You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

When would be next housing Bottom?

- Thread starter OCLuvr

- Start date

ThirtySomethingWEquity

Active member

Compressed-Village said:I don't mean to sound mean, this is just genuine questions for wanting to wait. Or timing the bottom. So if you were to buy last year with the lower price and higher rate, wouldn't you would be in a better position with the refinancing at a lower rate today or a few months ago? I would say yes.

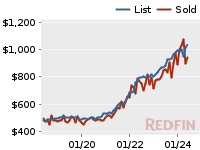

I own a townhouse in Irvine now, and I will be hopefully be buying something bigger soon. I was about to buy in a new development for around a million and changed my mind last minute. So far, if I buy today I'd be saving about ~50k off the list price and get quite a low interest rate from the builder. I think it will only get better for houses around that price range. The data shows my anecdote holds true for others across the county.

ThirtySomethingWEquity said:Compressed-Village said:I don't mean to sound mean, this is just genuine questions for wanting to wait. Or timing the bottom. So if you were to buy last year with the lower price and higher rate, wouldn't you would be in a better position with the refinancing at a lower rate today or a few months ago? I would say yes.

I own a townhouse in Irvine now, and I will be hopefully be buying something bigger soon. I was about to buy in a new development for around a million and changed my mind last minute. So far, if I buy today I'd be saving about ~50k off the list price and get quite a low interest rate from the builder. I think it will only get better for houses around that price range. The data shows my anecdote holds true for others across the county.

Right now cash is king..

ThirtySomethingWEquity

Active member

eyephone said:Right now cash is king..

I wish, I'm heavy on cash too, light on equities. Seems like I missed out on a couple rallies this year.

irvinehomeowner

Well-known member

Rizdak said:One thing I?ll throw out there. If you are trying to buy your forever owner-occupied home, do you really need to time the market perfectly? I would say buy and hold for the long term if you can comfortably afford it.

That?s what I?ve been saying.

And why wait for a slowdown if it?s not significant?

Rizdak said:One thing I?ll throw out there. If you are trying to buy your forever owner-occupied home, do you really need to time the market perfectly? I would say buy and hold for the long term if you can comfortably afford it.

You dont need to but if you waited 1 year and it saved you 140K plus nearly 0.75% less on rate, wouldnt that feel much better?

12% cheaper with nearly 0.75% lower rates. That equates to roughly 20% cheaper home in 1 year. OUCH!

https://www.redfin.com/CA/Irvine/7-Olinda-92602/home/5771806

https://www.redfin.com/CA/Irvine/9-Bodega-Bay-92602/home/5771905

irvinehomeowner

Well-known member

@meccos12:

That's a good example, but I can't find any other Sonoma models in that area (Northpark) with that kind of drop, which is why I said it's hard to find the bargains on a specific floorplan.

Also, the listing activity looks weird, 2 price drops and same realty group for buyer and seller.

That's a good example, but I can't find any other Sonoma models in that area (Northpark) with that kind of drop, which is why I said it's hard to find the bargains on a specific floorplan.

Also, the listing activity looks weird, 2 price drops and same realty group for buyer and seller.

irvinehomeowner said:@meccos12:

That's a good example, but I can't find any other Sonoma models in that area (Northpark) with that kind of drop, which is why I said it's hard to find the bargains on a specific floorplan.

Also, the listing activity looks weird, 2 price drops and same realty group for buyer and seller.

I dont think the activity looks weird. Realtyone is a large group in Irvine so it is not unusual to have same group representing both sides. Also I do not see what is unusual about having 2 price drops in 3 months. If there was no interest, I would expect at least 2 drops in that time frame.

With that said, I would have been more sad if I was the person who bought this:

https://www.redfin.com/CA/Irvine/16-Bodega-Bay-92602/home/5771794#marketing-remarks-scroll

On the same street, but paid 173k more. I wouldnt be so sad if this was a 4M dollar house since as a precentage it wouldnt be much, but for a house thats barely above 1M? That is huge.

Here is another. Even smaller house but sold for 1.19

https://www.redfin.com/CA/Irvine/20-Bodega-Bay-92602/home/5771527

irvinehomeowner

Well-known member

I saw those other Bodega ones but where are the cheaper ones people should be able to buy today?

If it's a real slowdown, shouldn't there be a number of these same models available for less?

If it's a real slowdown, shouldn't there be a number of these same models available for less?

Mety said:Before we discuss any further, I think we need to hear what your definition of "real slowdown" or "significant discount" is.

I'll use your definition, what is yours of a significant discount? Meccos had 12% in a previous post, but I'm open. If you want a number let's say 10% price discount from the past year and a half vs the past 3/4 months, is that fair? It's more conservative than Mecco's 12% example.

irvinehomeowner said:I saw those other Bodega ones but where are the cheaper ones people should be able to buy today?

If it's a real slowdown, shouldn't there be a number of these same models available for less?

Why do you assume there would be a number of these same models out at any given time? There were a few that sold last year for a high price as demonstrated. The one that sold this year was significantly discounted and there is one more out right now. The one currently listed is much more upgraded than any of the previous homes that sold, but is listed at or lower than the model matches that sold in 2018 and has been on the market for 50 days.

https://www.redfin.com/CA/Irvine/29-Dinuba-92602/home/5771881

Guess what is coming next for this house? A price adjustment since it has not sold in nearly 50 days. This will sell for less than the homes that sold in 2018 even though it is a much more upgraded home. It is just a matter of how much less.

Mety said:Before we discuss any further, I think we need to hear what your definition of "real slowdown" or "significant discount" is.

Everyone will have a different definitions, however I do not think anyone will argue a 12-15% drop in 1 year as demonstrated by the examples above.

irvinebullhousing

Well-known member

Does this 2 or 3 homes dropped their price represent the entire Irvine market or homes that are currently listed on the MLS in Irvine?

Hardly, because those two homes were in distress of a divorce sale. It happenned to be on the same street. Maybe Bob and Mary did a switcharoo of partners.

Swinging it.

Hardly, because those two homes were in distress of a divorce sale. It happenned to be on the same street. Maybe Bob and Mary did a switcharoo of partners.

Swinging it.

akkord said:Mety said:Before we discuss any further, I think we need to hear what your definition of "real slowdown" or "significant discount" is.

I'll use your definition, what is yours of a significant discount? Meccos had 12% in a previous post, but I'm open. If you want a number let's say 10% price discount from the past year and a half vs the past 3/4 months, is that fair? It's more conservative than Mecco's 12% example.

I was talking to everyone not just you, but thanks for answering.

Here are some examples not just limiting to North Park but Irvine area. Please check the price histories. Not all of them are under super recent categories, but the point is the waiting situation instead of buying right away played well between the entire last year and recent.

https://www.zillow.com/homedetails/110-Confederation-Way-Irvine-CA-92602/25520651_zpid/

This was listed first in 2018 at $980 and finally got sold Feb this year at $808k. You can do the math how much % that is and it's much higher than your 10%. West Irvine is pretty close to NP also.

https://www.redfin.com/CA/Irvine/29-Keepsake-92618/home/40102842

The buyer would have paid $52k more if bought in Oct. 2018 when first listed. Good thing they waited.

https://www.redfin.com/CA/Irvine/181-Pathway-92618/home/45377541

$800k to $691k. For real? It was not a short sale either.

https://www.zillow.com/homedetails/216-Firefly-Irvine-CA-92618/147889373_zpid/

Almost $40k savings? Sure, we can take that. Oh, the interest rate got better also.

https://www.redfin.com/CA/Irvine/74-Borghese-92618/home/51681127

I saved $270k on this one. Thanks!

https://www.redfin.com/CA/Irvine/71-Brindisi-92603/home/58555201

Ok, not as much savings, but still $75k reduction sounds good.

https://www.redfin.com/CA/Irvine/103-Canopy-92603/home/5944496

Almost 10% cuts.

https://www.redfin.com/CA/Irvine/12-Campanero-E-92620/home/4784525

$900k to $797? Psss..

meccos12 said:Mety said:Before we discuss any further, I think we need to hear what your definition of "real slowdown" or "significant discount" is.

Everyone will have a different definitions, however I do not think anyone will argue a 12-15% drop in 1 year as demonstrated by the examples above.

But again, that number might not be much significant drop to IHO. So if that's not agreed upon, I don't think the discussion would work well.

irvinehomeowner

Well-known member

@Mety:

You should post those in my "Significant Savings" thread.

I don't have time to look through them in detail but I think some of those have a story other than "slowdown".

Keep them coming!

You should post those in my "Significant Savings" thread.

I don't have time to look through them in detail but I think some of those have a story other than "slowdown".

Keep them coming!