I'm sure this time is different...

The last time US stocks were this pricey relative to the debt market, the S&P 500 crashed 50%

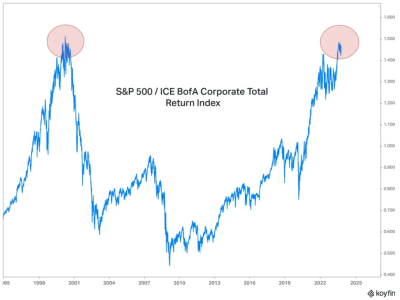

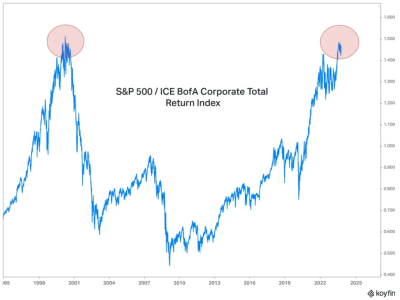

In August this year, the S&P 500 climbed to levels last seen during the peak of dot-com boom, relative to an index that tracks the US corporate bond market, according to data from global analytics platform Koyfin. The gauge is still holding near those highs, despite the recent pullback in equities.

The metric last surged this high in the spring of 2000 — and that was followed by a multi-year meltdown in stocks that saw the S&P 500 crash 50% between March 2000 and October 2002.

Another indicator that shows the richness of stocks relative to debt is the so-called equity risk premium — or the extra return on shares over government debt, which is considered a safer form of investment. The metric has plunged this year lows unseen in decades, indicating elevated stock valuations.

"Equity risk premium is near its

worst ever level going back to 1927. In the 6 instances this has occurred, the markets saw a major correction & recession/depression - 1929, 1969, 99/00, 07, 18/19, present," research firm MacroEdge said in a

recent post on X.

US stocks are near their most expensive levels in over two decades, relative to the debt market. The last time stocks were this pricey was during the dot-com boom - and that was followed by a 50% crash in the S&P 500.

finance.yahoo.com