irvinehomeowner

Well-known member

I miss @usctrojancpa real estate updates. Makes me wonder how the market is out there considering how high the prices are.

I used to do a market prediction poll around June every year but it was pointless because the prices just keep going up.

There are dips and lulls but there hasn't been a long multi-year sustained drop since the late 00 crash (maybe mid-Covid counts?).

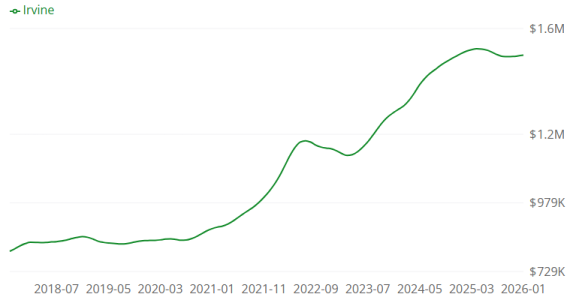

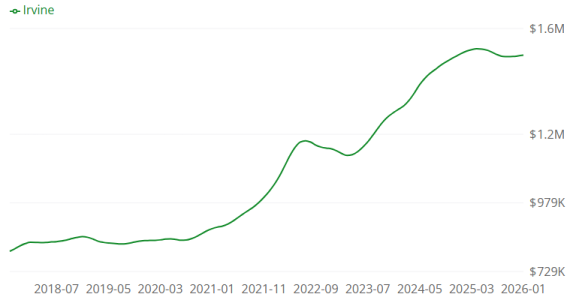

This Zillow chart shows the growth for 10 years:

www.zillow.com

www.zillow.com

And this could probably even go back to 2010 because 2012-13 felt like it was accelerating.

15 years of increasing prices seems ridiculous. And this isn't just Irvine, it's probably most of Orance County and SoCal.

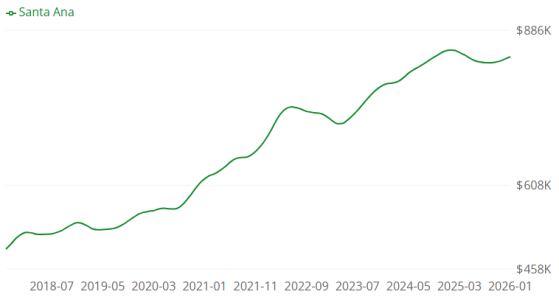

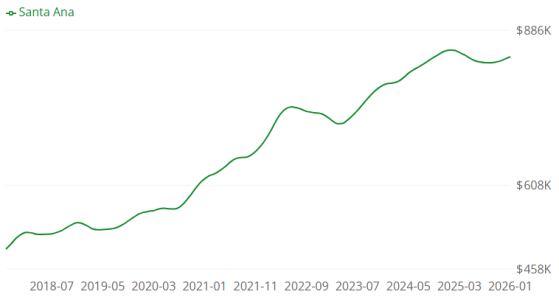

Santa Ana has a similar curve:

I don't think incomes have doubled in the last 10 years for most people but interest rates have (where are all those "buy when rates are high" proponents?).

So high prices and high rates should suppress the market right? But look at the growth since 2023 when rates were in the 6% range.

How does anyone get into their first home today? Instead of stretching seems more like they have to downsize to make things work.

I used to do a market prediction poll around June every year but it was pointless because the prices just keep going up.

There are dips and lulls but there hasn't been a long multi-year sustained drop since the late 00 crash (maybe mid-Covid counts?).

This Zillow chart shows the growth for 10 years:

Irvine, CA Housing Market: 2026 Home Prices & Trends | Zillow

The average home value in Irvine, CA is $1,517,282, down 0.4% over the past year. Learn more about the Irvine housing market and real estate trends.

And this could probably even go back to 2010 because 2012-13 felt like it was accelerating.

15 years of increasing prices seems ridiculous. And this isn't just Irvine, it's probably most of Orance County and SoCal.

Santa Ana has a similar curve:

I don't think incomes have doubled in the last 10 years for most people but interest rates have (where are all those "buy when rates are high" proponents?).

So high prices and high rates should suppress the market right? But look at the growth since 2023 when rates were in the 6% range.

How does anyone get into their first home today? Instead of stretching seems more like they have to downsize to make things work.