Hello all,

I am looking to purchase a property in Irvine which is classified as a condo and is NOT in a high-risk fire zone.

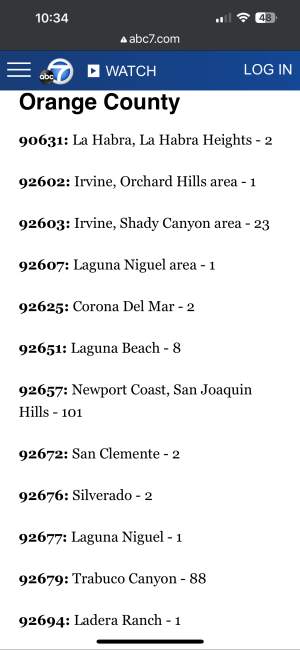

1. With all the new-policy moratoriums, has anyone had recent luck in obtaining homeowner's insurance for a condomium in Orange County?

2. Does anyone own their property via a wholly-owned LLC or living trust? If so, was your insurer able to insure it in the name of the LLC/trust or add it as an "additional insured" without much issue?

So far I have had no luck with State Farm, Allstate (both have moratoriums still), Bamboo (won't cover condos)...Mercury also doesn't seem to know how to add LLCs as additional insured to their policies.

Any referrals or tips would be greatly appreciated.

Thank you in advance!

I am looking to purchase a property in Irvine which is classified as a condo and is NOT in a high-risk fire zone.

1. With all the new-policy moratoriums, has anyone had recent luck in obtaining homeowner's insurance for a condomium in Orange County?

2. Does anyone own their property via a wholly-owned LLC or living trust? If so, was your insurer able to insure it in the name of the LLC/trust or add it as an "additional insured" without much issue?

So far I have had no luck with State Farm, Allstate (both have moratoriums still), Bamboo (won't cover condos)...Mercury also doesn't seem to know how to add LLCs as additional insured to their policies.

Any referrals or tips would be greatly appreciated.

Thank you in advance!