irvinebullhousing

Well-known member

OCtoSV said:[url]https://finance.yahoo.com/news/mortgage-rates-rebound-us-economy-123000032.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAALO4B-IAEGUZjT2NPBFeRm2wzoTustXZY4OqmHY1zTkO2vvrj5hfU0jYAgpBTnU-9H3Rkh7jVtpLQsSLhG_R4rwMG0Qp_HCGjA5dcxmcjXytjGMa-ba-Fy4XTD-VVG8XAiqdjEnrWIBH_K-BEZZ3e31JLOc7LEkRWK5IjUkJ1-UK]https://finance.yahoo.com/news/mortgage-rates-rebound-us-economy-123000032.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAALO4B-IAEGUZjT2NPBFeRm2wzoTustXZY4OqmHY1zTkO2vvrj5hfU0jYAgpBTnU-9H3Rkh7jVtpLQsSLhG_R4rwMG0Qp_HCGjA5dcxmcjXytjGMa-ba-Fy4XTD-VVG8XAiqdjEnrWIBH_K-BEZZ3e31JLOc7LEkRWK5IjUkJ1-UK][url]https://finance.yahoo.com/news/mortgage-rates-rebound-us-economy-123000032.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAALO4B-IAEGUZjT2NPBFeRm2wzoTustXZY4OqmHY1zTkO2vvrj5hfU0jYAgpBTnU-9H3Rkh7jVtpLQsSLhG_R4rwMG0Qp_HCGjA5dcxmcjXytjGMa-ba-Fy4XTD-VVG8XAiqdjEnrWIBH_K-BEZZ3e31JLOc7LEkRWK5IjUkJ1-UK[/url]

?The mortgage market had already factored in several additional rounds of the Fed?s rate hike, but may have to adjust a bit higher based on today?s uncomfortable inflation rate,? said Lawrence Yun, chief economist for the National Association of Realtors.

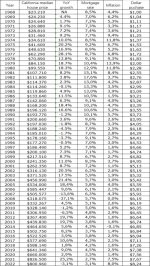

San Jose housing??KABOOMM