irvinehomeowner

Well-known member

What is Chapman's track record?

I guess it's time for a new poll as it looks like prices were up from last June.

I guess it's time for a new poll as it looks like prices were up from last June.

A broken clock is right 2 times a day.What is Chapman's track record?

I guess it's time for a new poll as it looks like prices were up from last June.

A broken clock is right 2 times a day.

Irvine, CA , SFR+Condo Avg.how high have prices gone up since 2020? 11% is nothing.

2 friends (female OC execs - (banker and CFO) were at the event at the PC. Technology seemed to be the only sector exception to the recession call.What is Chapman's track record?

I guess it's time for a new poll as it looks like prices were up from last June.

For it to be a real correction, prices need to go down 100%Irvine, CA , SFR+Condo Avg.

May 2020 - $870k

May 2023 - $1.36M

Irvine prices went down about 20% +/- from the peak in 2006/2007 to 2009/2011 (we had a bottom bottom in 2009 and 2011 after the $8k tax credit expired) while other surrounding cities went down 30-40%. Irvine prices recovered first and went higher than most all other OC cities.

USC is only giving you the numbers for SFR's. If you include condos/townhomes then Irvine's drop was closer to 30% +/-.That’s super interesting to hear. Thanks for pulling the data. So based on those numbers, Irvine/OC wasn’t immune to macroeconomic events. So we can let the data speak and not someone who wants to throw generalizations without supporting data

USC is only giving you the numbers for SFR's. If you include condos/townhomes then Irvine's drop was closer to 30% +/-.

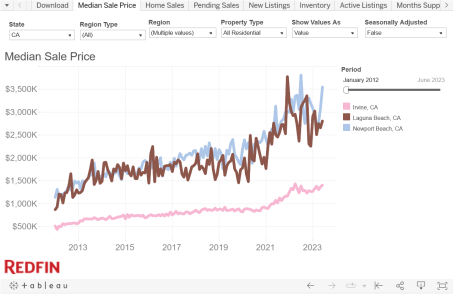

Not only that but USC is pushing a falsehood when it comes to his claim that Irvine went higher than most all other OC cities. Here you can see that Laguna and Newport both went higher than Irvine on an actual and percentage basis.

Irvine ~ Jan 2012 $510k --> Apr 2022 $1,430k = 180% increase

Laguna Beach ~ Jan 2012 $865k --> Apr 2022 $2,948 = 241% increase

Newport Beach ~ Jan 2012 $1,133 --> Apr 2022 $3,338 = 195% increase

View attachment 9069

Is it up 6% from January of this year or is it up 6% from this time last year? If the former, it could possibly be seasonality?That's why I said "most all" OC cities. The beach cities like Newport and Laguna will outperform Irvine because of being closer to the water.

Btw, what happened to the downturn that we were supposed to get in 2023? Why are prices up 6%+ this year?

Is it up 6% from January of this year or is it up 6% from this time last year? If the former, it could possibly be seasonality?

Even poor Santa Ana outpaced Irvine in percentage terms. How sad is that?

Irvine ~ Jan 2012 $510k --> Apr 2022 $1,430k = 180% increase

Santa Ana ~ Jan 2012 $271k --> Apr 2022 $775 = 186% increase

View attachment 9070

I'll do Newport because I used to want to live there:

https://www.trulia.com/real_estate/Newport_Beach-California/market-trends/

High: ~Jul 07 - $1.6m

Low: ~Jul 12 - $862,500 (there is a lower low in 09 of $800k but I wanted to keep the time frame similar to Irvine)

Drop: 46%

Irvine did fare better than other areas in OC.

When I kept saying TayMo was raising prices here.......... but now.............. might be showing signs of some cracks. So it would seem to me that if the economy is doing so well and there is no recession (cuz the fed who knows everything...lol! said so yesterday), the 10 year bond should rise and break from that range which has supported new home builders with buy downs to 5% or less which it seems should make it difficult to buy those rates down that low and there ya go............ housing suddenly peaked out with a great economy. (TayMo starting to send emails encouraging people to come on out and see us, etc just like they did at the peak) and maybe sideways is the best we get with flippers getting caught.My mistake, up over 7% since 12/31/22 and up over 1% since 6/30/22.

And I suppose Santa Ana outperformed because it is closer to taquerias... lol... "Most all" means most all but the data shows Irvine is middle of the pack. The cities it did outperform, it did not do so by much. Factor in mello/HOA and Irvine buyers came out even further behind.That's why I said "most all" OC cities. The beach cities like Newport and Laguna will outperform Irvine because of being closer to the water.

Btw, what happened to the downturn that we were supposed to get in 2023? Why are prices up 6%+ this year?

Yet when USC does the same exact thing you have no problem with it! Where's AccidentalAnal when we need him?I like to move the goalposts and make my cost basis at a random point in time, like a random 2012 start date to compare Irvine.