I don't read these new home threads like I used to but man... $2-$3m now for new "upgrade" homes?

Congrats to Cal for getting into his Cielo home that I think he's been talking about forever and sort of hard to believe in this high priced environment he can sell a home he just got and get into another one. Where is that guy who keeps saying these high interest rates are going to destroy Irvine pricing?

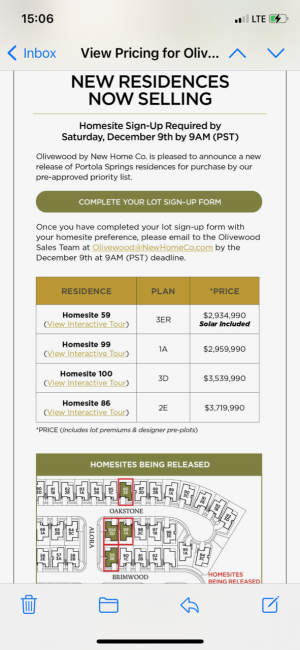

Now I need to compare Cielo floorplans to Olivewood to see what I would prefer if I was one of those magical $600k household earners.

I'm sure there will be some cash buyers that would be willing to take my Bluffs 2 off my hands.

As for comparison, the only fair comparison would be Cielo Plan 1 vs. Olivewood Plan 3 vs. Azul Plans 2/3. These are in the ~3200 sq ft range. Olivewood Plans 1 and 2 are sub 3000 sq ft and so is Azul Plan 1.

Cal Pac is going to change the Azul Plan 2 (starting from phase 3) to make it ~3200 sq ft. Basically, they now make the loft standard (instead of high ceiling), and they're removing the den between bedrooms 2 and 3 to add a bathroom to each room. They will likely convert the other bathroom into a powder room, and MAYBE use that extra space for master bedroom. At least,

I would use that extra space for master bedroom.

We did consider Olivewood Plan 3, but there were several things we didn't like. Kitchen layout was bad and the island is squarish shape rather than rectangular. Since kitchen is the most important to my wife, that's a huge disadvantage. It also doesn't have high ceiling. And the lots are

extremely small. For example, the home that we were offered in phase 1 had a 3800 sq ft lot, and it's a corner lot too, while the Cielo home we got has a 5100 sq ft lot. But man, the location is so nice, at the peak of Portola Springs.