Liar Loan

Well-known member

Kenkoko said:Stocks could have gone to 0 seems like a hyperbole to me. We're talking about average investors investing in major index funds. There's no evidence of such in the past 4+ decade. Equities has significantly outperformed Irvine RE in any 5 year period in the past 2 + decade.

And this "you at least have a place to live even in case it depreciates" makes even less sense to me. Do people who have not yet bought homes live in the streets? I am a firm believer that one do not need to own a home to be happy in life.

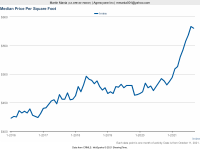

For somebody talking "sophisticated" investing strategies, this is such a wrong statement about stocks and Irvine real estate. From 2000 to 2005 you would've had a negative stock return (leveraged would have been a blood bath), while Irvine RE doubled or tripled over the same time period.

Kenkoko shouldn't be listened to when it comes to investing. How's that for a slam dunk?