usctrojancpa

Well-known member

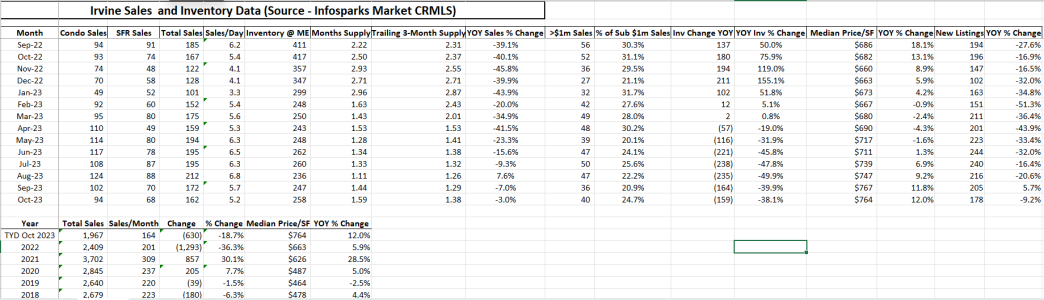

My Irvine market update has been long overdue. I’ve been working hard this year to make things happen for my clients as the market has gotten very challenging. I don’t think anyone would have been able to predict how 2023 would have played out at the end of 2022. As the were finished up 2022, Irvine market prices drifted lower by about 9% from the peak pricing back in April/May 2022. Then suddenly there was a huge pivot in pricing starting in Jan/Feb 2023 and I experienced all of my 4 listings during that time period getting multiple offers and going over list price with strong open house traffic. From there prices continued to steadily increase each month as inventory levels remained constrained all the while interest rates went from the 6% range to kissing 8% in the past few weeks (we have drifted down to the low-to-mid 7% range as we speak).

Here’s the most surprising part for me and I’m sure most of you….as of the end of October, Irvine prices are about 5% HIGHER than the peak pricing that we had in April/May 2022. Who would have thought that would have happened, especially with rates being higher today than back at the end of 2022? Not me and probably not anyone else but the market will do what the market does. Why have prices increased? Simple, low inventory levels and that’s why I’ve been telling everyone for years and years to watch inventory levels as they will be a very good predictor of where home prices will go. Why is inventory so low? Because rates are high and a lot of people who would otherwise want to purchase another home (either to move-up or downsize) do not want to give you their low 2.5-3% low fixed rate. Is demand down? Absolutely, as I’ve had about a dozen buyers who have gone onto the sidelines this year as not only have rates gone up but prices have also gone up during that time. However, the decrease in demand has more been more than offset by a decrease in supply.

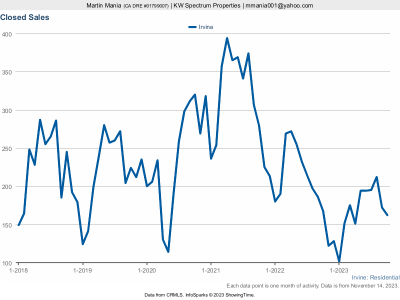

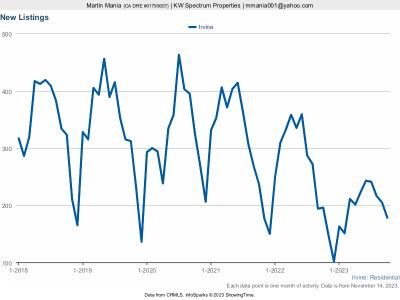

The attached data closes sales through October 2022. Sales volumes continued dropping off from 2022 levels into 2023 as inventory levels kept decreasing as less properties have been listed on the market. I have also provided some data to show how many new listings have been listed each month since Jan 2021. From a year-over-year perspective, we are down almost 19% (down approx. 47% from the sales volume that we saw in 2021) and at levels not seen since 2011 when we were getting out of the Great Recession. Due to the low level of inventory that we currently have, we can expect that sales volume will remain low for the rest of this year and into early next year.

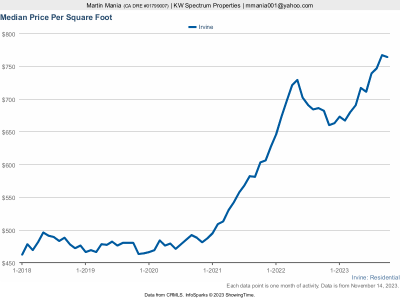

The median home price has increased from $663/sf at the end of December 2022 to $764/sf in October 2023 or an increase of $101/sf almost a 15% increase for the first 10 months of 2023. October 2023 prices increased approx. 12% or $82/sf from October 2022 prices. It may look like prices are beginning to level out but we saw something similar Jan to Feb and July to August so we’ll need to see a few more months of data to confirm this trend. However, I don’t foresee prices decreasing meaningfully until inventory levels materially increase from today’s levels. I have seen that there’s been a significant increase in the number of Irvine homes being purchased for all cash from previous years. Irvine has always had about 25-30% of all transactions be cash purchases but that % is now up to 40-50% as many financed buyers have went to sidelines due to both the higher prices and higher interest rates.

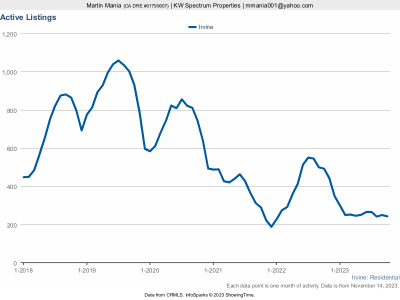

Inventory levels continued their decline from December 2022 levels into 2023. Typically inventory levels bottom out at the end of the year between Christmas and the New Year and peak out during July/August. That is not what happened at all, inventory levels drifted lower and lower even as we got into the Spring selling season (March-May) and never increased like we should typically see in the Summer selling season (June-August). At the end of 2022, we were just under 3 months of inventory which is borderline weak seller market and neutral market and once we got into Feb/March 2023 the supply of months decreased to 1.5 months of inventory which is a strong seller’s market and hence why we began to see material price increases with bidding wars on many properties. For the first 10 months of 2022 there were 2,893 new home listings for sale while in the first 10 months of 2023 there were only 2,281 new home listings for sale or a decrease of over 21%.

Interest rates stayed fairly flat in the first few months of 2023 but then we experienced the banking crisis in March 2023 with SVB and a few other banks failing which caused interest rates to decrease to the low 6% range. However, interest rates began to increase once the Fed stepped in to calm things down and continued to signal to market that rates would stay higher for longer. Even though the Fed stopped increasing the overnight rate, interest rates continued to increase until rates were around 8% last month. Interest rates have come down back down by ½% to ¾% in the past few weeks as inflation data came in lower so we are in the low-to-mid 7% range as I write this analysis. If the inflation data continues to come in weak, interest rates will continue to drift lower even if the Fed does not cut their rates. When will the Fed actually begin to cut interest rates? No one really knows but my guess would be late 2024/early 2025 at the earliest.

Overall, the market the market remains a strong seller’s market and the prices will probably continue to grind higher. I have seen multiple offers on my listings and listings that I’ve made offers for my buyers as inventory levels remain low. When I’ve asked my buyers who purchased and are actively looking to purchase why they are buying today they tell me that they have the need to do it, they can afford it, and believe that when interest rates come down home prices will probably be higher so they rather buy now and just refi their interest rate when interest rates come down in the next few years. As someone very smart once told me, you can always refi your rate lower, but you can’t refi your purchase price lower. It’ll be interesting to see how the rest of 2023 plays out.

Here’s the most surprising part for me and I’m sure most of you….as of the end of October, Irvine prices are about 5% HIGHER than the peak pricing that we had in April/May 2022. Who would have thought that would have happened, especially with rates being higher today than back at the end of 2022? Not me and probably not anyone else but the market will do what the market does. Why have prices increased? Simple, low inventory levels and that’s why I’ve been telling everyone for years and years to watch inventory levels as they will be a very good predictor of where home prices will go. Why is inventory so low? Because rates are high and a lot of people who would otherwise want to purchase another home (either to move-up or downsize) do not want to give you their low 2.5-3% low fixed rate. Is demand down? Absolutely, as I’ve had about a dozen buyers who have gone onto the sidelines this year as not only have rates gone up but prices have also gone up during that time. However, the decrease in demand has more been more than offset by a decrease in supply.

The attached data closes sales through October 2022. Sales volumes continued dropping off from 2022 levels into 2023 as inventory levels kept decreasing as less properties have been listed on the market. I have also provided some data to show how many new listings have been listed each month since Jan 2021. From a year-over-year perspective, we are down almost 19% (down approx. 47% from the sales volume that we saw in 2021) and at levels not seen since 2011 when we were getting out of the Great Recession. Due to the low level of inventory that we currently have, we can expect that sales volume will remain low for the rest of this year and into early next year.

The median home price has increased from $663/sf at the end of December 2022 to $764/sf in October 2023 or an increase of $101/sf almost a 15% increase for the first 10 months of 2023. October 2023 prices increased approx. 12% or $82/sf from October 2022 prices. It may look like prices are beginning to level out but we saw something similar Jan to Feb and July to August so we’ll need to see a few more months of data to confirm this trend. However, I don’t foresee prices decreasing meaningfully until inventory levels materially increase from today’s levels. I have seen that there’s been a significant increase in the number of Irvine homes being purchased for all cash from previous years. Irvine has always had about 25-30% of all transactions be cash purchases but that % is now up to 40-50% as many financed buyers have went to sidelines due to both the higher prices and higher interest rates.

Inventory levels continued their decline from December 2022 levels into 2023. Typically inventory levels bottom out at the end of the year between Christmas and the New Year and peak out during July/August. That is not what happened at all, inventory levels drifted lower and lower even as we got into the Spring selling season (March-May) and never increased like we should typically see in the Summer selling season (June-August). At the end of 2022, we were just under 3 months of inventory which is borderline weak seller market and neutral market and once we got into Feb/March 2023 the supply of months decreased to 1.5 months of inventory which is a strong seller’s market and hence why we began to see material price increases with bidding wars on many properties. For the first 10 months of 2022 there were 2,893 new home listings for sale while in the first 10 months of 2023 there were only 2,281 new home listings for sale or a decrease of over 21%.

Interest rates stayed fairly flat in the first few months of 2023 but then we experienced the banking crisis in March 2023 with SVB and a few other banks failing which caused interest rates to decrease to the low 6% range. However, interest rates began to increase once the Fed stepped in to calm things down and continued to signal to market that rates would stay higher for longer. Even though the Fed stopped increasing the overnight rate, interest rates continued to increase until rates were around 8% last month. Interest rates have come down back down by ½% to ¾% in the past few weeks as inflation data came in lower so we are in the low-to-mid 7% range as I write this analysis. If the inflation data continues to come in weak, interest rates will continue to drift lower even if the Fed does not cut their rates. When will the Fed actually begin to cut interest rates? No one really knows but my guess would be late 2024/early 2025 at the earliest.

Overall, the market the market remains a strong seller’s market and the prices will probably continue to grind higher. I have seen multiple offers on my listings and listings that I’ve made offers for my buyers as inventory levels remain low. When I’ve asked my buyers who purchased and are actively looking to purchase why they are buying today they tell me that they have the need to do it, they can afford it, and believe that when interest rates come down home prices will probably be higher so they rather buy now and just refi their interest rate when interest rates come down in the next few years. As someone very smart once told me, you can always refi your rate lower, but you can’t refi your purchase price lower. It’ll be interesting to see how the rest of 2023 plays out.