are you still net short the market? The rest of your thesis played out well though spreads are widening keeping mortgae rates elevated, but I hope you reversed your equity positions.I'm not fighting the Fed as I'm net short in the stock market. I know the Fed will go higher than the market thinks and will stay there longer than the market thinks. I don't see small real estate investors and institutional investors mass selling residential properties. There is a general structural shortage of housing so that itself will keep somewhat of a floor under market, especially in areas where it is difficult to build a large number of new housing units. One of the problems that we have with inventory now is that so many people locked in rates in the 2%s to 3%s so unless those owners have to sell they won't be selling anytime soon. The Fed controls short term rates and mortgage rates are based on long term rates so my argument that the higher the Fed goes and the longer that they stay the more they'll invert the yield curve and end up keeping mortgage rates contained.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How high will mortgage rates climb in the next 36 months?

- Thread starter OCtoSV

- Start date

NEW -> Contingent Buyer Assistance Program

Why is bacon so high for ya all......... is it because California pork law? Well that is good cuz that means it will be a buck or two a pound here in a week or so like pork last week was so cheap since it can't be sold in Cali. Even so......... it WILL come down in Cali if that is your normal price due to excess supply at that price.

Head on over to Vons/Albies and grab your 50 cent items. They are stock up prices for me..... canned tomatoes, kraft m/c, boxed pasta and lots more. They have had that deal at least twice for you and for us in the last few weeks. Watch your ads.... ya all got pantries, use them (unless u don't cook and eat out but I'm a cook at home gal and it kills me when I can't just go to my pantry and grab what I need).

Need gift cards? Buy them at albies when they have gift card deals (or any other time if you need them now). 400 points ($200 in gift cards without promos) gets you a $7 meat coupon.

So for interest rates............. why should the fed lower rates? They always go to far, that's why but say they do get that "soft landing", why mess it up? If they managed to not break something they should leave them alone. Let rates just stay steady. We had MANY years of 7% mortgages and we were fine. Part of the reason real estate is good now is people think rates are near a top and will drop so they will just refinance later............ because that is mostly all they have ever known (anyone who is 60 was just graduating high school when rates topped and I would say virtually no one that age was buying a house then). We could indeed see a mortgage problem (foreclosures) in a year or two or three if rates rise a little more and go sideways as those who were so sure they could refinance find out they are stuck with their payments when the economy is sucking wind. Of course Irvine, and the OC have so many people and not much land left to build I doubt any move lower would be minimal.

Since you asked....she locked in one of my clients in at 6.50% at 0pts with no relationship discount (jumbo loan with 25% down).

The Fed is playing the long game with RE speculation and as you point out a sustained period of normalized rates will very likely lead to a steady stream of inventory over the next couple years as recent buyers panic over inability to refi lower. But there is no shortage of land in OC and no shortage of inventory even today at least compared to the Bay Area where my zip code of 40K people has 19 properties for sale, nothing under $2M.

Is the AZ heat worse this year or is that just media hype? I used to have many colleagues in Chandler and they’ve always complained about summer and needing to wait until 9pm to play in the pool.

And just think - that is 200 bps higher than my 5/1 ARM i used to buy my first house in 2003. A 40 yr bond bull market has turned into a raging bear. Caveat emptor!

https://www.sfgate.com/food/article/safeway-overcharging-for-food-bay-area-18274669.php

sgip

Well-known member

That figure is inclusive of mortgage bankers who have jumbo conduits, but their terms are not the same as if you were to go directly to a Bank or Credit Union. A Mortgage Banker might offer their best customer profile a 6.875% rate for a loan that's being sold to Chase/Wells/Citi. Go to Chase, Wells, or Citi directly for that loan and your rate would be about .125 to .25 less with additional options to see that rate reduced further.

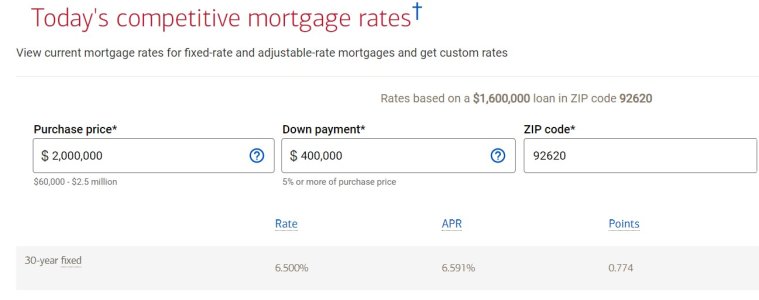

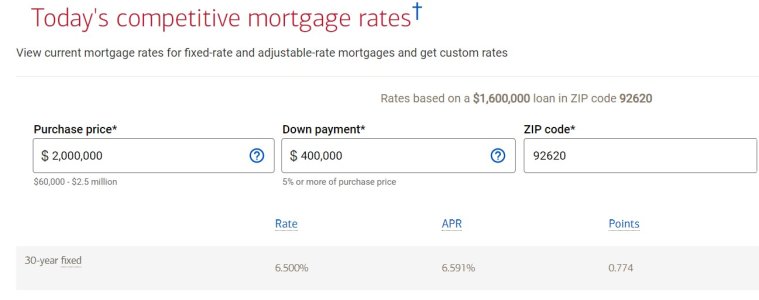

Example: BofA ( a company I do not work for....) today has a 6.50, 6.591 APY rate for .774 in fee. Assuming .125 in rate for .50 in fee, the "zero point rate" would be around 6.75%. If you have an account with the bank you are applying with, if you move money, stocks, etc to the bank you are applying with, if your score is above 800, or put more than 20% down (in my example I used 20% down....) the rate would probably fall close to 6.50 for very minimal fees.

Moral of the story: Average rates are fine as an indication of the direction of rates. Going directly to a Bank / Credit Union for a quote will provide you for the most part with a better deal than what the average rate is proclaiming.

Source: https://www.bankofamerica.com/mortgage/mortgage-rates/

Example: BofA ( a company I do not work for....) today has a 6.50, 6.591 APY rate for .774 in fee. Assuming .125 in rate for .50 in fee, the "zero point rate" would be around 6.75%. If you have an account with the bank you are applying with, if you move money, stocks, etc to the bank you are applying with, if your score is above 800, or put more than 20% down (in my example I used 20% down....) the rate would probably fall close to 6.50 for very minimal fees.

Moral of the story: Average rates are fine as an indication of the direction of rates. Going directly to a Bank / Credit Union for a quote will provide you for the most part with a better deal than what the average rate is proclaiming.

Source: https://www.bankofamerica.com/mortgage/mortgage-rates/

Last edited:

Liar Loan

Well-known member

Mortgage Rates Are Basically Back to 9-Month Highs (and for Jumbos a new cyclical high!)

For all intents and purposes, the average 30yr fixed rate at the average lender is as high as it's been since November 2022. The number itself as far as we see it is 7.10 which means most lenders are quoting 7.125% after adjusting for discount points (or just "points" for short).

Ready2Downsize

Well-known member

Lol........ $12 for a pound of bacon........... ya all need to learn to shop. I pay attention to grocery prices (always have) and $12 for a pound of bacon is beyond ridiculous! It's not even good for ya. Two weeks ago we had boneless skinless chicken breasts for 99 cents per pound and last week we had pork chops for 67 cents per pound (not crappy quality either). I think it was limit 10 pounds on the chicken, none on pork and they never ran out like I hoped they would so I could get rain checks. I'm running low on eggs so I had suck it up and pay 1.27 per dozen for cage free today minus senior discount. I usually wait till they go on sale for a buck (or less per dozen and get a few dozen).whoa whoa whoa - is that what they teach in the UCLA econ dept? WHY would the Powell Fed (1st non-economist to run the Fed) cut rates for any reason but recession? Wouldn't that by definition be inflationary? If inflation declines without a corresponding rise in unemployment that means the economy can tolerate higher rates. Headline PCE may be going down due to used car prices declining but food inflation is rampant - in fact it's now embedded. Have you paid attention recently at the grocery store? I never did but do now and prices for everything but fresh meat, fish, veggies and beer (my staples) are waaay up. Bacon is $12 for a 12 oz package. Fuel also given this administration's war on fossil fuels. We will never see a $2 gallon of gas or a 4% mortgage rate the rest of this decade or maybe in our lifetimes.

6-7% represents a return to historically normalized mortgage rates. And as you pointed out even a 6% jumbo rate has sidelined most financed buyers - that didn;t require 8 or 9%. We had 20 years of Fed rate repression to force assets into the markets seeking yield and then COVID - that's all in the rear view now. Prices are not likely to come down for a while in South OC as there are obviously still buyers willing to absorb much higher mortgage payments per your very useful data, but those may dwindle, just like the how the bursting of the 80s RE bubble in OC played out through the early/mid 90s, a time where no one believed RE would ever appreciate again. Irvine has proven itself somewhat immune given the ballast of the FCBs, and it will be very interesting to see how long that ballast remains.

Why is bacon so high for ya all......... is it because California pork law? Well that is good cuz that means it will be a buck or two a pound here in a week or so like pork last week was so cheap since it can't be sold in Cali. Even so......... it WILL come down in Cali if that is your normal price due to excess supply at that price.

Head on over to Vons/Albies and grab your 50 cent items. They are stock up prices for me..... canned tomatoes, kraft m/c, boxed pasta and lots more. They have had that deal at least twice for you and for us in the last few weeks. Watch your ads.... ya all got pantries, use them (unless u don't cook and eat out but I'm a cook at home gal and it kills me when I can't just go to my pantry and grab what I need).

Need gift cards? Buy them at albies when they have gift card deals (or any other time if you need them now). 400 points ($200 in gift cards without promos) gets you a $7 meat coupon.

So for interest rates............. why should the fed lower rates? They always go to far, that's why but say they do get that "soft landing", why mess it up? If they managed to not break something they should leave them alone. Let rates just stay steady. We had MANY years of 7% mortgages and we were fine. Part of the reason real estate is good now is people think rates are near a top and will drop so they will just refinance later............ because that is mostly all they have ever known (anyone who is 60 was just graduating high school when rates topped and I would say virtually no one that age was buying a house then). We could indeed see a mortgage problem (foreclosures) in a year or two or three if rates rise a little more and go sideways as those who were so sure they could refinance find out they are stuck with their payments when the economy is sucking wind. Of course Irvine, and the OC have so many people and not much land left to build I doubt any move lower would be minimal.

usctrojancpa

Well-known member

I wonder what jumbo rate the good mortgage fairy Sherry is handing out these days, though Irvine appears to be a cash market currently

Since you asked....she locked in one of my clients in at 6.50% at 0pts with no relationship discount (jumbo loan with 25% down).

Agree on almost all counts R2D. Up here in the Bay Area we get raped on all consumer pricing due to the extremely high avg income - avg salary in the city of San Jose is $180K. This was “gently” studied in a recent article in the SJ Merc News on inflation so I imagine the $12 bacon is more like $7 or $8 in OC. I bought the bacon to make a bacon wrapped pesto stuffed pork tenderloin - great recipe. We’re big cook at home people and go out for things we can’t easily make like quality sushi.Lol........ $12 for a pound of bacon........... ya all need to learn to shop. I pay attention to grocery prices (always have) and $12 for a pound of bacon is beyond ridiculous! It's not even good for ya. Two weeks ago we had boneless skinless chicken breasts for 99 cents per pound and last week we had pork chops for 67 cents per pound (not crappy quality either). I think it was limit 10 pounds on the chicken, none on pork and they never ran out like I hoped they would so I could get rain checks. I'm running low on eggs so I had suck it up and pay 1.27 per dozen for cage free today minus senior discount. I usually wait till they go on sale for a buck (or less per dozen and get a few dozen).

Why is bacon so high for ya all......... is it because California pork law? Well that is good cuz that means it will be a buck or two a pound here in a week or so like pork last week was so cheap since it can't be sold in Cali. Even so......... it WILL come down in Cali if that is your normal price due to excess supply at that price.

Head on over to Vons/Albies and grab your 50 cent items. They are stock up prices for me..... canned tomatoes, kraft m/c, boxed pasta and lots more. They have had that deal at least twice for you and for us in the last few weeks. Watch your ads.... ya all got pantries, use them (unless u don't cook and eat out but I'm a cook at home gal and it kills me when I can't just go to my pantry and grab what I need).

Need gift cards? Buy them at albies when they have gift card deals (or any other time if you need them now). 400 points ($200 in gift cards without promos) gets you a $7 meat coupon.

So for interest rates............. why should the fed lower rates? They always go to far, that's why but say they do get that "soft landing", why mess it up? If they managed to not break something they should leave them alone. Let rates just stay steady. We had MANY years of 7% mortgages and we were fine. Part of the reason real estate is good now is people think rates are near a top and will drop so they will just refinance later............ because that is mostly all they have ever known (anyone who is 60 was just graduating high school when rates topped and I would say virtually no one that age was buying a house then). We could indeed see a mortgage problem (foreclosures) in a year or two or three if rates rise a little more and go sideways as those who were so sure they could refinance find out they are stuck with their payments when the economy is sucking wind. Of course Irvine, and the OC have so many people and not much land left to build I doubt any move lower would be minimal.

The Fed is playing the long game with RE speculation and as you point out a sustained period of normalized rates will very likely lead to a steady stream of inventory over the next couple years as recent buyers panic over inability to refi lower. But there is no shortage of land in OC and no shortage of inventory even today at least compared to the Bay Area where my zip code of 40K people has 19 properties for sale, nothing under $2M.

Is the AZ heat worse this year or is that just media hype? I used to have many colleagues in Chandler and they’ve always complained about summer and needing to wait until 9pm to play in the pool.

Thanks USC. That’s up 100 bps in the last month (wow) and she’s only 50 bps below Bankrate - losing her magic.Since you asked....she locked in one of my clients in at 6.50% at 0pts with no relationship discount (jumbo loan with 25% down).

And just think - that is 200 bps higher than my 5/1 ARM i used to buy my first house in 2003. A 40 yr bond bull market has turned into a raging bear. Caveat emptor!

Timely article on how the food inflation in the Bay areaAgree on almost all counts R2D. Up here in the Bay Area we get raped on all consumer pricing due to the extremely high avg income - avg salary in the city of San Jose is $180K. This was “gently” studied in a recent article in the SJ Merc News on inflation so I imagine the $12 bacon is more like $7 or $8 in OC. I bought the bacon to make a bacon wrapped pesto stuffed pork tenderloin - great recipe. We’re big cook at home people and go out for things we can’t easily make like quality sushi.

The Fed is playing the long game with RE speculation and as you point out a sustained period of normalized rates will very likely lead to a steady stream of inventory over the next couple years as recent buyers panic over inability to refi lower. But there is no shortage of land in OC and no shortage of inventory even today at least compared to the Bay Area where my zip code of 40K people has 19 properties for sale, nothing under $2M.

Is the AZ heat worse this year or is that just media hype? I used to have many colleagues in Chandler and they’ve always complained about summer and needing to wait until 9pm to play in the pool.

https://www.sfgate.com/food/article/safeway-overcharging-for-food-bay-area-18274669.php

Ouch - Ackman shorting long duration Treasuries - 5.5% target!Thanks USC. That’s up 100 bps in the last month (wow) and she’s only 50 bps below Bankrate - losing her magic.

And just think - that is 200 bps higher than my 5/1 ARM i used to buy my first house in 2003. A 40 yr bond bull market has turned into a raging bear. Caveat emptor!

Liar Loan

Well-known member

Identical arguments were made in 2005-06. Yet OC population has been declining and is the lowest it's been in eight years!! That's what happens when you have young adults moving either inland/out of state and not having many children, with only a rapidly aging cohort left behind.Of course Irvine, and the OC have so many people and not much land left to build I doubt any move lower would be minimal.

Last edited:

CA losing population and OC will probably lead the pack given the cost of living there relative to median wages.Identical arguments were made in 2005-06. Yet OC population has been declining and is the lowest it's been in eight years!! That's what happens when you have young adults moving either inland/out of state and not having many children, with only a rapidly aging cohort left behind.

View attachment 9089

irvinehomeowner

Well-known member

So population growth is the new Baba Yaga?

Liar Loan

Well-known member

I suppose if enough Chinese buy homes and keep them empty OC has nothing to worry about.So population growth is the new Baba Yaga?

That and other $$$ institutions, wonder how active they are in OCI suppose if enough Chinese buy homes and keep them empty OC has nothing to worry about.

Liar Loan

Well-known member

The good news for California is that the Asian buyer is still going strong.

www.ocregister.com

www.ocregister.com

California’s share has fallen slightly since 2018, though it remained the favorite destination for buyers from China, Hong Kong and Taiwan — who made up some 13% of all foreign buyers, more than double the share a year earlier.

Foreigners buy fewest US homes since 2009

Purchases slid to the lowest levels since the Great Recession as a strong dollar makes prices too steep for many.

California’s share has fallen slightly since 2018, though it remained the favorite destination for buyers from China, Hong Kong and Taiwan — who made up some 13% of all foreign buyers, more than double the share a year earlier.