In a note to clients earlier this month, Goldman Sachs forecasted that four American cities in particular should gear up for a seismic decline compared to that of the

2008 housing crash.

San Jose, California;

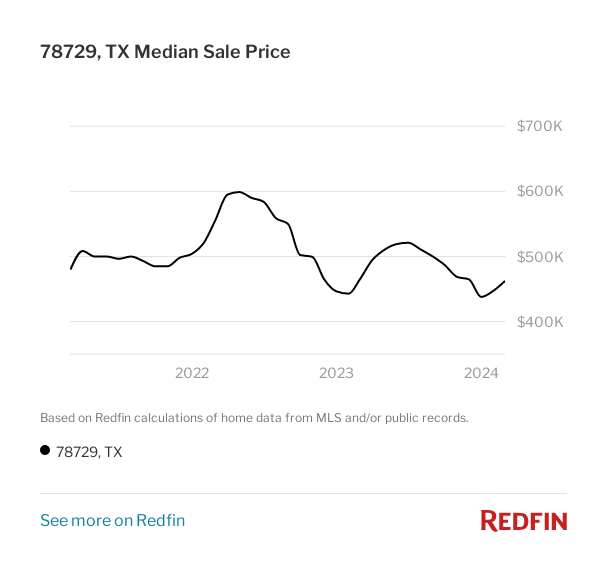

Austin, Texas;

Phoenix, Arizona; and

San Diego, California, will likely see boom-and-bust

declines of more than 25%.

“Our 2023 revised forecast primarily reflects our view that interest rates will remain at elevated levels longer than currently priced in, with 10-year Treasury yields peaking in 2023 Q3. As a result, we are raising our forecast for the 30-year fixed mortgage rate to 6.5% for year-end 2023 (representing a 30 bp increase from our prior expectation),” the strategists say.