?

I dunno, maybe you think that the financial problems were not created from too much debt? As the young people are want to say these days, "Good luck with that."