irvinehomeowner

Well-known member

What I'm saying is prices jumped for not so apparent reasons... more likely, unfundamental ones.Irvinecommuter said:IHO...I am lost as to your overall thesis. Are you saying it's a bubble just because prices are high?

Whether that defines a bubble or not, I am unsure. Economic conditions don't totally support such high prices even with low interest rates because that's not the whole picture.

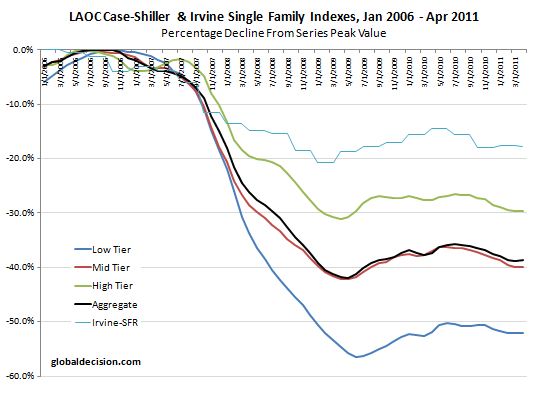

Surrounding cities are still in the pits... yet Irvine has seen big jumps in pricing (at least in the segment I am looking at).

My main premise, is prices seem to be higher than the last bubble, and if that is not a "mini-bubble" (as the poll has shown the majority pick), then what is it?