To say that 2022 was an interesting year would be an understatement. The year (2022) started out as hot as 2021 ended. I would describe 4Q 2021 as a period of buyer FOMO due to the fear of prices continuing to go up while 1Q 2022 could be described as a period of buyer FOMO due to missing out on locking in low interest rates as they started to slowly rise in the beginning of 2022. Pricing peaking about in May (April escrows) at a little over 14% from the end of 2021 and then the price declines took hold as interest rates begin to increase as high as 7% for conforming loans and as high as 6% for jumbo loans. Inventory levels increased from approximately 3 weeks at the beginning of the year to about 2.5 months by the end of the year. Builders who didn’t offer broker co-op commissions starting offering them later in the year and other builders started increasing the broker co-ops to agents.

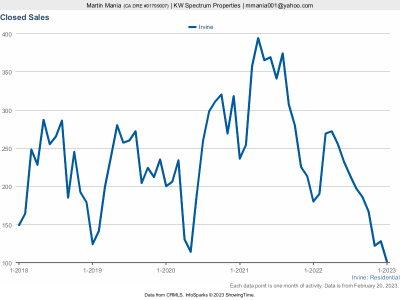

The attached data closes sales through December 2022. Sales volumes continued dropping off from 2021 levels in early 2022 as inventory levels kept decreasing as less properties have been listed on the market. Then in the middle of 2022 the bid-ask spread between what the buyers were willing to pay and what sellers were willing to accept and some sellers began taking their listings off the market because they weren’t going to get the price that they wanted. For the year, the total sales volume decreased by 36% from 3,702 to 2,409. Due to the low level of inventory going into 2023, we can expect that sales volume will remain low for at least the first few months.

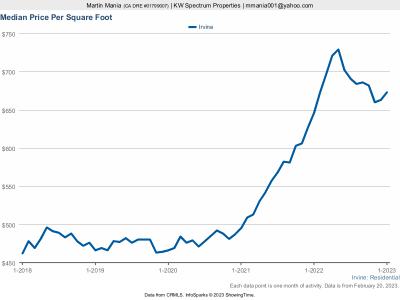

The median home price increase from $626/sf in December 2021 to $663/sf in December 2022 or an increase of approximately 6% for the year. Pricing peaked out at $729/sf in May 2022 and by the end of the year prices declined to $663/sf or by approximately 9%. This price decline has seemed to have leveled out by November 2022 as that is when interest rates started coming off the peak. I’m also seeing pricing head up a little bit in early 2023 as interest rates fell by almost 1% from the end of the year to the end of January 2023.

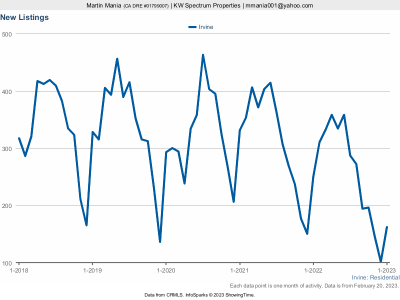

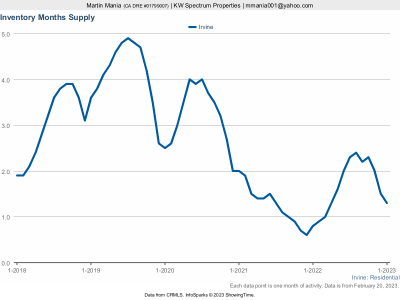

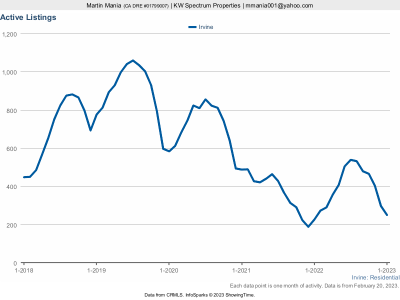

Inventory levels continued their decline until May 2022 when prices peaked out. Starting in June 2022 inventory levels began increasing on a year over year basis as buyers began to pull back. Inventory levels increased from 136 homes at the end of 2021 or about 3 weeks of inventory to 249 homes at the end of 2022 or about 2.5 months of inventory. Even though inventory levels increased significantly from the end of 2021, 2.5 months of inventory falls into a weak seller’s market. The reason why inventory levels have increased further is that the number of new listings in 2022 were 17% lower than in 2021 (3,138 homes vs 3,776 homes). This trend of less new listings has continued into 2023 and there is less inventory on the market today than at the end of 2022. The main reason for that is that many potential move-up buyers have decided to start put in their current homes because they have a fixed interest rate in the 2% to 3% range so it’s hard for them to deal with an interest rate of 5%+.

In terms of new homes, all new home builder wait lists remained packed through the first half of the year and then builder inventory begin to grow. I heard from an insider source that Irvine Pacific had a few months of more cancellations and sales a few months late in 2022. Builders like California Pacific Homes who did not offer any broker co-ops began to offer them and builders that had low broker co-ops increased them materially in the second half of the year. As prices have leveled off and inventory levels began to decrease in 2023, builders began selling their quicker move-in homes. Pricing for new phase releases seems to be flat now as builders see that they can’t continue to increase pricing.

Interest rates increased materially in 2022 from around the high 2%s to as high as 7% for conforming loans and as high as 6% for jumbo loans which happened in October (investment property rates were 1% higher). However, interest rates pulled back to around 5.50% for jumbo loans and 6.50% for conforming loans by the end of 2022. By the end of January 2023, rates drifted down to 5% for jumbo loans and 6% for confirming loans but have drifted back up to about where rates were at the end of 2022. The Fed will continue to increase interest rates into 2023 and maybe even go as high as 6% but I don’t believe that will materially increase interest rates as the higher they go the more the bond market will price in lower inflation in the future (which is the main driver of longer term bond yields).

Overall, the market the market looks to have flattened out for now. I have seen multiple offers on my listings and listings that I’ve made offers for my buyers as inventory levels remain low. Only significant interest rates moves will have a material effect on prices so the thing to watch carefully is inventory levels. If interest rates (jumbo loans) get into the low-to-mid 4% I would expect that move-up buyers will be inclined to come to the market and seriously consider selling their homes. Last year I predicted that prices would be up 5-10% from 2021 and we ended up approximately up 6%. For 2023, I believe pricing will be flattish or down 3% to up 3% depending upon where rates go and how the inventory level picture plays out.