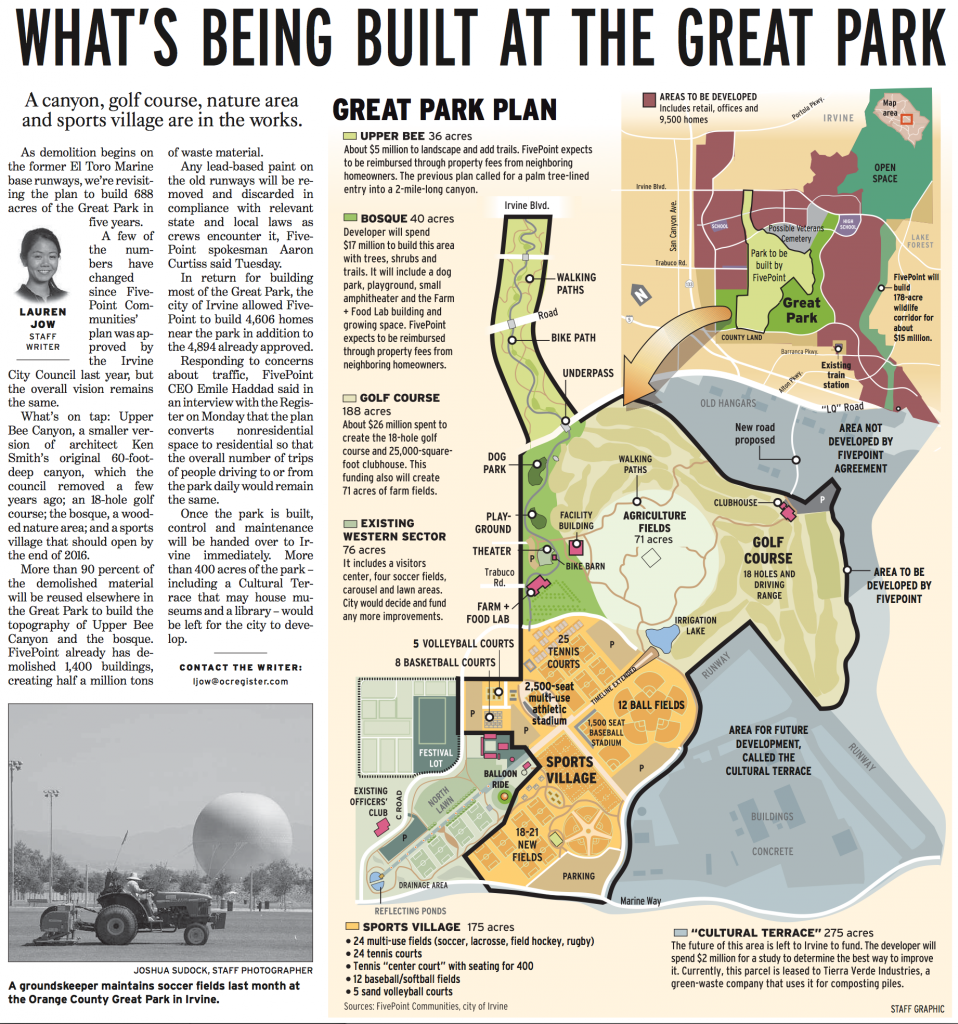

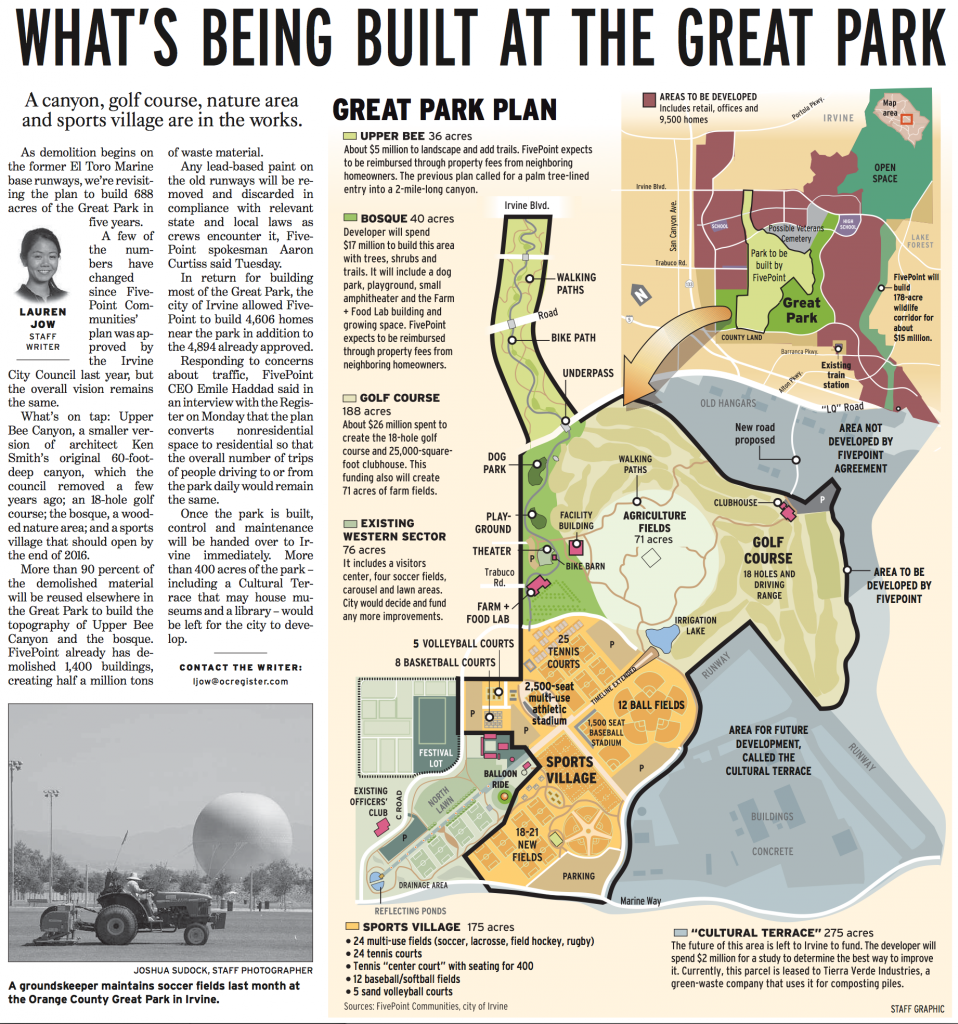

Here's an article in the OC Register today with the latest plan.

Personally, very disappointed with what the Great Park has become. It had the potential to be one of the greatest municipal parks in the US, but now it doesn't seem so much. The golf course is wasted space for most people. Personally, the only parts I can imagine using are Upper Bee Canyon, and the Bosque area.

Personally, very disappointed with what the Great Park has become. It had the potential to be one of the greatest municipal parks in the US, but now it doesn't seem so much. The golf course is wasted space for most people. Personally, the only parts I can imagine using are Upper Bee Canyon, and the Bosque area.