You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ICE or EV?

- Thread starter irvinehomeowner

- Start date

NEW -> Contingent Buyer Assistance Program

Remember that for many years Tesla was not a profitable car maker, but deeply intomoney laundering.... Er... "Reselling Cap And Trade Emissions credits" as a big portion of their earnings. That farcical program has been one of many reasons for EV mandates.

Fisker reports wider-than-expected losses, underwhelming deliveries for the third quarter

· Electric vehicle startup Fisker on Monday reported a third-quarter loss that was wider than Wall Street expected.

· It said it delivered only about 1,100 Ocean electric SUVs in the third quarter.

· But, it said, deliveries have accelerated since quarter-end, with over 1,200 Oceans delivered in October and “hundreds” more en route to customers now.

https://www.cnbc.com/2023/11/13/fis...rce=iosappshare|com.apple.UIKit.activity.Mail

One wonders if their per unit build loss is as wide as Rivian's.

Any way to find this out in their financials?

Fisker shares sink 20% after EV maker discloses ‘material weaknesses’ in financial reporting

But there was more. In a Monday nightregulatory filing after its earnings report, Fisker said that following the abrupt departure of its chief accounting officer in October, it “determined that it has material weaknesses in the Company’s internal control over financial reporting.”

Those weaknesses will delay its quarterly 10-Q filing, it said.

https://www.sec.gov/Archives/edgar/data/1720990/000172099023000118/fsrnt10-qform12bx25req32023.htm

A lot of tech companies in general wouldn't exist without cheap money policies. It's almost as if cheap money is meant to encourage economic growth through risk-taking??

insideevs.com

insideevs.com

What is funny is that none of the German lux brands are at the LA Auto Show... must be selling by reputation.

morekaos

Well-known member

total disaster, the clock is ticking. When your net losses are equal to your total revenue, you’re not long for this world….bring out your dead!

“The company’s third-quarter net loss of $1.37 billion…The EV maker reported $1.34 billion in revenue for the quarter”

www.cbtnews.com

www.cbtnews.com

“The company’s third-quarter net loss of $1.37 billion…The EV maker reported $1.34 billion in revenue for the quarter”

Rivian trims losses in Q3 and boosts production targets

Rivian reported its Q3 results beating expectations and offered an improved outlook, including an increase in its annual production target

www.cbtnews.com

www.cbtnews.com

morekaos

Well-known member

As I’ve said…Toyota has this figured out…I still believe hydrogen is the future for trucks and heavy duty vehicles.

morekaos

Well-known member

As I told you..cutting prices is not a good sign, especially when the word “forced” is used to describe the cuts…

Electric Vehicle Makers Forced to Slash Prices as Consumers Give Cold Shoulder: ‘There Was a Miscalculation’

Demand for electric vehicles is on the slide.

The Wall Street Journal reported that amid a decline in the sales of electric vehicles, manufacturers and sellers are resorting to price cuts and other incentives to help reduce the buildup of unsold cars.

“I think there was a miscalculation about demand and how much EVs would be coveted,” said Joseph Yoon, an Edmunds analyst.

https://www.msn.com/en-us/autos/new...31&cvid=605e10acb6b84eadae359db4f571f479&ei=4

…and the secondary market is not going to save them (also as I told you)…

Rapid depreciation hits electric car market, surprising experts

Used electric cars are depreciating more rapidly than previously expected, posing significant challenges for both owners and manufacturers of these vehicles.

While electric vehicles have been available for some time, it is only in recent years that their popularity in Europe has surged and gone mainstream. As a result, the development of the secondary market for these vehicles is underway. However, the initial trend is showing disappointment for both manufacturers and users of electric vehicles, as reported by Automotive News Europe.

The calculations from Fintana Knight, head of the analytical firm Automotive Equity Management, reveal that the depreciation rate for a used electric car against its combustion counterpart ranges between 10 and 12 percentage points, unfavorably, for the electric car.

https://www.msn.com/en-us/autos/new...31&cvid=17d71bdaadfe41a3f4a499beab34ea66&ei=3

Electric Vehicle Makers Forced to Slash Prices as Consumers Give Cold Shoulder: ‘There Was a Miscalculation’

Demand for electric vehicles is on the slide.

The Wall Street Journal reported that amid a decline in the sales of electric vehicles, manufacturers and sellers are resorting to price cuts and other incentives to help reduce the buildup of unsold cars.

“I think there was a miscalculation about demand and how much EVs would be coveted,” said Joseph Yoon, an Edmunds analyst.

https://www.msn.com/en-us/autos/new...31&cvid=605e10acb6b84eadae359db4f571f479&ei=4

…and the secondary market is not going to save them (also as I told you)…

Rapid depreciation hits electric car market, surprising experts

Used electric cars are depreciating more rapidly than previously expected, posing significant challenges for both owners and manufacturers of these vehicles.

While electric vehicles have been available for some time, it is only in recent years that their popularity in Europe has surged and gone mainstream. As a result, the development of the secondary market for these vehicles is underway. However, the initial trend is showing disappointment for both manufacturers and users of electric vehicles, as reported by Automotive News Europe.

The calculations from Fintana Knight, head of the analytical firm Automotive Equity Management, reveal that the depreciation rate for a used electric car against its combustion counterpart ranges between 10 and 12 percentage points, unfavorably, for the electric car.

https://www.msn.com/en-us/autos/new...31&cvid=17d71bdaadfe41a3f4a499beab34ea66&ei=3

morekaos

Well-known member

as I’ve been warning, the funeral Pyre will be large and painful… disastrous government policy created this crisis out of thin air for nothing.A lot of these companies probably wouldn't exist without the cheap money policies of the past 15 years.

sgip

Well-known member

I wouldn't say "out of thin air for nothing..."as I’ve been warning, the funeral Pyre will be large and painful… disastrous government policy created this crisis out of thin air for nothing.

Remember that for many years Tesla was not a profitable car maker, but deeply into

morekaos

Well-known member

Well, 2 times is not the charm after all…shall we try for three?...Doomed…again!….

Fisker cuts production guidance for Ocean EV after last-minute snags

Electric vehicle startup Fisker on Tuesday reported a wider first-quarter loss than expected and cut its production guidance for the full year.

- CEO Henrik Fisker told CNBC that the company expects regulatory approval to begin deliveries of the Ocean in the U.S. before the end of May.

- It said it expects to build 1,400 to 1,700 vehicles in the second quarter, assuming its suppliers ramp up as expected.

Fisker cuts production guidance for Ocean EV after last-minute snags

CEO Henrik Fisker told CNBC that the company expects regulatory approval to begin deliveries of the Ocean in the U.S. before the end of May.www.cnbc.com

Fisker reports wider-than-expected losses, underwhelming deliveries for the third quarter

· Electric vehicle startup Fisker on Monday reported a third-quarter loss that was wider than Wall Street expected.

· It said it delivered only about 1,100 Ocean electric SUVs in the third quarter.

· But, it said, deliveries have accelerated since quarter-end, with over 1,200 Oceans delivered in October and “hundreds” more en route to customers now.

https://www.cnbc.com/2023/11/13/fis...rce=iosappshare|com.apple.UIKit.activity.Mail

sgip

Well-known member

Well, 2 times is not the charm after all…shall we try for three?...

Fisker reports wider-than-expected losses, underwhelming deliveries for the third quarter

· Electric vehicle startup Fisker on Monday reported a third-quarter loss that was wider than Wall Street expected.

· It said it delivered only about 1,100 Ocean electric SUVs in the third quarter.

· But, it said, deliveries have accelerated since quarter-end, with over 1,200 Oceans delivered in October and “hundreds” more en route to customers now.

https://www.cnbc.com/2023/11/13/fisker-fsr-earnings-report-q3-2023.html?__source=iosappshare|com.apple.UIKit.activity.Mail

One wonders if their per unit build loss is as wide as Rivian's.

Any way to find this out in their financials?

irvinehomeowner

Well-known member

Karma is also trying to make a comeback...

insideevs.com

insideevs.com

I don't think they can do it.

Can The Reborn Karma Automotive Pull It Off This Time?

Karma Automotive is back in action after a brief hiatus early this decade. The firm is set to offer three vehicles by 2026.

I don't think they can do it.

The Motor Court Company

Well-known member

I expect only Tesla and Rivian will survive at the end as far as all electric car company go...

morekaos

Well-known member

As I said…the Scam continues to fall apart…Like Crypto…Doomed!..One wonders if their per unit build loss is as wide as Rivian's.

Any way to find this out in their financials?

Fisker shares sink 20% after EV maker discloses ‘material weaknesses’ in financial reporting

But there was more. In a Monday nightregulatory filing after its earnings report, Fisker said that following the abrupt departure of its chief accounting officer in October, it “determined that it has material weaknesses in the Company’s internal control over financial reporting.”

Those weaknesses will delay its quarterly 10-Q filing, it said.

https://www.sec.gov/Archives/edgar/data/1720990/000172099023000118/fsrnt10-qform12bx25req32023.htm

Hugo Township

Active member

A lot of these companies probably wouldn't exist without the cheap money policies of the past 15 years.

A lot of tech companies in general wouldn't exist without cheap money policies. It's almost as if cheap money is meant to encourage economic growth through risk-taking??

Liar Loan

Well-known member

Zombie companies are not a sustainable form of economic growth though. Look at China's real estate sector as an example of what happens.A lot of tech companies in general wouldn't exist without cheap money policies. It's almost as if cheap money is meant to encourage economic growth through risk-taking??

morekaos

Well-known member

Doomed…

EV list price was 28% higher than a gas vehicle last month, CarGurus said. That brings the cost for a 60-month loan with an interest rate of near 8% on an average new EV to $277 more a month than a gas car, it said.

Beyond the car itself, the total cost of ownership during the first five years is also higher. Installing at-home chargers can run about $2,000 upfront, and insurance generally costs more. You may save on fuel but with gas prices dropping for eight weeks in a row, that incentive’s waning.

Maintenance costs might be lower, but you'll likely buy more tires with heavier EVs running them down faster.

In early February, EVs cost consumers an average of $65,202 during the first five years, while gas vehicles cost $56,962, the National Automobile Dealers Association said.

Here's why people aren't buying EVs in spite of price cuts and tax breaks.

EV inventories have increased by 506% from a year ago, with EVs sitting on lots for longer, according to CarGurus’ October report, released this month. EVs sit on the market an average 82 days versus 64 days for gas-powered vehicles, it said. In response to slowing demand, automakers like Ford and GMare cutting production.EV list price was 28% higher than a gas vehicle last month, CarGurus said. That brings the cost for a 60-month loan with an interest rate of near 8% on an average new EV to $277 more a month than a gas car, it said.

Beyond the car itself, the total cost of ownership during the first five years is also higher. Installing at-home chargers can run about $2,000 upfront, and insurance generally costs more. You may save on fuel but with gas prices dropping for eight weeks in a row, that incentive’s waning.

Maintenance costs might be lower, but you'll likely buy more tires with heavier EVs running them down faster.

In early February, EVs cost consumers an average of $65,202 during the first five years, while gas vehicles cost $56,962, the National Automobile Dealers Association said.

Hugo Township

Active member

You don't even have to look at China. Look at WeWork!

morekaos

Well-known member

Just like I told you…the fools rushed in. Now the shareholders and taxpayers pay the price….What happened to all those “Green jobs” they promised?…not much to be thankful for here…

The decision adds to a recent retreat from EVs by automakers globally. Demand for the vehicles is lower than expected due to higher costs and challenges with supply chains and battery technologies, among other issues.

www.cnbc.com

www.cnbc.com

Ford to scale back plans for $3.5 billion Michigan battery plant as EV demand disappoints, labor costs rise

Ford said Tuesday that it is cutting production capacity by roughly 43% to 20 gigawatt hours per year and reducing expected employment from 2,500 jobs to 1,700 jobs. The company declined to disclose how much less it would invest in the plant. Based on the reduced capacity, it would still be about a $2 billion investment.The decision adds to a recent retreat from EVs by automakers globally. Demand for the vehicles is lower than expected due to higher costs and challenges with supply chains and battery technologies, among other issues.

Ford to scale back plans for $3.5 billion Michigan battery plant as EV demand disappoints, labor costs rise

Ford is scaling back production capacity and expected employment at the battery plant in Michigan.

irvinehomeowner

Well-known member

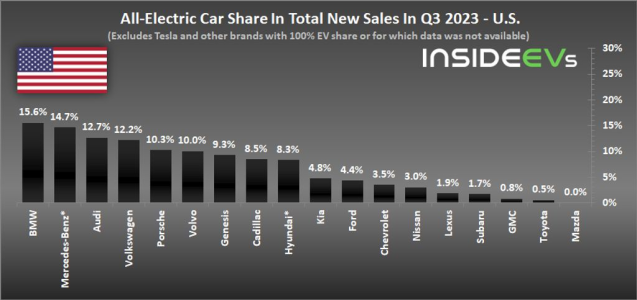

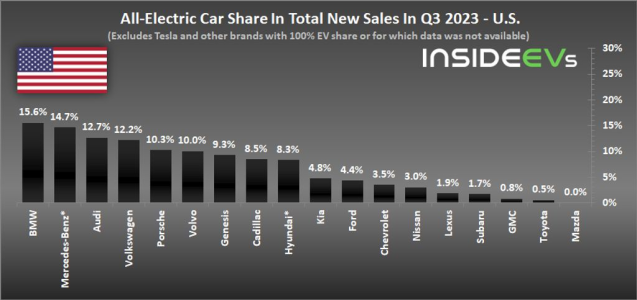

BMW, Mercedes Saw EVs Make Up 15% Of Their Total U.S. Sales In Q3 2023

When analyzing all-electric car sales, often we focus on the volume, although there is a more important thing and that's the share of BEVs out of the automaker's total sales.

What is funny is that none of the German lux brands are at the LA Auto Show... must be selling by reputation.