You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

President Trump

- Thread starter Movingup

- Start date

NEW -> Contingent Buyer Assistance Program

The thing that SUPER irritated me was property taxes. On what planet does the government need 40-60K on a cookie cutter lot every single year? (selling your house is going to reset that level for the new buyer). Move to another area with new homes and taxes are MUCH lower and they are putting in streets, parks, lights etc too so how in hell does the government "need" what they get from higher priced homes? It's not like you don't pay income tax like some states, sales tax like other states, low vehicle or gas taxes. It's just never enough. The only thing u don't get taxed on is groceries.

Our property taxes are not going up again next year (they might be going down a little like they did this year). Everyone who gets money from property taxes submits their budget. Every property is reassessed each year (and it does go up). The amount of money needed is calculated and a percent of the property value is assigned. This includes building more roads, lights, parks etc, pay raises, hiring more staff and still the property taxes do not go up (because there is a higher number of properties paying taxes each year due to building new homes). But in California, taxes go up 2% from a significant base just because they can. The site is down so I can't check the exact amount but I'm pretty sure we pay about $2500 per year and our income tax is 2.5%. There are pages of tax credits we can donate to which come straight off state income tax so every year we donate the max to United Food Bank (this year it will be somewhere around $1000 credit not deduction) and local schools. There are a ton more we can also donate too. This state is not unique. HOW on God's green earth other states are able to "make due" while California absolutely soaks people half to death? There is only so much the weather is worth and if California could they would tax the amount of sunshine per day.

I am curious about his green card status. Green cards are valid for up to ten years; then have to be renewed. Did he get his green card before 2004? If so, he would have had to deal with his criminal record in his renewal application. Me wonders if he has a valid green card.

https://www.alllaw.com/articles/nol...es-renewing-green-card-felony-conviction.html

If you are a U.S. lawful permanent resident who has been convicted of a felony—or indeed any crime—then applying to renew your green card carries risk. You could end up being removed from the U.S. (deported).

This article was written before Trump's second term. The law has not changed. What has changed is our immigration laws are being enforced.

In other words ZIRP causes inflation (like the Fed-induced inflation of 2021 & 2022). Whereas, a tariff is nothing more than a tax and doesn't create inflation any more than an income tax, property tax, or sales tax. Taxes actually remove money from the economy, so in that sense they are dis-inflationary.

You only apply that opinion on your presidents. Otherwise you create a thread and hundreds of posts pointing out the smallest criticisms of others.

His diminished mental capacity should concern you like it did with Biden.

Ready2Downsize

Well-known member

But there are stock options too. There has to be high income people to be able to qualify for higher priced homes even if they move equity from previous houses because the property taxes will be a major expense due to the high base (and add in mello if it's still applicable). We bought and sold 6 houses in the OC thru the years and every sale was to Asians and they all had mortgages but they also had businesses and other properties. My last Irvine home had majority Caucasian original owners on our street (business owners, lawyers, doctors mostly) and now it is 100% Asian. Even the Tustin Legacy street I lived on was majority Caucasian and when we left every sale went to Asians. Everyday ordinary income type buyers just can't afford Irvine or even central OC any more. I'm not against Asians, all of my good friends in high school were Asian (mostly Japanese) but the makeup of the area has changed and the 85K buyers (even dual income) isn't going to cut it anymore.We are quite fortunate and are way over that.

But Irvine probably has 10-20% of households that would have over $585k of household income? 20% seems high actually. But all houses are crazy expensive in Irvine. I can’t imagine most home buyers are FCBs or people with huge down payment assistance from family but perhaps they are.

I was on Reddit and saw some Irvine poster that was a software engineer and I think they make pretty good money but not sure how many software engineering jobs there are in Irvine that are making more than 585k. It really would have to be a combination of 2 high ranking finance people, doctors, or lawyers - generally speaking for the w2 crowd. Then I’m assuming there must be a decent amount of business owners? Perhaps a good % of people are legacy 1990s Irvine buyers that have remained in Irvine? I guess crowd could be on the lower end of the earnings spectrum and afford to live in Irvine.

Ready2Downsize

Well-known member

We never made that kind of salary, for one thing I retired when I was 42. I did have an etsy shop for a while but it was just a hobby type thing, so only one salary but pretty significant stock trade income but it still irritates me to no end to hear the "rich" need to pay their fair share because imo they pay way more than their fair share and to hear it from people who don't even pay any federal tax makes me even more mad.We paid about 120k in just state income tax. Then we paid almost 20k in property taxes. The registration for 2 cars was about 1,400-1,500. Then we pay substantially more in federal income taxes. So we pay a lot of taxes. That’s why initially I was happy because I thought i would save $11,100

The only way to not pay the California taxes would be to move to another state. Not willing to do that at this point. But in my view we pay more than our fair share so I do get annoyed when I hear about democrats trying to raise taxes, or removing the cap on social security wage base. We would have a pretty big tax hit if they ever removed the cap for SS. I’m just keeping my fingers crossed that it happens after we retire

The thing that SUPER irritated me was property taxes. On what planet does the government need 40-60K on a cookie cutter lot every single year? (selling your house is going to reset that level for the new buyer). Move to another area with new homes and taxes are MUCH lower and they are putting in streets, parks, lights etc too so how in hell does the government "need" what they get from higher priced homes? It's not like you don't pay income tax like some states, sales tax like other states, low vehicle or gas taxes. It's just never enough. The only thing u don't get taxed on is groceries.

Our property taxes are not going up again next year (they might be going down a little like they did this year). Everyone who gets money from property taxes submits their budget. Every property is reassessed each year (and it does go up). The amount of money needed is calculated and a percent of the property value is assigned. This includes building more roads, lights, parks etc, pay raises, hiring more staff and still the property taxes do not go up (because there is a higher number of properties paying taxes each year due to building new homes). But in California, taxes go up 2% from a significant base just because they can. The site is down so I can't check the exact amount but I'm pretty sure we pay about $2500 per year and our income tax is 2.5%. There are pages of tax credits we can donate to which come straight off state income tax so every year we donate the max to United Food Bank (this year it will be somewhere around $1000 credit not deduction) and local schools. There are a ton more we can also donate too. This state is not unique. HOW on God's green earth other states are able to "make due" while California absolutely soaks people half to death? There is only so much the weather is worth and if California could they would tax the amount of sunshine per day.

irvinehomeowner

Well-known member

I don't mind the EV credit cut but also cutting solar and battery credits is shortsighted and maybe that's why Elon is no longer BFF.

This OpEd has some good points:

Clean energy shouldn't be a political decision. You really need multiple avenues of power esp with electricity hungry AI and crypto.

MCGA.

This OpEd has some good points:

Clean energy shouldn't be a political decision. You really need multiple avenues of power esp with electricity hungry AI and crypto.

MCGA.

Last edited:

Loco_local

Active member

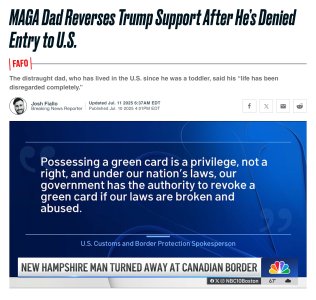

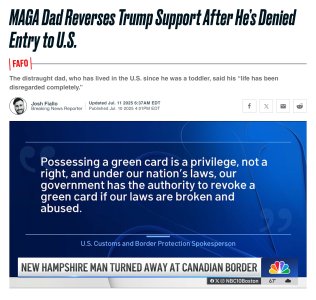

If you’re a green card holder and ever got caught smoking pot, you better not leave the country. There have been so many stories like this one. How is it beneficial to lock up working fathers of American children? Besides the emotional trauma it causes, it’s certainly not economically efficient for taxpayers.

www.thedailybeast.com

www.thedailybeast.com

MAGA Dad Gets Green Card Revoked Despite Backing Trump

The distraught dad, who has lived in the U.S. since he was a toddler, said his “life has been disregarded completely.”

Green card holders are legal and have to worry. They better make sure they obey all traffic laws or don’t piss of the wrong person who might falsely accused them of a crime. How is keeping a father who has a five year old misdemeanor conviction locked up in a for profit prison for months an efficient use of tax payer money? The children aren’t going back to Argentina. They aren’t going to have to emotional and financial support of their father. The parents will probably stay in the US and they won’t have their son to help them.

morekaos

Well-known member

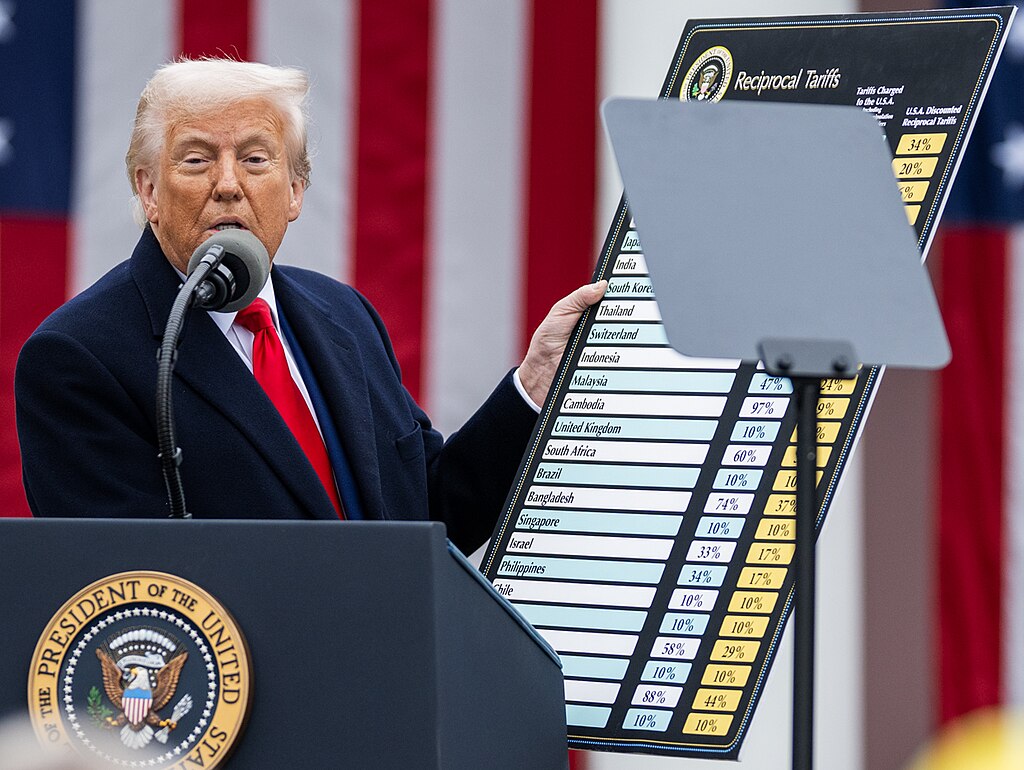

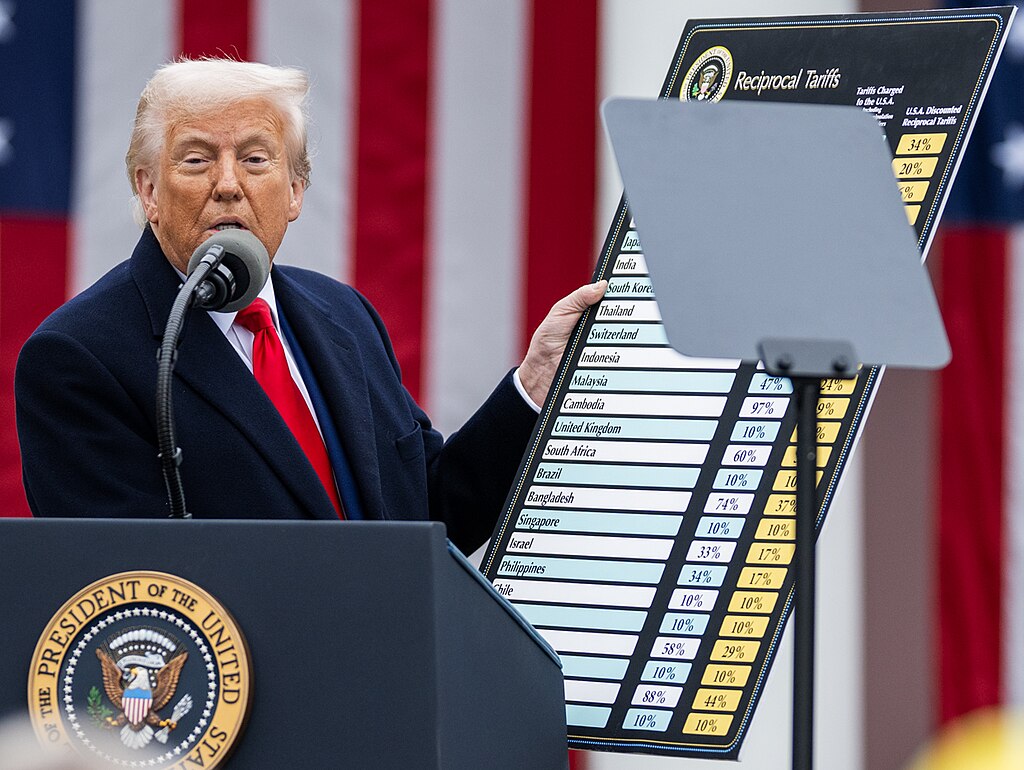

but but but …30 Nobel economists said it will never work…

The surplus was fueled largely by a surge in tariff revenues, driven by Trump’s aggressive trade policies.

www.econotimes.com

www.econotimes.com

U.S. Posts First Monthly Budget Surplus Since 2017 Amid Tariff Windfall

Just a week after President Donald Trump signed the “Big Beautiful Bill” into law, the U.S. Treasury surprised markets with a rare budget surplus for June 2025. The federal government reported a $27 billion surplus—the first monthly surplus in eight years—defying economists’ forecasts of a $41.5 billion deficit.The surplus was fueled largely by a surge in tariff revenues, driven by Trump’s aggressive trade policies.

U.S. Posts First Monthly Budget Surplus Since 2017 Amid Tariff Windfall - EconoTimes

Just a week after President Donald Trump signed the Big Beautiful Bill into law, the U.S. Treasury surprised markets with a rare budget surplus for June 2025. The federal government reported a $27 billion surplusthe first...

morekaos

Well-known member

It’s not just political it is practical ….I don't mind the EV credit cut but also cutting solar and battery credits is shortsighted and maybe that's why Elon is no longer BFF.

Clean energy shouldn't be a political decision. You really need multiple avenues of power esp with electricity hungry AI and crypto.

MCGA.

ENVIRONMENTAL DISASTER

Wind and solar energy, along with the batteries and transmission lines they require to function even minimally, are inherently bad for the environment. But sometimes they are even worse, as when turbine blades fail. This sad story from the Nantucket Current is one we have seen repeatedly around the country:So the turbine was 15 miles out into the ocean, and it was so large–the length of a football field–that it littered the region, including Nantucket’s beaches, with debris.GE Vernova will pay the town of Nantucket and island businesses $10.5 million as part of a settlement related to the offshore wind turbine blade failure in July 2024 at the Vineyard Wind farm.

***

The town announced the settlement Friday morning with GE Vernova, the manufacturer of the Haliade-X turbine that failed, nearly one year since the 300-foot-long blade collapsed 15 miles southwest of the island, littering Nantucket beaches with debris and scattering fiberglass and foam around the region.

irvine buyer

Active member

And every one of the stories I have read involve a criminal record including this one. New Hampshire decriminalized the possession of small amounts of cannabis back in July 2017. Prior to that, possession of cannabis was a felony. The article states that this person's offenses occurred back in 2004 and 2007.If you’re a green card holder and ever got caught smoking pot, you better not leave the country. There have been so many stories like this one.

I am curious about his green card status. Green cards are valid for up to ten years; then have to be renewed. Did he get his green card before 2004? If so, he would have had to deal with his criminal record in his renewal application. Me wonders if he has a valid green card.

https://www.alllaw.com/articles/nol...es-renewing-green-card-felony-conviction.html

If you are a U.S. lawful permanent resident who has been convicted of a felony—or indeed any crime—then applying to renew your green card carries risk. You could end up being removed from the U.S. (deported).

This article was written before Trump's second term. The law has not changed. What has changed is our immigration laws are being enforced.

irvinehomeowner

Well-known member

And you claim the media fearmongers. This is still not a reason to stymie alt energy avenues.It’s not just political it is practical ….

ENVIRONMENTAL DISASTER

Wind and solar energy, along with the batteries and transmission lines they require to function even minimally, are inherently bad for the environment. But sometimes they are even worse, as when turbine blades fail. This sad story from the Nantucket Current is one we have seen repeatedly around the country:

So the turbine was 15 miles out into the ocean, and it was so large–the length of a football field–that it littered the region, including Nantucket’s beaches, with debris.

Liar Loan

Well-known member

So they aren't just targeting Latinx's after all?If you’re a green card holder and ever got caught smoking pot, you better not leave the country. There have been so many stories like this one. How is it beneficial to lock up working fathers of American children? Besides the emotional trauma it causes, it’s certainly not economically efficient for taxpayers.

morekaos

Well-known member

Sure it is but if you don’t agree just don’t throw away taxpayer funds to prop it up.And you claim the media fearmongers. This is still not a reason to stymie alt energy avenues.

morekaos

Well-known member

But, but, but the FED and CEO’s all said tariffs will raise inflation, balloon the deficit and send the economy into a recession…and those 50 Noble prize “economists” assured us that economic disaster will soon engulf us…this can’t be right..can it?

So the experts were bracing for core inflation to rise to 0.3% in June, but it came in at 0.2% instead. That may not sound like a big deal, but when you consider the apocalyptic predictions we've been hearing from the left for months now, this is a win for Trump.

“Look, you've got to look at this report as another victory for President Trump who has focused on reining in inflation, and that's what we're seeing from this report again,” observed Maria Bartiromo on Fox Business.

For months, so-called experts have been warning of catastrophic inflation under Trump, but the disaster they’ve been hyping never showed up. Not even close.It’s almost like they’re rooting for economic pain just to score political points. Here’s the inconvenient truth: inflation is still lower today than it was under Joe Biden. That’s a fact the liberal media would rather memory-hole because it blows up their entire narrative.

Here’s What the Left Doesn’t Want You to Know About the Inflation Report – PJ Media

During Trump's time in office, the federal deficit slid to $498 billion from $741 billion in the same time period a year earlier, when Joe Biden was in office. That's about a third lower between the amount paid out and the amount paid in, meaning, the federal government is no longer spending like it used to. Why is the press missing this story? Well, because they are counting it from the fiscal year's beginning, not from the Trump administration's second term beginning, which is a far more useful indicator. Trump is slashing the deficit and only the smarter guys on Wall Street, like Brian Wesbury, can see it. The rest are reading reports like these and saying the deficit is up, unable to see that they are lumping Joe Biden's bad figures in with President Trump's figures, creating a doo-doo in the punchbowl kind of distortion

https://www.americanthinker.com/blo...ion_and_cut_the_deficit_by_about_a_third.html

'When You Made a Mistake…': Billionaire Home Depot Founder Does 180 on Trump's Tariffs, Presidency

Billionaire Home Depot co-founder Ken Langone has done a 180 after blasting Trump's sweeping tariffs, explaining, "When you made a mistake, admit it." "I am sold on Trump," Langone told the hosts. "In fact, I will say this. I think he's got a good shot at going down in history as one of our best presidents ever." A host on the panel pointed out the "real turnaround" from Langone, adding, "Because you didn't want to vote for him!"

"I told you the reason," the Billionaire donor responded. "I tell ya, I'm a believer. What I'm seeing happening is absolutely nothing short of a great thing. There's a beat. People are walking with more bounce in their step. It's all around."

'When You Made a Mistake…': Billionaire Home Depot Founder Does 180 on Trump's Tariffs, Presidency – RedState

So the experts were bracing for core inflation to rise to 0.3% in June, but it came in at 0.2% instead. That may not sound like a big deal, but when you consider the apocalyptic predictions we've been hearing from the left for months now, this is a win for Trump.

“Look, you've got to look at this report as another victory for President Trump who has focused on reining in inflation, and that's what we're seeing from this report again,” observed Maria Bartiromo on Fox Business.

For months, so-called experts have been warning of catastrophic inflation under Trump, but the disaster they’ve been hyping never showed up. Not even close.It’s almost like they’re rooting for economic pain just to score political points. Here’s the inconvenient truth: inflation is still lower today than it was under Joe Biden. That’s a fact the liberal media would rather memory-hole because it blows up their entire narrative.

Here’s What the Left Doesn’t Want You to Know About the Inflation Report – PJ Media

During Trump's time in office, the federal deficit slid to $498 billion from $741 billion in the same time period a year earlier, when Joe Biden was in office. That's about a third lower between the amount paid out and the amount paid in, meaning, the federal government is no longer spending like it used to. Why is the press missing this story? Well, because they are counting it from the fiscal year's beginning, not from the Trump administration's second term beginning, which is a far more useful indicator. Trump is slashing the deficit and only the smarter guys on Wall Street, like Brian Wesbury, can see it. The rest are reading reports like these and saying the deficit is up, unable to see that they are lumping Joe Biden's bad figures in with President Trump's figures, creating a doo-doo in the punchbowl kind of distortion

https://www.americanthinker.com/blo...ion_and_cut_the_deficit_by_about_a_third.html

'When You Made a Mistake…': Billionaire Home Depot Founder Does 180 on Trump's Tariffs, Presidency

Billionaire Home Depot co-founder Ken Langone has done a 180 after blasting Trump's sweeping tariffs, explaining, "When you made a mistake, admit it." "I am sold on Trump," Langone told the hosts. "In fact, I will say this. I think he's got a good shot at going down in history as one of our best presidents ever." A host on the panel pointed out the "real turnaround" from Langone, adding, "Because you didn't want to vote for him!"

"I told you the reason," the Billionaire donor responded. "I tell ya, I'm a believer. What I'm seeing happening is absolutely nothing short of a great thing. There's a beat. People are walking with more bounce in their step. It's all around."

'When You Made a Mistake…': Billionaire Home Depot Founder Does 180 on Trump's Tariffs, Presidency – RedState

Last edited:

Liar Loan

Well-known member

Milton Friedman, a prominent monetarist economist, famously stated that "inflation is always and everywhere a monetary phenomenon."

This means that in his view, persistent inflation is primarily caused by excessive growth in the money supply. While other factors can influence prices in the short run, Friedman argued that sustained inflation is ultimately rooted in too much money chasing too few goods.

In other words ZIRP causes inflation (like the Fed-induced inflation of 2021 & 2022). Whereas, a tariff is nothing more than a tax and doesn't create inflation any more than an income tax, property tax, or sales tax. Taxes actually remove money from the economy, so in that sense they are dis-inflationary.

irvinehomeowner

Well-known member

Since this is in the current news cycle:

He even doubled down and said Biden appointed him.

Awaiting the morekaos spin...

He even doubled down and said Biden appointed him.

Awaiting the morekaos spin...

irvinehomeowner

Well-known member

Said it a thousand times… I don’t care…they all suck…what I care about is policy and action. Trump could shoot someone on broadway and I wouldn’t care as long as he keeps policying like he is. Presidents aren’t parents… their CEO’s

You only apply that opinion on your presidents. Otherwise you create a thread and hundreds of posts pointing out the smallest criticisms of others.

His diminished mental capacity should concern you like it did with Biden.

sgip

Well-known member

Let's hope this news on Tuesday isn't simply TACO

https://www.zerohedge.com/political/trump-considering-eliminating-capital-gains-tax-houses

https://www.zerohedge.com/political/trump-considering-eliminating-capital-gains-tax-houses