You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Question for real estate investors

- Thread starter Loco_local

- Start date

NEW -> Contingent Buyer Assistance Program

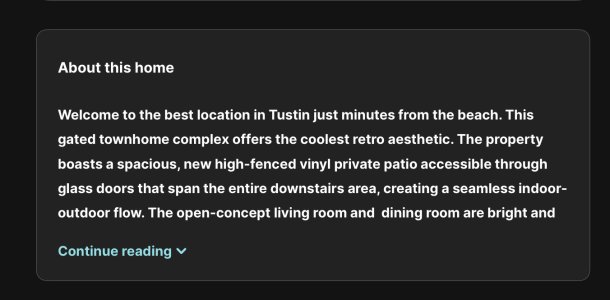

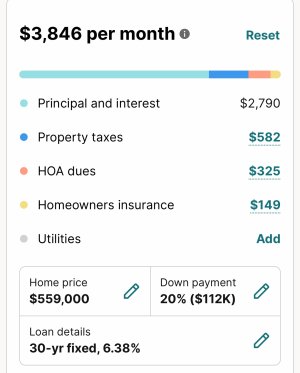

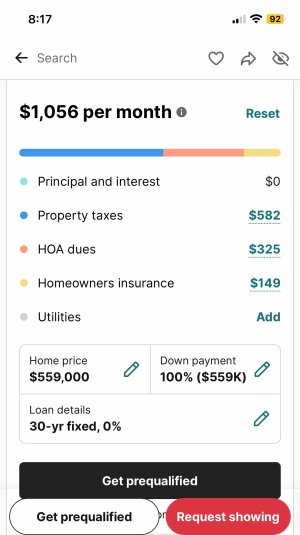

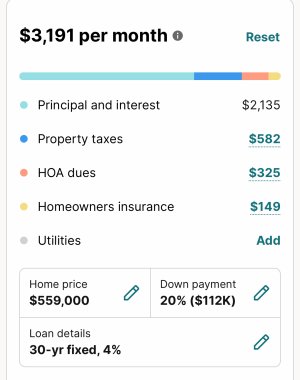

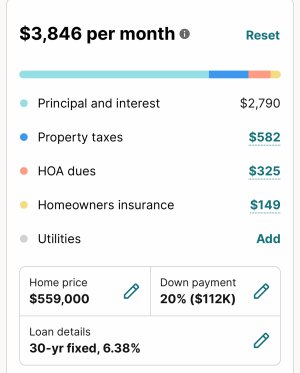

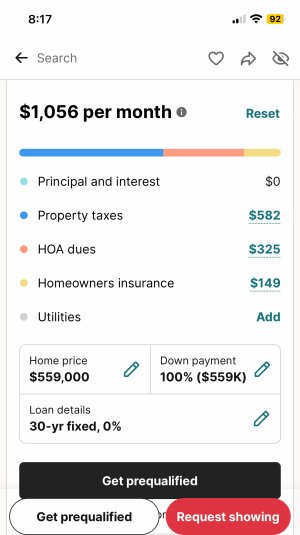

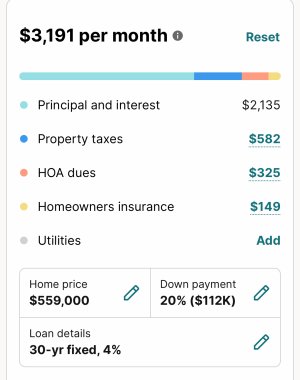

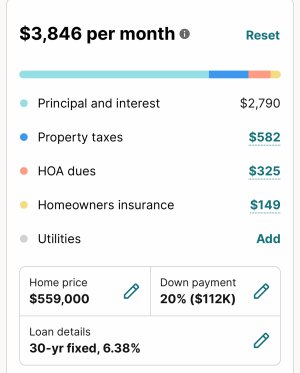

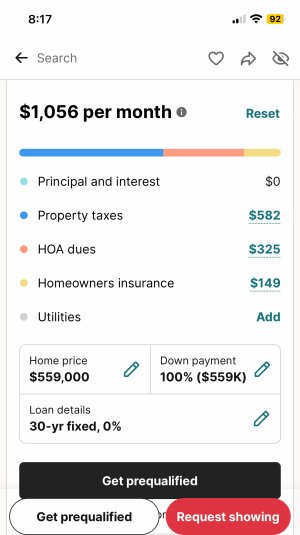

As a rental, I don’t see how this cash flows. Just look at the assumptions below, that don’t even factor in vacancy, repairs, capital expenditure costs, so you’d really have to charge insanely high rent just to break even. Even if you paid all cash, there are better investments with higher potential return that are more passive (ie: buy & hold low cost total market index funds).

My dad did but he sold it.

GrowthStateofMind

Active member

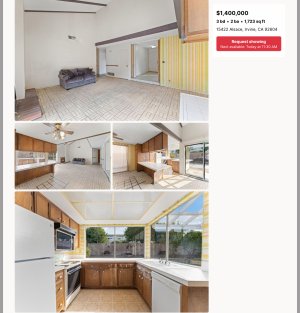

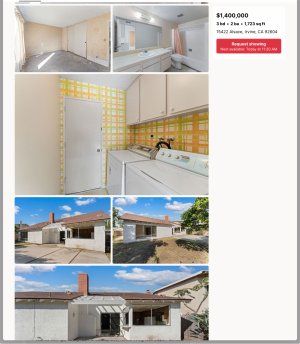

Oh man, looks like the HOA is doing a poor job of managing exterior of that community. There’s some serious TLC needed inside and out.

As a rental, I don’t see how this cash flows. Just look at the assumptions below, that don’t even factor in vacancy, repairs, capital expenditure costs, so you’d really have to charge insanely high rent just to break even. Even if you paid all cash, there are better investments with higher potential return that are more passive (ie: buy & hold low cost total market index funds).

Attachments

GrowthStateofMind

Active member

And as a fix & flip, I saw 2 nearby comps that are listed at $650k and $660k, respectively… I don’t know that one would come ahead on rehabbing that place then reselling considering the agent fees, renovation costs probably would exceed $100k

usctrojancpa

Well-known member

I tell all my investor clients, the best bang for the buck nowadays is a 3-bedroom DETACHED property in most part of South OC. You'll get no Mello Roos and very reasonable HOA with good potential appreciation as long as you buy in "B" or better schools areas. And I put my money where my mouth is, I own a 3-bd detached condo in Baker Ranch and Aliso Viejo.

irvinehomeowner

Well-known member

Baker for proximity (sort of), Aliso for area.

Don't you own a property in Meadows?I tell all my investor clients, the best bang for the buck nowadays is a 3-bedroom DETACHED property in most part of South OC. You'll get no Mello Roos and very reasonable HOA with good potential appreciation as long as you buy in "B" or better schools areas. And I put my money where my mouth is, I own a 3-bd detached condo in Baker Ranch and Aliso Viejo.

usctrojancpa

Well-known member

Don't you own a property in Meadows?

My dad did but he sold it.

Loco_local

Active member

vsfan

Active member

Almost only the land is worth selling, imho.How much would it cost to renovate a house like this for an average person who isn’t doing any of the work themselves? How much do you think it could sell for when completed? Do you think it will sell for anywhere close to the asking price?

View attachment 10690View attachment 10691