CalBears96

Well-known member

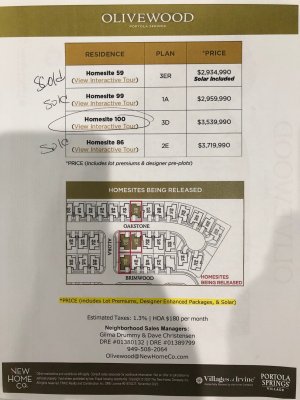

The fact that it only says Solar included makes me think that there weren't enough upgrades to even mention. It does, however, say that the price includes lot premium & designer pre-plots. At this point, lot 59 probably has passed stage 2 upgrade deadline, which means they may have upgraded kitchen cabinets, countertops, backsplash, etc.My bet is a bit of both, but the majority of the increase is the builder bumping the price. The builders will be testing how desperate and how deep the pockets of the buyers on the waitlists are.

I don't know how expensive New Home Company, but it cost us around $80k for stage 2. Of course, we added bottom and top cabinets in the pantry, upgraded to waterfall island using quartzite and the rest of the kitchen countertops in quartz. We also did recess lights and fan pre-wire in all bedrooms. But Shea design studio is more expensive than Irvine Pacific, that's for sure.