usctrojancpa

Well-known member

So to say that 2020 was an interesting year in the real estate market would be a huge understatement. The year starts off at a healthy balance with a very weak seller?s market then it basically freezes for 4-6 weeks in mid-March when we got the lockdown to a full-blown buying frenzy in the past 3-4 months of the year.

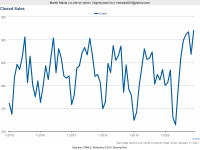

Attached is the data for both November and December 2020. Interestingly enough, November 2020 saw a drop in sales volume to 268 sold homes from 317 sold homes in October 2020 but sales volume was still up over 26% YOY in November 2020. From my analysis of the data, it would seem that the drop in sales was due in part to a lack of resale inventory and the timing of closings getting pushed out to December (maybe because of the Thanksgiving holiday). That being said, December 2020 was a record sales month with 320 closed transactions which was up over 36% from December 2019. This was the most shocking part of the data for me as December tends to seasonably be one of the low sales volume months of the year. As of January 18th, we still have 315 Irvine homes in escrow so it looks like January may also be a very strong sales month as well.

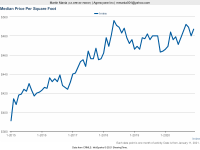

The median home price dipped down to $480/sf in November 2020 but then blipped higher to $487/sf. Not sure what caused the November dip as I saw more intense bidding by lower-end buyers starting in October so maybe it more higher-priced homes selling since we saw a large drop in sub $1m home purchases in November to 62% from 67% in October. That trend continues into December while the median sales price increase which tells me that the higher-priced homes increased in price as well to bring up median sales price in December.

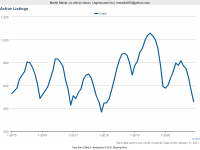

Inventory levels continued their decline in November and December. The decline from 730 homes in October 2020 to 554 in November was fairly steep and over 24% less inventory than November 2019 but still somewhat in line with the seasonal drop that is seen during that time. December saw a continuation of the decrease in inventory to 458 homes for sale at the end of the year which was almost 20% less than the number of homes for sale at the end of 2019 and those levels haven?t been seen since early 2018. Some may ask?what?s causing the low inventory problem, lack of supply or too much demand. Well, I checked the data and discovered that there were 984 new listings from September 2020 through November 2020 while there was 855 new listings from September 2019 through November 2019 or a 15% increase in the number of new listings in the 2020 time period. This tells me that the strong demand is causing the low supply, not the lack of new homes coming onto the market. You can see that in the 3-month average of inventory levels which are now below 2 months worth of inventory which is means we are in a very strong seller?s market. The lower end of the market (sub $900k) is seeing the least amount of inventory and the most intense bidding wars from buyers.

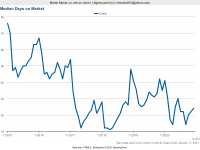

It has been increasingly more and more difficult to get my buyers a home into escrow as the bidding wars seem to get crazier and crazier out there. It?s not just the Irvine market, I?ve made offers for clients in Lake Forest, Mission Viejo, Costa Mesa, Huntington Beach, Cypress, Laguna Niguel, Fountain Valley, and a few other OC cities and it?s the same thing?.hard to get a showing appt and 5-20 offers. I can?t say that the market is frothy as it feels more like a low-interest FOMO by lower end buyers. In the majority of instances, sellers will either just accept the highest offer buyer offer right off the bat or only counter the top 2-4 buyers so I tell my buyers to put their best foot forward with their initial offer. Buyers are asked to waive appraisal contingencies and shorten their contingency removal period to as few as 10 days on seller multiple counteroffers. If you aren?t bidding materially over the list price and current comps (regardless of recent the comps are) or you are putting less than 20% down, you basically have very little chance in getting the home (forget about being a contingent buyer in this market).

Most builder waitlists for lower-end homes continue to build so if you are not on the waitlist then your chances of getting a lot are pretty slim. I?ve seen some significant price increases (5%+) from CalPac for their homes including Tristania, Montara, Celeste, and Talise in the past few months as they see how strong the real estate market has become. Even higher-end builders are increasing the pace of their homes sales and demand including Lennar with Capella and Crescendo along with Shea who is selling Cetara. Many builders will not allow you to purchase a home until you have closed on the sale of your home if you are contingent (a few do allow you to get into a contract if you are in escrow).

Interest rates stayed pretty steady around 2.50% to 2.625% for conforming loans but we saw jumbo loan rates dip down into the 2.75% to 2.875% range in the last few months of the year. Even investment property interest rates dipped down to 3% from the low 3% range in the past few months which has brought a few of my investment clients into the market. The high balance conforming loan limit increased from $765,500 in 2020 to $822,375 in 2021. Last week we did see interest rates increase a bit and ranged 2.75% to 2.825% due to gov?t fiscal spending plans which caused a selloff in the bond and MBS bond markets. The jumbo loan rates seemed to stay flattish for the most part from what I heard from my Wells and BofA lender. It?ll be interesting to see where rates go from here.

Overall, the market remains to be very strong and even nice higher-priced properties are going into escrow quickly. It doesn?t look like the increased covid case and death counts have done anything to the real estate market in the past few months. The competition for homes in the lower end seems to have intensified and gotten worse. In my opinion, the market has swung too much into a seller?s market which is not healthy and causes a lot of irrational buyer decisions. Hopefully, once we get into February and March we will see a higher amount of homes hit the market so most of that buyer demand can be satisfied.

Attached is the data for both November and December 2020. Interestingly enough, November 2020 saw a drop in sales volume to 268 sold homes from 317 sold homes in October 2020 but sales volume was still up over 26% YOY in November 2020. From my analysis of the data, it would seem that the drop in sales was due in part to a lack of resale inventory and the timing of closings getting pushed out to December (maybe because of the Thanksgiving holiday). That being said, December 2020 was a record sales month with 320 closed transactions which was up over 36% from December 2019. This was the most shocking part of the data for me as December tends to seasonably be one of the low sales volume months of the year. As of January 18th, we still have 315 Irvine homes in escrow so it looks like January may also be a very strong sales month as well.

The median home price dipped down to $480/sf in November 2020 but then blipped higher to $487/sf. Not sure what caused the November dip as I saw more intense bidding by lower-end buyers starting in October so maybe it more higher-priced homes selling since we saw a large drop in sub $1m home purchases in November to 62% from 67% in October. That trend continues into December while the median sales price increase which tells me that the higher-priced homes increased in price as well to bring up median sales price in December.

Inventory levels continued their decline in November and December. The decline from 730 homes in October 2020 to 554 in November was fairly steep and over 24% less inventory than November 2019 but still somewhat in line with the seasonal drop that is seen during that time. December saw a continuation of the decrease in inventory to 458 homes for sale at the end of the year which was almost 20% less than the number of homes for sale at the end of 2019 and those levels haven?t been seen since early 2018. Some may ask?what?s causing the low inventory problem, lack of supply or too much demand. Well, I checked the data and discovered that there were 984 new listings from September 2020 through November 2020 while there was 855 new listings from September 2019 through November 2019 or a 15% increase in the number of new listings in the 2020 time period. This tells me that the strong demand is causing the low supply, not the lack of new homes coming onto the market. You can see that in the 3-month average of inventory levels which are now below 2 months worth of inventory which is means we are in a very strong seller?s market. The lower end of the market (sub $900k) is seeing the least amount of inventory and the most intense bidding wars from buyers.

It has been increasingly more and more difficult to get my buyers a home into escrow as the bidding wars seem to get crazier and crazier out there. It?s not just the Irvine market, I?ve made offers for clients in Lake Forest, Mission Viejo, Costa Mesa, Huntington Beach, Cypress, Laguna Niguel, Fountain Valley, and a few other OC cities and it?s the same thing?.hard to get a showing appt and 5-20 offers. I can?t say that the market is frothy as it feels more like a low-interest FOMO by lower end buyers. In the majority of instances, sellers will either just accept the highest offer buyer offer right off the bat or only counter the top 2-4 buyers so I tell my buyers to put their best foot forward with their initial offer. Buyers are asked to waive appraisal contingencies and shorten their contingency removal period to as few as 10 days on seller multiple counteroffers. If you aren?t bidding materially over the list price and current comps (regardless of recent the comps are) or you are putting less than 20% down, you basically have very little chance in getting the home (forget about being a contingent buyer in this market).

Most builder waitlists for lower-end homes continue to build so if you are not on the waitlist then your chances of getting a lot are pretty slim. I?ve seen some significant price increases (5%+) from CalPac for their homes including Tristania, Montara, Celeste, and Talise in the past few months as they see how strong the real estate market has become. Even higher-end builders are increasing the pace of their homes sales and demand including Lennar with Capella and Crescendo along with Shea who is selling Cetara. Many builders will not allow you to purchase a home until you have closed on the sale of your home if you are contingent (a few do allow you to get into a contract if you are in escrow).

Interest rates stayed pretty steady around 2.50% to 2.625% for conforming loans but we saw jumbo loan rates dip down into the 2.75% to 2.875% range in the last few months of the year. Even investment property interest rates dipped down to 3% from the low 3% range in the past few months which has brought a few of my investment clients into the market. The high balance conforming loan limit increased from $765,500 in 2020 to $822,375 in 2021. Last week we did see interest rates increase a bit and ranged 2.75% to 2.825% due to gov?t fiscal spending plans which caused a selloff in the bond and MBS bond markets. The jumbo loan rates seemed to stay flattish for the most part from what I heard from my Wells and BofA lender. It?ll be interesting to see where rates go from here.

Overall, the market remains to be very strong and even nice higher-priced properties are going into escrow quickly. It doesn?t look like the increased covid case and death counts have done anything to the real estate market in the past few months. The competition for homes in the lower end seems to have intensified and gotten worse. In my opinion, the market has swung too much into a seller?s market which is not healthy and causes a lot of irrational buyer decisions. Hopefully, once we get into February and March we will see a higher amount of homes hit the market so most of that buyer demand can be satisfied.