usctrojancpa

Well-known member

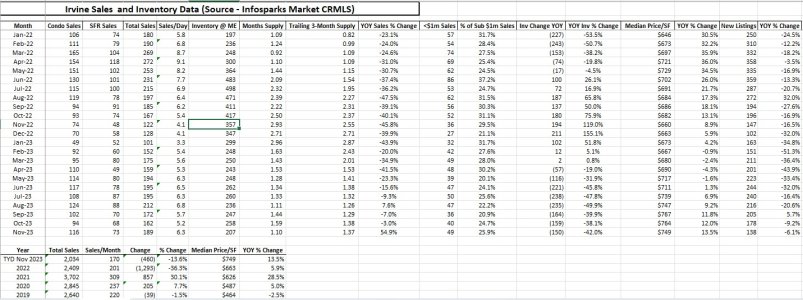

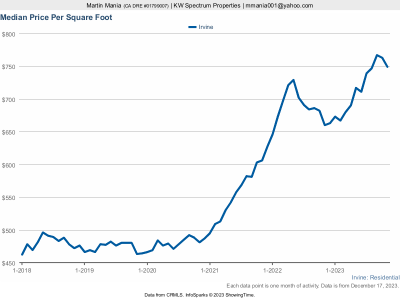

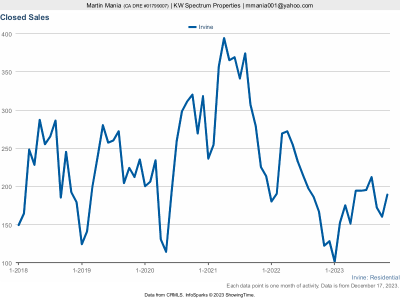

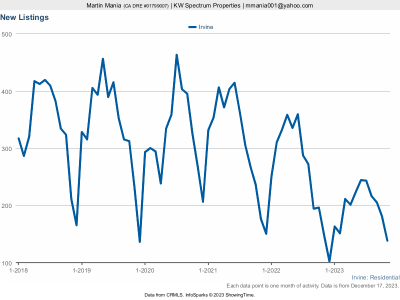

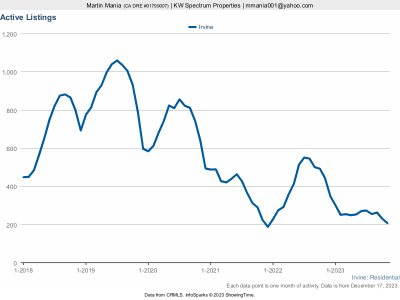

Below I've attached the November 2023 data for Irvine. Sales ticked up to almost as high as what we've seen in the summer time to 189 homes or almost 55% higher than November 2022. Inventory levels continued to decrease and were approximately 42% lower than this time last year, closing in on 1-month worth of inventory. New listing inventory continued to be lower than what we saw last year. The interesting part of the data was that the median price per SF decreased about 2% from October 2023 but I think that has to do that more attached condos sold in the month versus SFR homes but the median price per SF still increased almost 14% year-over-year.