USCTrojanCPA said:

One of the big drivers that will keep prices crashing (barring any big black swan events) is the fact that housing was under built since the Great Recession so now there is a housing shortage and we see that in the frustratingly low inventory levels.

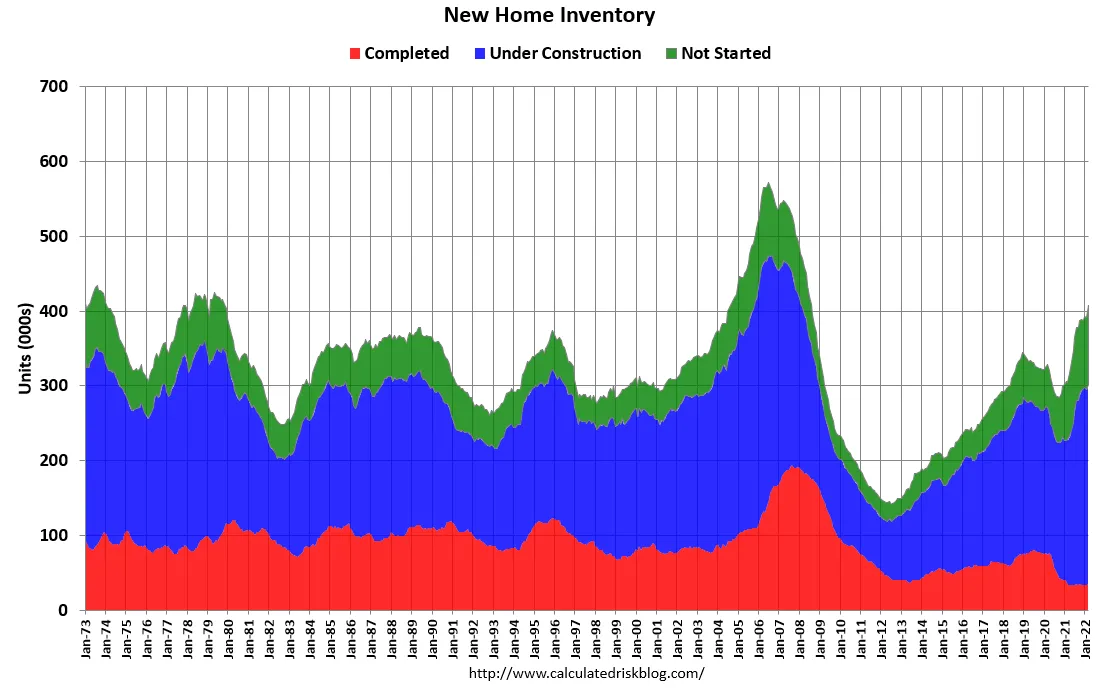

I believe this narrative was much more true for 2010-2020 than it will be for 2020-2030. The number of new homes for sale is the highest since 1979, excluding the mid-00's bubble. (See the chart below.) Given the population increases since the 1970's, we are at healthy levels of new home construction once again.

On the demand side, there was a demographic wave of millenials reaching prime home buying age, but that is going to flatten out in the next 1-2 years and stay flattened out for the rest of the decade, meanwhile Boomers are declining in numbers by an increasing amount each year.

There is going to be a triple whammy of supply hitting the market during the next 5-10 years:

-The most new homes under construction since 1973 (apartments and houses)

-Boomers selling due to ill health or death

-Lower household formation due to the lower marriage and birthrates of the past 14 years (i.e. less demand for apartments and starter homes)