You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Housing Analysis

- Thread starter eyephone

- Start date

NEW -> Contingent Buyer Assistance Program

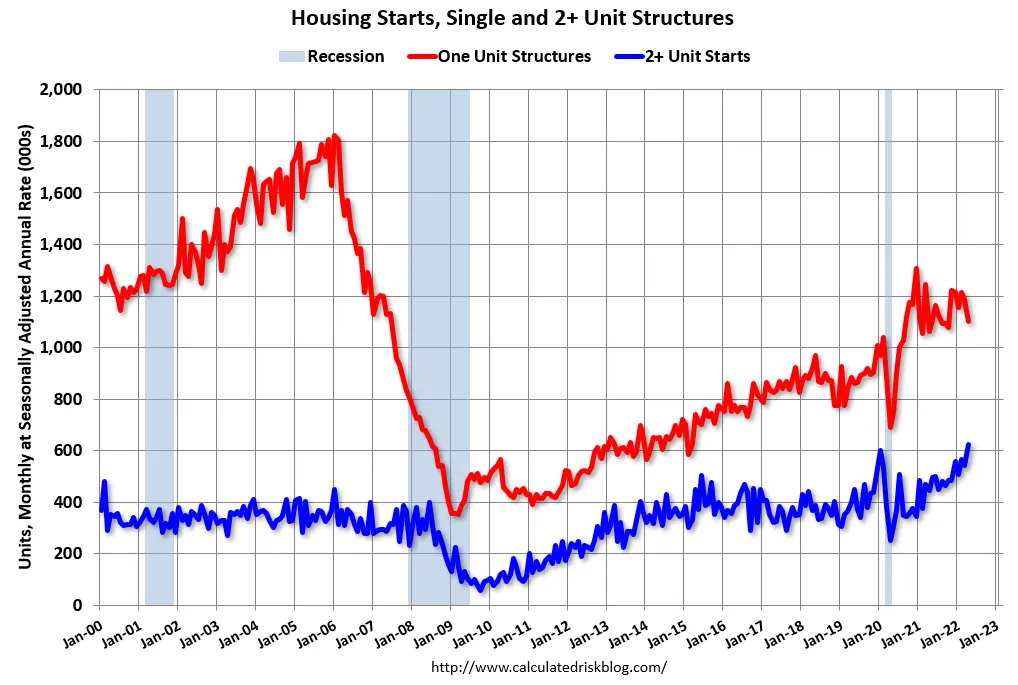

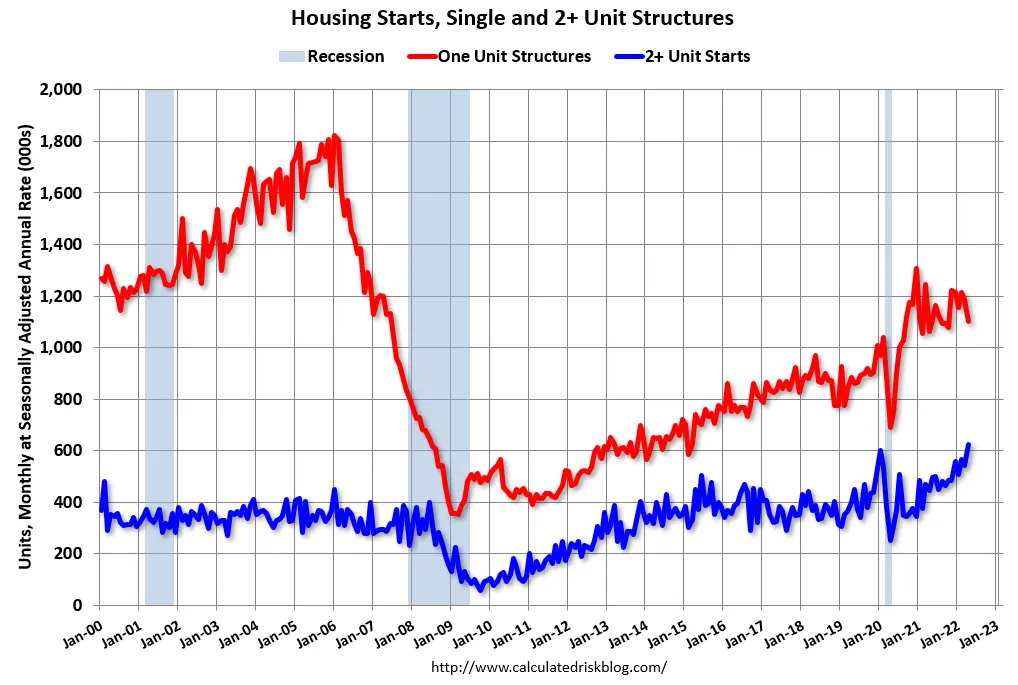

There are 1.641 million homes under construction - the most ever!

Housing starts are trending up YoY, but are not at a record high.

Orange County and Irvine have outperformed the national real estate market for a long time and will probably do so for the foreseeable future.

We are in complete agreement, which is why I sold my inland rentals. Places like Riverside and Phoenix will get squashed much more severely. Of course, condos in OC have a history of getting pummeled badly, so we shouldn't assume all of OC, or even Irvine, will move in lockstep.

There I agree with you, attached condo will under perform detached properties just like they did in the last downturn.

I think the best thing for society would be homes increasing at a slow & steady pace, instead of these boom/bust cycles that leave so much pain and wreckage in their wake. Unfortunately, I don't have any control over the markets. I can only post information to help guide others into making better housing decisions.

If you are thinking of buying a home, you might want to wait until things go on sale. At the very least, there's no reason to rush. The housing shortage has been cancelled.

Funny how he mentions inventory levels, I remember someone else talking about watching inventory levels.

And last year inventory was stupid low, we are still hovering around 1 month of inventory with your big increase in inventory (we were down as low as 1 week of inventory at one point) so it's going to take a lot more inventory on the market for prices to come down materially (think over 3 months of inventory).

Sure, but this ballgame has only just begun.

We always get so fixated on Irvine Irvine Irvine. Not everything is based on Irvine and if anything, whatever happens with other parts of California will happen to Irvine as well. Especially ones that are buying at $700+ per sqft in those dense, no lot, and no driveway type of homes. At some point, your cost basis needs to justify the premium that was paid. Location matters, but if people are bidding homes that don?t deserve that premium in a normal market, it will be impacted regardless of where you?re located.

Liar Loan

Well-known member

zubs said:In 1974 we had 2.4 million housing starts.

In 2006 we had 2.2 million housing starts.

Why is 1.641 million housing starts the ALL-TIME RECORD?

I gotta keep on top of housing starts for my own business.

There are 1.641 million homes under construction - the most ever!

Housing starts are trending up YoY, but are not at a record high.

irvinehomeowner

Well-known member

Liar Loan

Well-known member

Where is USC these days? He must be really busy.

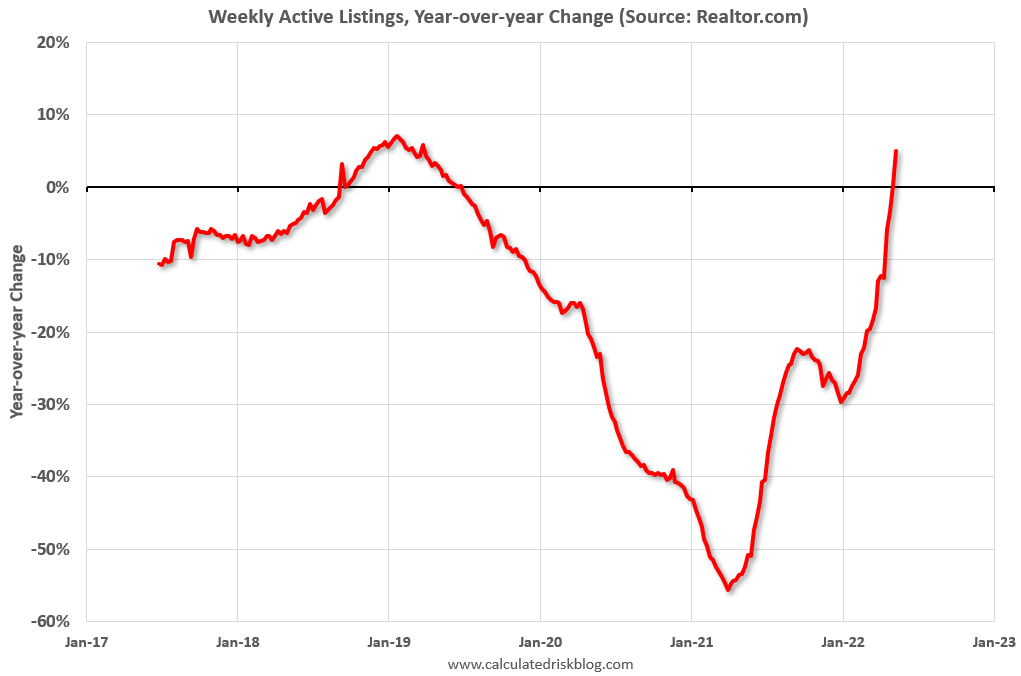

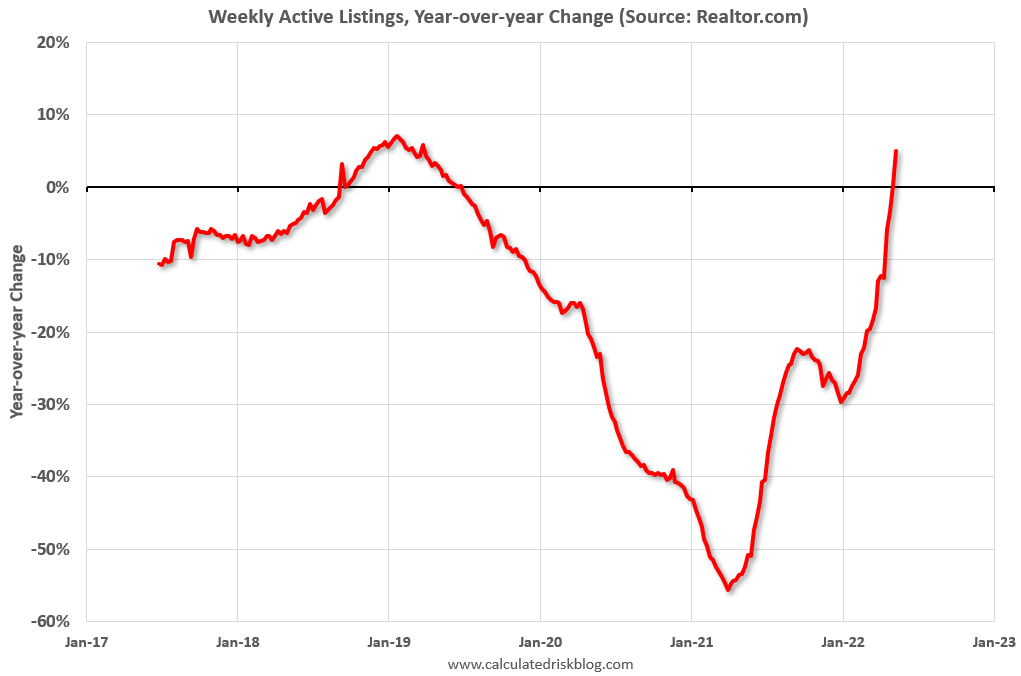

Weekly Inventory Up 5% Year-over-year

https://www.calculatedriskblog.com/2022/05/realtorcom-reports-weekly-inventory-up_19.html

Weekly Inventory Up 5% Year-over-year

https://www.calculatedriskblog.com/2022/05/realtorcom-reports-weekly-inventory-up_19.html

usctrojancpa

Well-known member

Here's data from MLS in terms of Irvine inventory levels...

Inventory @ 4/30/20 - 742 homes

Inventory @ 4/30/21 - 414 homes

Inventory @ 4/30/22 - 308 homes

That looks like a decline of about 25% YOY to me. Here's the inventory levels for all of Orange County...

Inventory @ 4/30/20 - 4,227 homes

Inventory @ 4/30/21 - 2,707 homes

Inventory @ 4/30/22 - 2,454 homes

Orange County inventory levels are down 9% YOY so looks like Irvine inventory levels have stayed lower. The rest of the country is seeing higher inventory YOY but we aren't in Irvine or Orange County.

Inventory @ 4/30/20 - 742 homes

Inventory @ 4/30/21 - 414 homes

Inventory @ 4/30/22 - 308 homes

That looks like a decline of about 25% YOY to me. Here's the inventory levels for all of Orange County...

Inventory @ 4/30/20 - 4,227 homes

Inventory @ 4/30/21 - 2,707 homes

Inventory @ 4/30/22 - 2,454 homes

Orange County inventory levels are down 9% YOY so looks like Irvine inventory levels have stayed lower. The rest of the country is seeing higher inventory YOY but we aren't in Irvine or Orange County.

CalBears96

Well-known member

How many L's does LL have to take before he realizes that data for the rest of the country is NOT the same as data for the Irvine or Orange County?

usctrojancpa

Well-known member

CalBears96 said:How many L's does LL have to take before he realizes that data for the rest of the country is NOT the same as data for the Irvine or Orange County?

Orange County and Irvine have outperformed the national real estate market for a long time and will probably do so for the foreseeable future.

Liar Loan

Well-known member

USCTrojanCPA said:CalBears96 said:How many L's does LL have to take before he realizes that data for the rest of the country is NOT the same as data for the Irvine or Orange County?

Orange County and Irvine have outperformed the national real estate market for a long time and will probably do so for the foreseeable future.

We are in complete agreement, which is why I sold my inland rentals. Places like Riverside and Phoenix will get squashed much more severely. Of course, condos in OC have a history of getting pummeled badly, so we shouldn't assume all of OC, or even Irvine, will move in lockstep.

usctrojancpa

Well-known member

Liar Loan said:USCTrojanCPA said:CalBears96 said:How many L's does LL have to take before he realizes that data for the rest of the country is NOT the same as data for the Irvine or Orange County?

Orange County and Irvine have outperformed the national real estate market for a long time and will probably do so for the foreseeable future.

We are in complete agreement, which is why I sold my inland rentals. Places like Riverside and Phoenix will get squashed much more severely. Of course, condos in OC have a history of getting pummeled badly, so we shouldn't assume all of OC, or even Irvine, will move in lockstep.

There I agree with you, attached condo will under perform detached properties just like they did in the last downturn.

irvinehomeowner

Well-known member

Finally... LL's dreams will come true.................

Liar Loan

Well-known member

irvinehomeowner said:Finally... LL's dreams will come true.................

I think the best thing for society would be homes increasing at a slow & steady pace, instead of these boom/bust cycles that leave so much pain and wreckage in their wake. Unfortunately, I don't have any control over the markets. I can only post information to help guide others into making better housing decisions.

If you are thinking of buying a home, you might want to wait until things go on sale. At the very least, there's no reason to rush. The housing shortage has been cancelled.

irvinehomeowner

Well-known member

Liar Loan... the people's champ.

Liar Loan

Well-known member

Pending home sales always decline this time of year... No worries though because Lawrence Yun says no drop in home prices.

Pending Home Sales Plunge To Lowest Level In Nearly A Decade?Worst Could Be Yet To Come

Pending home sales slid for the sixth consecutive month in April to the lowest level in nearly a decade, according to Tuesday data, and experts believe sales have much more room to fall as rising mortgage rates put a damper on a booming housing market.

Meanwhile, Yun says home prices "appear in no danger of any meaningful decline" given an ongoing housing shortage and swift selling, with listed homes generally seeing a contract signed within one month.

https://www.forbes.com/sites/jonath...n-nearly-a-decade-worst-could-be-yet-to-come/

Pending Home Sales Plunge To Lowest Level In Nearly A Decade?Worst Could Be Yet To Come

Pending home sales slid for the sixth consecutive month in April to the lowest level in nearly a decade, according to Tuesday data, and experts believe sales have much more room to fall as rising mortgage rates put a damper on a booming housing market.

Meanwhile, Yun says home prices "appear in no danger of any meaningful decline" given an ongoing housing shortage and swift selling, with listed homes generally seeing a contract signed within one month.

https://www.forbes.com/sites/jonath...n-nearly-a-decade-worst-could-be-yet-to-come/

usctrojancpa

Well-known member

Liar Loan said:Pending home sales always decline this time of year... No worries though because Lawrence Yun says no drop in home prices.

Pending Home Sales Plunge To Lowest Level In Nearly A Decade?Worst Could Be Yet To Come

Pending home sales slid for the sixth consecutive month in April to the lowest level in nearly a decade, according to Tuesday data, and experts believe sales have much more room to fall as rising mortgage rates put a damper on a booming housing market.

Meanwhile, Yun says home prices "appear in no danger of any meaningful decline" given an ongoing housing shortage and swift selling, with listed homes generally seeing a contract signed within one month.

https://www.forbes.com/sites/jonath...n-nearly-a-decade-worst-could-be-yet-to-come/

Funny how he mentions inventory levels, I remember someone else talking about watching inventory levels.

morekaos

Well-known member

National listings are growing...supply push...

Home listings suddenly jump as sellers worry they may miss out on the red-hot housing market

The supply of homes for sale jumped 9% last week compared with the same week one year ago, according to Realtor.com.

Real estate brokerage Redfin also reported that new listings rose nearly twice as fast in the four weeks ended May 15 as they did during the same period a year ago.

Pending home sales, a measure of signed contracts on existing homes, dropped nearly 4% in April, month to month and were down just over 9% from April 2021, according to the National Association of Realtors.

https://www.cnbc.com/2022/05/26/hom...-worry-theyll-miss-out-on-red-hot-market.html

Home listings suddenly jump as sellers worry they may miss out on the red-hot housing market

The supply of homes for sale jumped 9% last week compared with the same week one year ago, according to Realtor.com.

Real estate brokerage Redfin also reported that new listings rose nearly twice as fast in the four weeks ended May 15 as they did during the same period a year ago.

Pending home sales, a measure of signed contracts on existing homes, dropped nearly 4% in April, month to month and were down just over 9% from April 2021, according to the National Association of Realtors.

https://www.cnbc.com/2022/05/26/hom...-worry-theyll-miss-out-on-red-hot-market.html

usctrojancpa

Well-known member

Liar Loan said:Inventory is still low by historical standards, but it's rapidly increasing at the moment. Earlier this year, inventory was down -30% from a year ago, now it's up +9% and growing at an accelerating rate.

And last year inventory was stupid low, we are still hovering around 1 month of inventory with your big increase in inventory (we were down as low as 1 week of inventory at one point) so it's going to take a lot more inventory on the market for prices to come down materially (think over 3 months of inventory).

Liar Loan

Well-known member

USCTrojanCPA said:Liar Loan said:Inventory is still low by historical standards, but it's rapidly increasing at the moment. Earlier this year, inventory was down -30% from a year ago, now it's up +9% and growing at an accelerating rate.

And last year inventory was stupid low, we are still hovering around 1 month of inventory with your big increase in inventory (we were down as low as 1 week of inventory at one point) so it's going to take a lot more inventory on the market for prices to come down materially (think over 3 months of inventory).

Sure, but this ballgame has only just begun.

sleepy5136

Well-known member

With what is happening with rates and the talks of a recession, buyer sentiment is key. You are hearing big tech companies slowing or even stopping hiring right now. The RSUs for down payments are shrunk by more than half. Talks of a recession are all over the place. All of this matters because if one is ready to buy a home even with less competition, they are putting a pause on their home search as shown by inventories growing. Rates are higher and may have an impact on the demand, but I would argue the economic uncertainty is more concerning now and is a bigger factor as to the RE slowdown more so than rates.USCTrojanCPA said:Liar Loan said:Inventory is still low by historical standards, but it's rapidly increasing at the moment. Earlier this year, inventory was down -30% from a year ago, now it's up +9% and growing at an accelerating rate.

And last year inventory was stupid low, we are still hovering around 1 month of inventory with your big increase in inventory (we were down as low as 1 week of inventory at one point) so it's going to take a lot more inventory on the market for prices to come down materially (think over 3 months of inventory).

We always get so fixated on Irvine Irvine Irvine. Not everything is based on Irvine and if anything, whatever happens with other parts of California will happen to Irvine as well. Especially ones that are buying at $700+ per sqft in those dense, no lot, and no driveway type of homes. At some point, your cost basis needs to justify the premium that was paid. Location matters, but if people are bidding homes that don?t deserve that premium in a normal market, it will be impacted regardless of where you?re located.