irvinebullhousing

Well-known member

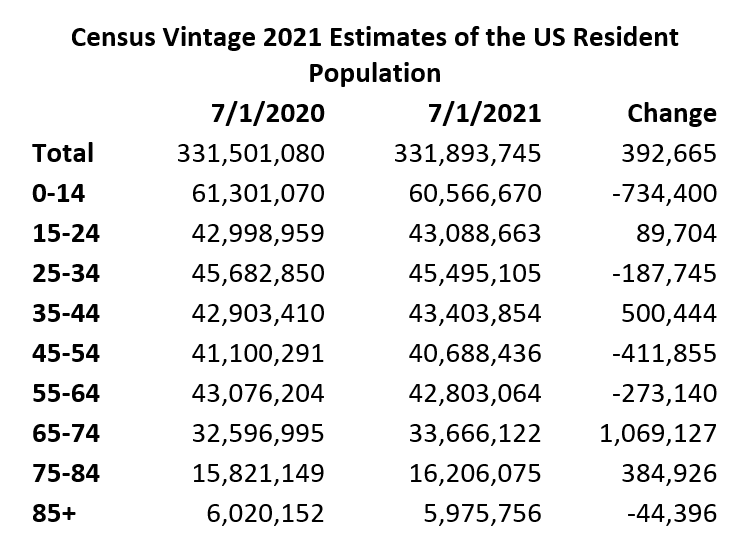

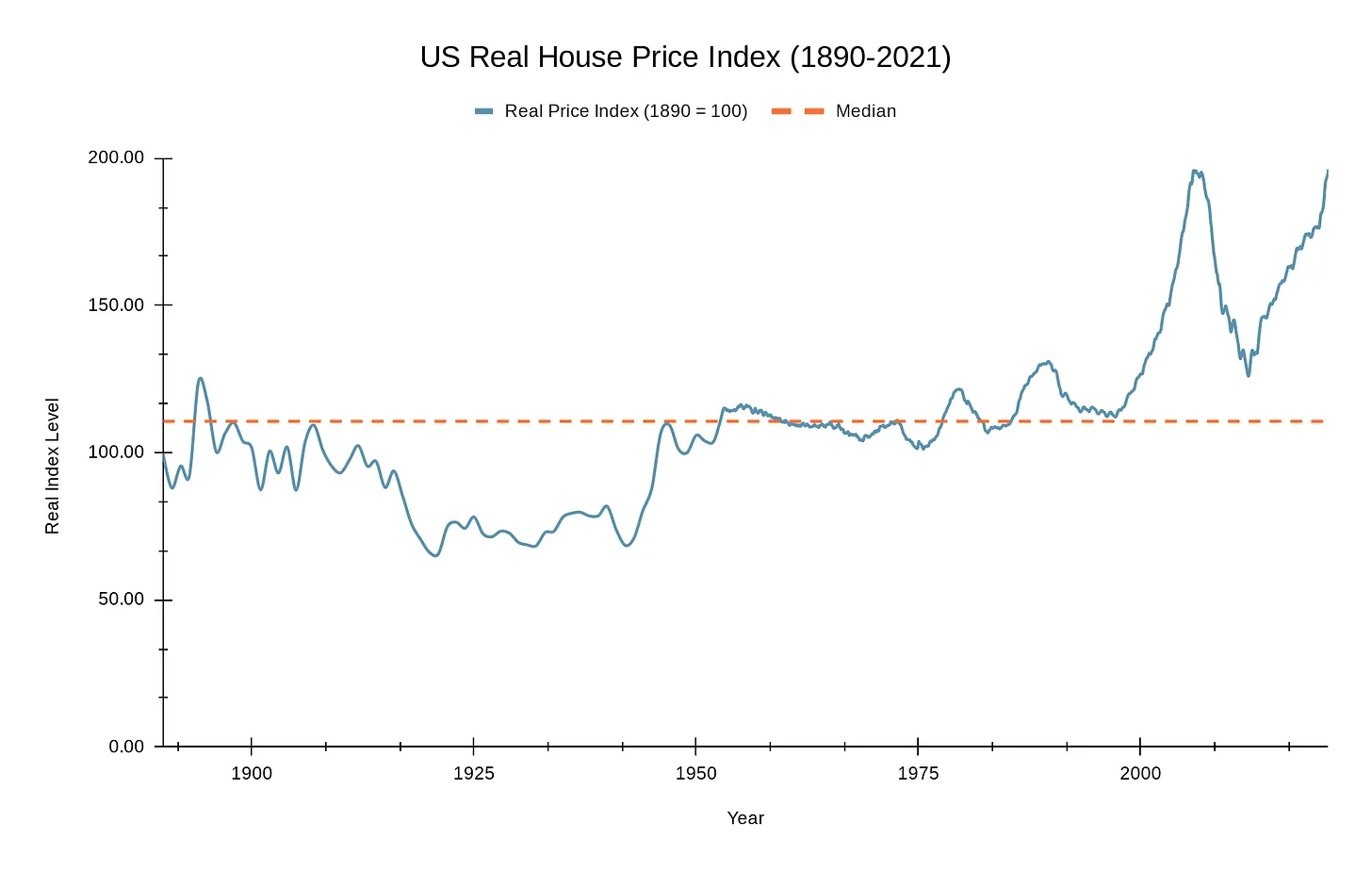

I am really sympathetic to home buyers today. You have still rising price, rising rates, and a fierce bid up buyers. Its a real fight out there. The imbalance is never been higher. The only thing that can put more days of homes on the active inventory is higher rate. Rate need to go much higher to encourage cool things off. This is just to calm things down. With demographics data at its best than it has ever been for Socal and Irvine according to Housingwire, and higher mortgage rate will provide a much need inventory, rather than gone within days.

Do people go here to get advise to buy a house? If they are, then they are not ready to buy. I highly doubt people take our talk here into consideration when purchas a home into their decsion of pulling the trigger.

Do people go here to get advise to buy a house? If they are, then they are not ready to buy. I highly doubt people take our talk here into consideration when purchas a home into their decsion of pulling the trigger.