Liar Loan

Well-known member

Wow... Almost 1 in 5 homeowners plans to sell this year.

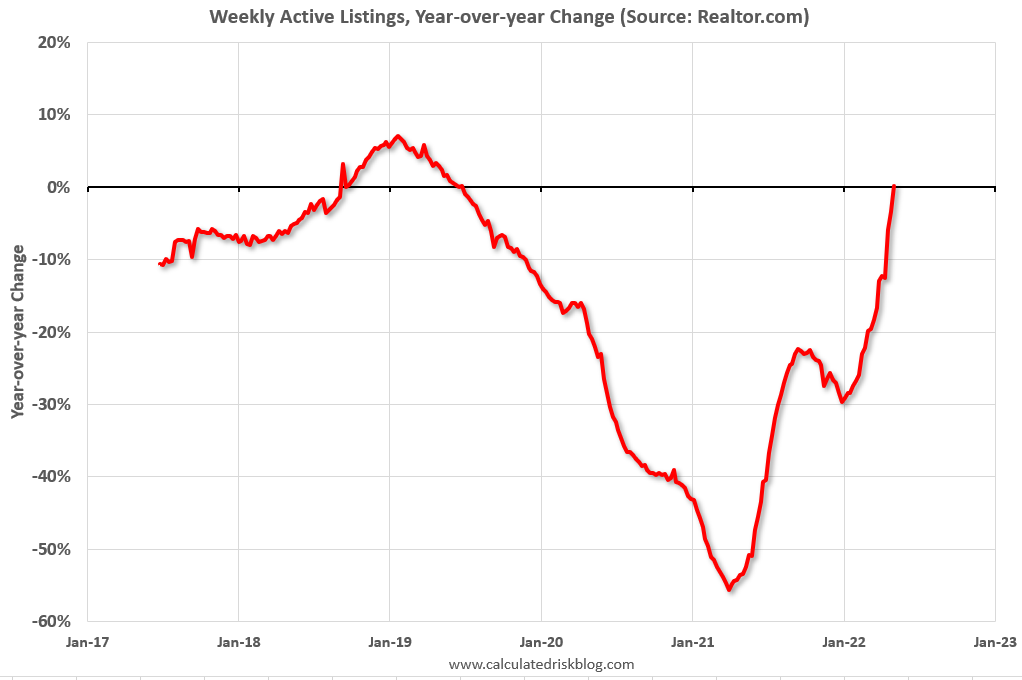

Realtor.com: More Supply is On the Way

After more than two years on the sidelines, there are signs more homeowners might finally be ready to sell.

Eighteen percent of homeowners in the U. S. plan on selling their homes within the next twelve months, according to Realtor.com?s 2022 Home Sellers report. This is more than twice the 8% of homeowners that typically said they planned to sell at the start of the Spring buying season pre-pandemic and almost double the 10% of homeowners who said they planned to sell in 2021.

As to why a larger number of homeowners than usual may be motivated to list their homes this year, a lot may have to do with the disruptions and uncertainty caused by the first two years of the pandemic, says Ratiu.

Early lockdowns made selling a home difficult. Later on, the rise of the Delta and Omicron variants put a return to a more normal routine in question. Uncertainty over school policies on masking and in-person learning, and over businesses bringing people back to the office also made a move during last year?s spring buying season a challenge.

?In a sense, [this year] is a catch-up,? Ratiu says. ?It?s over two years of delayed activity about to come on the market this year.?

Realtor.com: More Supply is On the Way

After more than two years on the sidelines, there are signs more homeowners might finally be ready to sell.

Eighteen percent of homeowners in the U. S. plan on selling their homes within the next twelve months, according to Realtor.com?s 2022 Home Sellers report. This is more than twice the 8% of homeowners that typically said they planned to sell at the start of the Spring buying season pre-pandemic and almost double the 10% of homeowners who said they planned to sell in 2021.

As to why a larger number of homeowners than usual may be motivated to list their homes this year, a lot may have to do with the disruptions and uncertainty caused by the first two years of the pandemic, says Ratiu.

Early lockdowns made selling a home difficult. Later on, the rise of the Delta and Omicron variants put a return to a more normal routine in question. Uncertainty over school policies on masking and in-person learning, and over businesses bringing people back to the office also made a move during last year?s spring buying season a challenge.

?In a sense, [this year] is a catch-up,? Ratiu says. ?It?s over two years of delayed activity about to come on the market this year.?