zubs

Well-known member

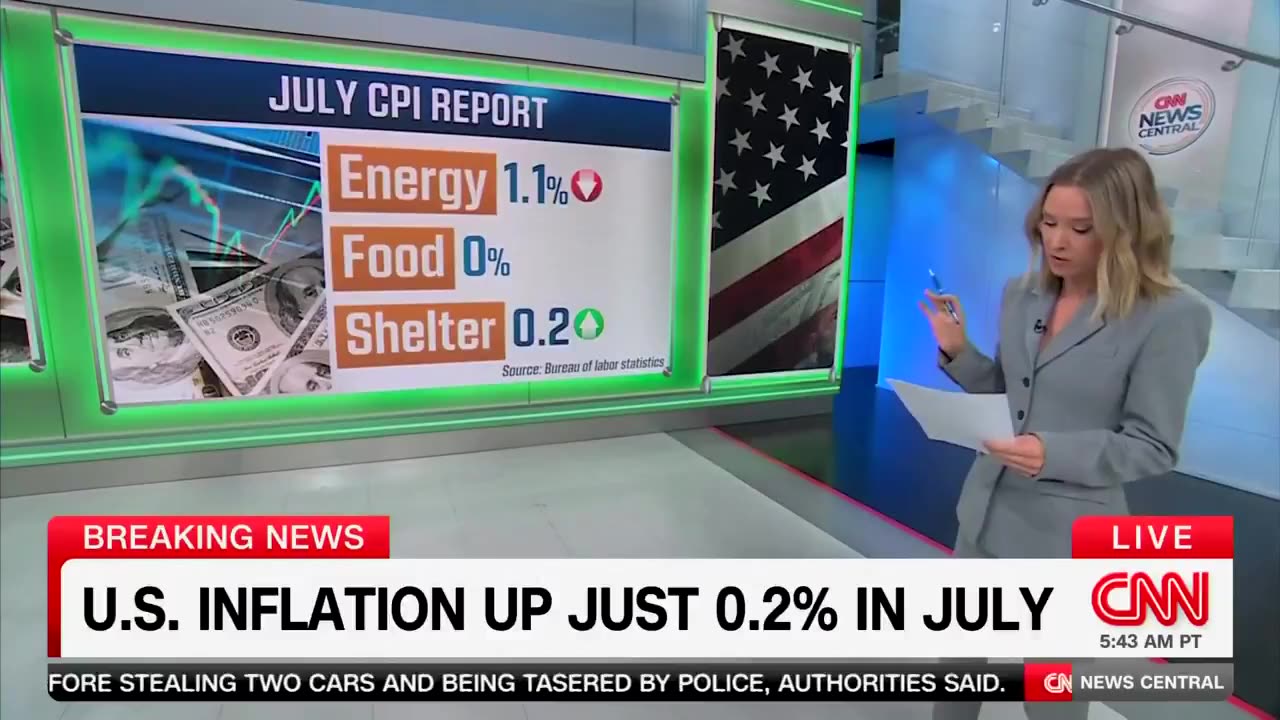

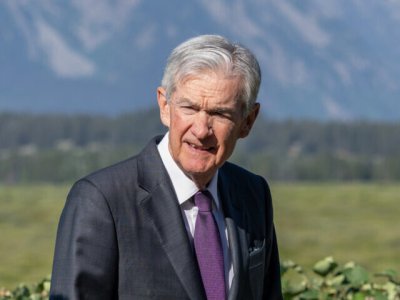

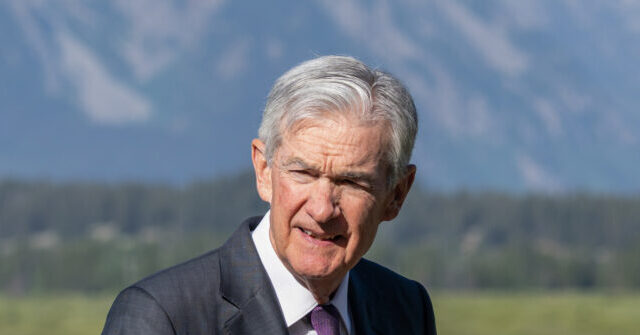

Jerome Powell knows inflation is going up currently, so he didn't reduce interest rates.

The USD can buy 10% less than 4 months ago as it has depreciated.

It compounds the tariff problem by 10% as foreign parts are 10% more expensive.

JP recently said he would not lower rates and we saw the USD appreciate last week.

The part I mention above goes to a US factory. They will run out in a few months....but this part needs 6 months to mfg and oceanship to reach their east coast warehouse (Houthis causing an extra 2.5 weeks of shipping problems as ASIA to NY goes through the suez canal). Customer is dragging their feet.

The USD can buy 10% less than 4 months ago as it has depreciated.

It compounds the tariff problem by 10% as foreign parts are 10% more expensive.

JP recently said he would not lower rates and we saw the USD appreciate last week.

The part I mention above goes to a US factory. They will run out in a few months....but this part needs 6 months to mfg and oceanship to reach their east coast warehouse (Houthis causing an extra 2.5 weeks of shipping problems as ASIA to NY goes through the suez canal). Customer is dragging their feet.

Last edited: