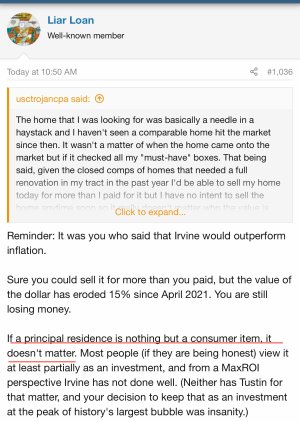

Reminder: It was you who said that Irvine would outperform inflation.

Sure you could sell it for more than you paid, but the value of the dollar has eroded 15% since April 2021. You are still losing money.

If a principal residence is nothing but a consumer item, it doesn't matter. Most people (if they are being honest) view it at least partially as an investment, and from a MaxROI perspective Irvine has not done well. (Neither has Tustin for that matter, and your decision to keep that as an investment at the peak of history's largest bubble was insanity.)