Liar Loan

Well-known member

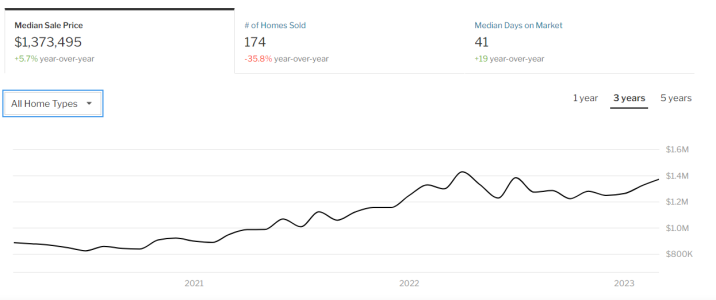

I haven't followed too close on the market trend, but I hear Irvine home prices haven't really dropped like other areas. Is that true?

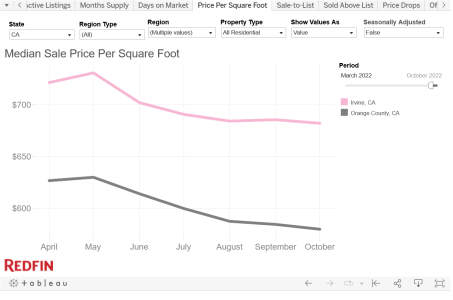

The Median Home Price in Irvine is falling faster than Orange County at large.

But PPSF is falling more slowly in Irvine than Orange County at large.

Either way, anybody that closed on a home in the first half of this year has lost money.