Liar Loan

Well-known member

irvinehomeowner said:best_potsticker_in_town said:On the buy-side, there will always be more than enough cash buyers for Irvine and they aren't as impacted by current events and interest rates.

Why is it whenever I say this... I'm a crazy man?

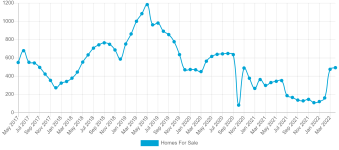

Because 2018 showed that it wasn't true; Rates hit 5% and suddenly the all-cash buyers dried up until 2020, when the printing presses fired up once again.