irvinebullhousing

Well-known member

What is this? Shit on Liar Loans Friday?

The world is going into depression, yoh!

There is bigger things happening.

The world is going into depression, yoh!

There is bigger things happening.

irvinehomeowner said:Liar Loan said:irvinehomeowner said:Liar Loan said:irvinehomeowner said:"Finally Got It Right Friday" brought to you by Liar Loan.

See other threads for his awesome takes.

It pains you. I can see that.

Nope... just embarrasses you more because you so need to be right after being so wrong for all these years.

It's... well... pathetic. But you do you.

Any more charts you want to post here?

I've only tried to help others. You clearly have more malicious motivations.

Oh really? Never you heard you tell people when to buy... that would be more helpful.

All you've done is cap on Irvine... and Arizona... so who here is the malicious one?

Keep digging that embarrassment hole deeper... it's pure comedy.

zubs said:Has LL ever advised people to buy?

He's been on here for more than a decade like me....

I mean 10plus years he must have said BUY BUY BUY...somewhere.

I don't wanna go through LL historical posts...2much work.

zubs said:2009 all the way to 2020 were all good times to buy.

You would be richer now if you bought @ anytime in those 11 years....

Which means you would be @ a loss if you sold during those 11 years....unless you exchanged it for something else.

Which leads me to the reason I never sell. I dunno what to do with the extra cash so I just leave it.

Liar Loan said:zubs said:2009 all the way to 2020 were all good times to buy.

You would be richer now if you bought @ anytime in those 11 years....

Which means you would be @ a loss if you sold during those 11 years....unless you exchanged it for something else.

Which leads me to the reason I never sell. I dunno what to do with the extra cash so I just leave it.

True, I bought four properties over that time. The problem is for Orange County, about 10 of the last 30 years have had declining property values. So 1/3 of the time, you are better off not buying, especially as a first time buyer. Timing matters... a lot.

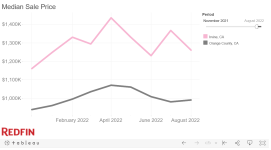

A 20% price decline from the peak brings prices down to 4Q 2021 price levels for Irvine as Irvine was up about 15% YTD in April/May.

Uh oh... LL is posting his fuzzy Redfin charts again.

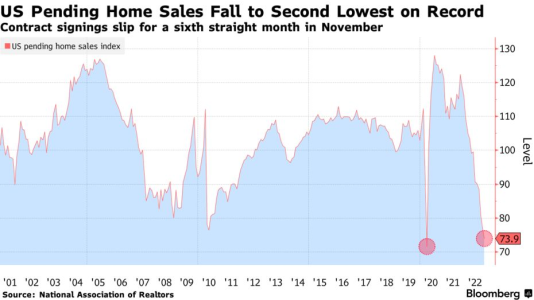

Local shocker in the paper this week was the Marin County median down 27% from the April peak. Coming to a housing market near you.There are 2 drivers of low pending homes sales and closed sales.....primarily a widening between the bid (buyer)/ask (seller) spread and secondarily lower than normal inventory levels.

Yeah we knew this was going to happen regardless of national trends. Remote work meant more people were going to… SVtoOC.Local shocker in the paper this week was the Marin County median down 27% from the April peak. Coming to a housing market near you.

Haha... right. Please cite your prediction that Marin county would be down 27% in 8 months... LOLYeah we knew this was going to happen regardless of national trends. Remote work meant more people were going to… SVtoOC.