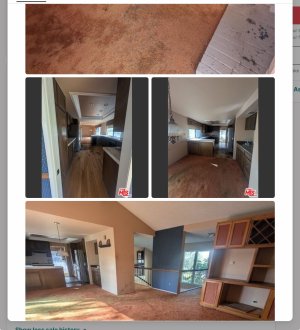

Wood flooring garage door??

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Newer Irvine listings with crazy WTF asking prices from equity sellers

- Thread starter usctrojancpa

- Start date

NEW -> Contingent Buyer Assistance Program

That home backs right up to a park. Better hope they don't out pickleball courts there.

Since 2020 (infinite QE) prices have been doubling every 3-4 years.

vsfan

Active member

Is that even possible? Okay with build code and etc.?Wood flooring garage door??

What do y’all think of this home? https://www.stessa.com/investment-properties/11-thunder-trl-6-irvine-ca-92614/details/F5bR7SqSULvq

Current ask is $2.2MM and the original ask was $2.5MM. If any of y’all were buying this home today, how much would you pay?

It’s not a SFR, it’s a townhome (attached only on one side) in a good location in Woodbridge, close to retail centers in Westpark and also Woodbridge plaza. Renovations appear to be well done but that being said is the seller attributing too much premium for the renovations and upgrades? This is a comp, 15 Firestone-https://redf.in/sKnPVm

Not renovated, but similar floor plan, size and it also sold recently for $1.6MM. Given this comp and knowing you will have to a pay a premium for the upgrades, how much more would you pay for a renovated home? Appreciate any insights.

Current ask is $2.2MM and the original ask was $2.5MM. If any of y’all were buying this home today, how much would you pay?

It’s not a SFR, it’s a townhome (attached only on one side) in a good location in Woodbridge, close to retail centers in Westpark and also Woodbridge plaza. Renovations appear to be well done but that being said is the seller attributing too much premium for the renovations and upgrades? This is a comp, 15 Firestone-https://redf.in/sKnPVm

Not renovated, but similar floor plan, size and it also sold recently for $1.6MM. Given this comp and knowing you will have to a pay a premium for the upgrades, how much more would you pay for a renovated home? Appreciate any insights.

Last edited:

vsfan

Active member

800 per sqft max.What do y’all think of this home? https://www.stessa.com/investment-properties/11-thunder-trl-6-irvine-ca-92614/details/F5bR7SqSULvq

Current ask is $2.2MM and the original ask was $2.5MM. If any of y’all were buying this home today, how much would you pay?

It’s not a SFR, it’s a townhome (attached only on one side) in a good location in Woodbridge, close to retail centers in Westpark and also Woodbridge plaza. Renovations appear to be well done but that being said is the seller attributing too much premium for the renovations and upgrades? This is a comp-https://redf.in/sKnPVm

Not renovated, but similar floor plan, size and sold recently for $1.6MM. Given this comp, and knowing you will have to a pay a premium for the upgrades, how much more would you pay for a renovated home? Appreciate any insights.

GrowthStateofMind

Active member

Why not just look for a similar-sized renovated home in Northwood area? Still pretty central and you can avoid that steep monthly HOA.What do y’all think of this home? https://www.stessa.com/investment-properties/11-thunder-trl-6-irvine-ca-92614/details/F5bR7SqSULvq

Current ask is $2.2MM and the original ask was $2.5MM. If any of y’all were buying this home today, how much would you pay?

It’s not a SFR, it’s a townhome (attached only on one side) in a good location in Woodbridge, close to retail centers in Westpark and also Woodbridge plaza. Renovations appear to be well done but that being said is the seller attributing too much premium for the renovations and upgrades? This is a comp, 15 Firestone-https://redf.in/sKnPVm

Not renovated, but similar floor plan, size and it also sold recently for $1.6MM. Given this comp and knowing you will have to a pay a premium for the upgrades, how much more would you pay for a renovated home? Appreciate any insights.

GrowthStateofMind

Active member

Or even The Ranch neighborhood off Yale and Irvine Center Drive for that matter if not Northwood @ravi. The SFRs there are a good size with decent lot sizes and 3-car garages.Why not just look for a similar-sized renovated home in Northwood area? Still pretty central and you can avoid that steep monthly HOA.

miniDragonPaw

Member

Interesting, https://www.zillow.com/homedetails/217-Piazza-Irvine-CA-92602/338255165_zpid/

Selling for a lost.

Selling for a lost.

Loco_local

Active member

More interesting is that the person selling bought it for almost $1.5 million more two years later.

does this belong here? Asking price is $1,015/SF. https://redf.in/Em4e6m

does this belong here? Asking price is $1,015/SF. https://redf.in/Em4e6m

That home backs right up to a park. Better hope they don't out pickleball courts there.

Ha with Mike Ward getting new pickleball courts, unlikely but you never know.That home backs right up to a park. Better hope they don't out pickleball courts there.

Just looked at old threads on homes in this community when it was built 10 years ago. Almost everyone at that time on here believed these homes were extremely expensive at $1MM, now 10 years later, they are almost certainly going to be sold at atleast close to $2MM or higher ($850/SF or higher). Any updated thoughts on the homes in this community?

irvinehomeowner

Well-known member

Yep. Irvine prices are crazy. 3br starter homes that are 40 years old are in the $1.5m+ range.

In an active real estate market like orange county, house price doubles every 10 years in general.Just looked at old threads on homes in this community when it was built 10 years ago. Almost everyone at that time on here believed these homes were extremely expensive at $1MM, now 10 years later, they are almost certainly going to be sold at atleast close to $2MM or higher ($850/SF or higher). Any updated thoughts on the homes in this community?

Loco_local

Active member

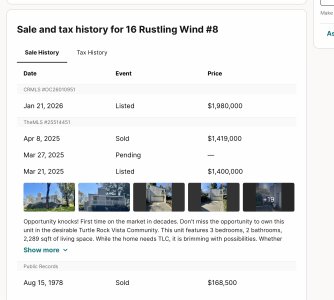

Liar Loan

Well-known member

If you look at @Loco_local's post you can see the last sale in 1978 for $168,500 and a current list price of $1,980,000. That's about a 4.9% annual increase so prices have doubled every 15 years in Irvine.In an active real estate market like orange county, house price doubles every 10 years in general.

If you look at @Loco_local's post you can see the last sale in 1978 for $168,500 and a current list price of $1,980,000. That's about a 4.9% annual increase so prices have doubled every 15 years in Irvine.

Since 2020 (infinite QE) prices have been doubling every 3-4 years.

Agreed but I just found it interesting that the price doubled (if not more than doubled) even when almost everyone on here believed 10 years ago prices for these homes were expensive compared to the comps to begin with.In an active real estate market like orange county, house price doubles every 10 years in general.

When it’s a 4.9% annual appreciation or let’s even double that to 10% which is insane but let use that as an example, once you have a primary residence to live in, what’s the appeal with residential real estate investing after that when you are getting roughly the same returns, if not more by just investing in the S&P 500? And by residential real estate investing I do not mean buying, fixing and forcing appreciation. There are folks who buy homes and just depend on appreciation and as you pointed out it’s not significant when you can get similar returns in the stock market.If you look at @Loco_local's post you can see the last sale in 1978 for $168,500 and a current list price of $1,980,000. That's about a 4.9% annual increase so prices have doubled every 15 years in Irvine.

Last edited:

CalBears96

Well-known member

Personally, I don't like to invest in real estate because it makes the money illiquid. However, the ROI is different than the stock market. The reason is the capital involved. Let's say you buy a $2M home with 30% down. That's $600k. The appreciation is based on $2M, but your capital is only $600k. That makes the ROI 3X the appreciation. If you somehow only need to put down 20%, then it would be 5X.When it’s a 4.9% annual appreciation or let’s even double that to 10% which is insane but let use that as an example, once you have a primary residence to live in, what’s the appeal with residential real estate investing after that when you are getting roughly the same returns, if not more by just investing in the S&P 500? And by residential real estate investing I do not mean buying, fixing and forcing appreciation. There are folks who buy homes and just depend on appreciation and as you pointed out it’s not significant when you can get similar returns in the stock market.