You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Irvine Homes and Real Estate

- Thread starter panda

- Start date

NEW -> Contingent Buyer Assistance Program

sure it would be interesting to see. Seasonality will come into play however.

Better would be to look at the last two quarters of this year versus last two quarters of 2017 to eliminate seasonality.

Luck is all there is to what I?ve accumulated. I never time the market, rather my real estate holdings are just from personal needs and passed down. I am good to my tenants and my tenants great to me, and I pay it forwards to where I can. Money, you can?t it take with you when it?s your time to see the Lord, but your children might be a little bit better off when received some helps.

Good for you . It?s also good to be humble as you seem to be . But as with everything in life , luck often times favors those who are prepared and ready.

I will say one thing from a high level perspective ? real estate is knocked around for being highly illiquid and a poor way to invest . But here is an asset where you have 100 percent transparency in terms of asset quality , local data and intense agent competition (in a market like Irvine )

Now compare that to equities ? Liquid , yes . Transparency? Good luck w that . Even the largest companies have skeletons in their closet you don?t know until you are left holding the bag (GE , anyone? ) .

Many of the high net worth individuals also love to ?direct lend? or invest in private assets ? no liquidity there and good luck trying to cash out in a down market

Interesting how data can be so different. Perhaps it is because you decided to use DOM instead of months of supply. Here is the months of supply I see from Redfin.

Good info.

In the 90s when I was in business school, we worshipped at the altar of Jack Welch. The man could do no wrong. multiple quarters of him hitting or exceeding his earnings forecasts year after year.

How did he do it? I'll have to look deeper into it, but it's something to do with GE capital and accounting tricks. In the end he did well for himself... and fucked GE.

Atleast he's wealthy...this is what we teach our MBA grads.

Like cosby, I'm glad he's not dead yet so he can see himself become the villain.

The higher end of the market has drag down the median price in Irvine. There is a lot of higher end inventory on the market ($1,3m+), including many unsold standing inventory new homes which I call today's shadow inventory, which is putting downward pricing pressure on the market as buyers are being very patient and picky.

To me 24-48 months or 2-4 years away is a short term hold for real estates.

Your prediction of this time frame, however, for buyers whom on the fence to buy seem lights years away. Perhaps you don?t feel the pain of practice patient and wait while the rental market costs for LA and OC skyrocketing, and not showing sign of slowing down even if there is a down turn for purchase when you in GA.

Who can guarantee that renters would not subject to face increase in the next 48 months, when laws had just passed to limit the 5 % annually increase PLUS inflation for rents in SOCAL?

Panda you are good at analytic data, that I give to you, but emotionally when renting facing annualized increase in rental cost makes people impatient and wanting to owned.

Money is dirt cheap to borrow.

As the saying goes, the market can stay irrational longer than you can stay liquid. There are so many variables, including human emotions, that go into housing that it's difficult to predict where the real estate market will go. That's why I always caveat my predictions with certain assumptions.

Panda said:Meccos..

Would you want me to break out the data points?

Q1Q2 vs Q3Q4 to see if there are any significant differences?

Who would be interested in seeing that data?

sure it would be interesting to see. Seasonality will come into play however.

Better would be to look at the last two quarters of this year versus last two quarters of 2017 to eliminate seasonality.

panda

Well-known member

Here is the data as follows:

Total Irvine = Townhome + Condos + SFRs

07/01/2017 - 12/31/2017

Median: $799,492

Homes Sold : 1487

Median DOM : 61

07/01/2018 - 12/31/2018

Median: $855,000

Homes Sold : 1283

Median DOM : 61

Median price is higher and the median days on the market is the same at 61 days for 2017 and 2018 July to December.

Total Irvine = Townhome + Condos + SFRs

07/01/2017 - 12/31/2017

Median: $799,492

Homes Sold : 1487

Median DOM : 61

07/01/2018 - 12/31/2018

Median: $855,000

Homes Sold : 1283

Median DOM : 61

Median price is higher and the median days on the market is the same at 61 days for 2017 and 2018 July to December.

irvinebullhousing

Well-known member

meccos12 said:Compressed-Village said:meccos12 said:Compressed-Village said:Irvine price will be stable as ever while the equities market nose dive. Irvine housing will be your best bet from now going forward.

You should pull all your money from all accounts and start buying Irvine homes then.

Been there, done that!!!

So are you saying that all of your money is in Irvine real estate? If so, much respect for you and good luck.

Luck is all there is to what I?ve accumulated. I never time the market, rather my real estate holdings are just from personal needs and passed down. I am good to my tenants and my tenants great to me, and I pay it forwards to where I can. Money, you can?t it take with you when it?s your time to see the Lord, but your children might be a little bit better off when received some helps.

Compressed-Village said:meccos12 said:Compressed-Village said:meccos12 said:Compressed-Village said:Irvine price will be stable as ever while the equities market nose dive. Irvine housing will be your best bet from now going forward.

You should pull all your money from all accounts and start buying Irvine homes then.

Been there, done that!!!

So are you saying that all of your money is in Irvine real estate? If so, much respect for you and good luck.

Luck is all there is to what I?ve accumulated. I never time the market, rather my real estate holdings are just from personal needs and passed down. I am good to my tenants and my tenants great to me, and I pay it forwards to where I can. Money, you can?t it take with you when it?s your time to see the Lord, but your children might be a little bit better off when received some helps.

Good for you . It?s also good to be humble as you seem to be . But as with everything in life , luck often times favors those who are prepared and ready.

I will say one thing from a high level perspective ? real estate is knocked around for being highly illiquid and a poor way to invest . But here is an asset where you have 100 percent transparency in terms of asset quality , local data and intense agent competition (in a market like Irvine )

Now compare that to equities ? Liquid , yes . Transparency? Good luck w that . Even the largest companies have skeletons in their closet you don?t know until you are left holding the bag (GE , anyone? ) .

Many of the high net worth individuals also love to ?direct lend? or invest in private assets ? no liquidity there and good luck trying to cash out in a down market

Panda said:Here is the data as follows:

Total Irvine = Townhome + Condos + SFRs

07/01/2017 - 12/31/2017

Median: $799,492

Homes Sold : 1487

Median DOM : 61

07/01/2018 - 12/31/2018

Median: $855,000

Homes Sold : 1283

Median DOM : 61

Median price is higher and the median days on the market is the same at 61 days for 2017 and 2018 July to December.

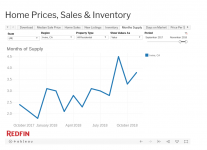

Interesting how data can be so different. Perhaps it is because you decided to use DOM instead of months of supply. Here is the months of supply I see from Redfin.

Attachments

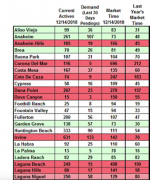

Here is a chart from Reports on Housing from Steve Thomas. This chart reports DOM but still gives a vastly different picture from your numbers. I find his reports most helpful because he uses the most current and up to date data rather than trailing data points so that you know whats going on now and not what happened 3 or 6 months ago. He controls seasonality by always comparing YoY numbers.

Attachments

meccos12 said:Here is a chart from Reports on Housing from Steve Thomas. This chart reports DOM but still gives a vastly different picture from your numbers. I find his reports most helpful because he uses the most current and up to date data rather than trailing data points so that you know whats going on now and not what happened 3 or 6 months ago. He controls seasonality by always comparing YoY numbers.

Good info.

zubs

Well-known member

fortune11 said:Now compare that to equities ? Liquid , yes . Transparency? Good luck w that . Even the largest companies have skeletons in their closet you don?t know until you are left holding the bag (GE , anyone? ) .

In the 90s when I was in business school, we worshipped at the altar of Jack Welch. The man could do no wrong. multiple quarters of him hitting or exceeding his earnings forecasts year after year.

How did he do it? I'll have to look deeper into it, but it's something to do with GE capital and accounting tricks. In the end he did well for himself... and fucked GE.

Atleast he's wealthy...this is what we teach our MBA grads.

Like cosby, I'm glad he's not dead yet so he can see himself become the villain.

usctrojancpa

Well-known member

Panda said:i am going to have to do some further analysis on this. Doesnt seem right that the Irvine housing appreciation is lagging behind the LA index appreciation.

The higher end of the market has drag down the median price in Irvine. There is a lot of higher end inventory on the market ($1,3m+), including many unsold standing inventory new homes which I call today's shadow inventory, which is putting downward pricing pressure on the market as buyers are being very patient and picky.

panda

Well-known member

Thanks Trojan. 2020 maybe the year for you to go heavy on listings in Irvine. I really think a 15% haircut in the Irvine market is highly probable in the next 24-48 months. Irvine buyers should extremely patient and picky and allow the deal to come to them. Soon the buyers will be in control.

USCTrojanCPA said:Panda said:i am going to have to do some further analysis on this. Doesnt seem right that the Irvine housing appreciation is lagging behind the LA index appreciation.

The higher end of the market has drag down the median price in Irvine. There is a lot of higher end inventory on the market ($1,3m+), including many unsold standing inventory new homes which I call today's shadow inventory, which is putting downward pricing pressure on the market as buyers are being very patient and picky.

irvinebullhousing

Well-known member

Panda said:Thanks Trojan. 2020 maybe the year for you to go heavy on listings in Irvine. I really think a 15% haircut in the Irvine market is highly probable in the next 24-48 months. Irvine buyers should extremely patient and picky and allow the deal to come to them. Soon the buyers will be in control.

USCTrojanCPA said:Panda said:i am going to have to do some further analysis on this. Doesnt seem right that the Irvine housing appreciation is lagging behind the LA index appreciation.

The higher end of the market has drag down the median price in Irvine. There is a lot of higher end inventory on the market ($1,3m+), including many unsold standing inventory new homes which I call today's shadow inventory, which is putting downward pricing pressure on the market as buyers are being very patient and picky.

To me 24-48 months or 2-4 years away is a short term hold for real estates.

Your prediction of this time frame, however, for buyers whom on the fence to buy seem lights years away. Perhaps you don?t feel the pain of practice patient and wait while the rental market costs for LA and OC skyrocketing, and not showing sign of slowing down even if there is a down turn for purchase when you in GA.

Who can guarantee that renters would not subject to face increase in the next 48 months, when laws had just passed to limit the 5 % annually increase PLUS inflation for rents in SOCAL?

Panda you are good at analytic data, that I give to you, but emotionally when renting facing annualized increase in rental cost makes people impatient and wanting to owned.

Money is dirt cheap to borrow.

panda

Well-known member

Compressed Village,

My comments were more for the first time home buyer in their 20s and 30s. You seem to be a wealthy Korean American in Irvine with multiple homes who is invested for the long term with a secure retirement in place for you and your family. Congratulations in achieving that.

I not only look at micro data but also the macro, sort of like looking at the forest rather than just the tree. The % that Irvine will correct will be highly correlated with the unemployment rate in Orange County. Irvine's housing market has seen its first negative appreciation number in 2019 since 2011. The current unemployment number in Irvine is right around 2.5% and if that number doubles to 5%, I think that Irvine's housing market will be more or less just flat 0 to - 5 percent. However, if we reach OC unemployment numbers between 7-10%, the correction can be between 15-25%. Also the international direct investments from China, India, and South Korea has also dropped quite bit in the last years. South Korea will face social, political, and economic challenges in the years ahead.

If I was a first time home buyer in Irvine, I would try to keep my rental overhead as low as possible and wait for about 24 months. Buying a currently valued $1 million dollar home in Irvine for between $600,000 to $850,000 in the next 24 - 48 months is not out of the question in my market analysis and research for Irvine. A lot of things will occur will in the macro market the next 24 months. 2019 was a great year for most investors where you can pretty much throw a dart in any sector and you would be a up 10-15%. Irvine's housing market is more like a developed country like the United States whereas Nashville's housing market is more like an emerging city like India where there is a lot more upside potential for real estate markets in the South. In the next 20 years, I plan to invest more heavily in the emerging markets vs the U.S. Same strategy holds for my future real estate investments. At the peak of the DOW in the year 1937, it took 17 years for the market to recover and get back to its 1937 high.

Panda.

My comments were more for the first time home buyer in their 20s and 30s. You seem to be a wealthy Korean American in Irvine with multiple homes who is invested for the long term with a secure retirement in place for you and your family. Congratulations in achieving that.

I not only look at micro data but also the macro, sort of like looking at the forest rather than just the tree. The % that Irvine will correct will be highly correlated with the unemployment rate in Orange County. Irvine's housing market has seen its first negative appreciation number in 2019 since 2011. The current unemployment number in Irvine is right around 2.5% and if that number doubles to 5%, I think that Irvine's housing market will be more or less just flat 0 to - 5 percent. However, if we reach OC unemployment numbers between 7-10%, the correction can be between 15-25%. Also the international direct investments from China, India, and South Korea has also dropped quite bit in the last years. South Korea will face social, political, and economic challenges in the years ahead.

If I was a first time home buyer in Irvine, I would try to keep my rental overhead as low as possible and wait for about 24 months. Buying a currently valued $1 million dollar home in Irvine for between $600,000 to $850,000 in the next 24 - 48 months is not out of the question in my market analysis and research for Irvine. A lot of things will occur will in the macro market the next 24 months. 2019 was a great year for most investors where you can pretty much throw a dart in any sector and you would be a up 10-15%. Irvine's housing market is more like a developed country like the United States whereas Nashville's housing market is more like an emerging city like India where there is a lot more upside potential for real estate markets in the South. In the next 20 years, I plan to invest more heavily in the emerging markets vs the U.S. Same strategy holds for my future real estate investments. At the peak of the DOW in the year 1937, it took 17 years for the market to recover and get back to its 1937 high.

Panda.

Compressed-Village said:Panda said:Thanks Trojan. 2020 maybe the year for you to go heavy on listings in Irvine. I really think a 15% haircut in the Irvine market is highly probable in the next 24-48 months. Irvine buyers should extremely patient and picky and allow the deal to come to them. Soon the buyers will be in control.

USCTrojanCPA said:Panda said:i am going to have to do some further analysis on this. Doesnt seem right that the Irvine housing appreciation is lagging behind the LA index appreciation.

The higher end of the market has drag down the median price in Irvine. There is a lot of higher end inventory on the market ($1,3m+), including many unsold standing inventory new homes which I call today's shadow inventory, which is putting downward pricing pressure on the market as buyers are being very patient and picky.

To me 24-48 months or 2-4 years away is a short term hold for real estates.

Your prediction of this time frame, however, for buyers whom on the fence to buy seem lights years away. Perhaps you don?t feel the pain of practice patient and wait while the rental market costs for LA and OC skyrocketing, and not showing sign of slowing down even if there is a down turn for purchase when you in GA.

Who can guarantee that renters would not subject to face increase in the next 48 months, when laws had just passed to limit the 5 % annually increase PLUS inflation for rents in SOCAL?

Panda you are good at analytic data, that I give to you, but emotionally when renting facing annualized increase in rental cost makes people impatient and wanting to owned.

Money is dirt cheap to borrow.

Not relating to the recent subject in this thread.

I would say by reading Pandas posts that he is knowledgeable about Real Estate and Business. For example he talks about the previous business cycles/recessions, and he takes the time to provide stats about different Real Estate markets.

I would say by reading Pandas posts that he is knowledgeable about Real Estate and Business. For example he talks about the previous business cycles/recessions, and he takes the time to provide stats about different Real Estate markets.

irvinebullhousing

Well-known member

The REAL problem here is FORECASTING.

History, does have a story to tell. I would argue that we forecasted many times before about dooms and busts.

All indicators in the past two years tell us that corrections should have happened.

Not only it surpasses the high, it went on and on.

Betting on red to comes up after ten straight black on roulette table is still a guess. I saw 18 rolls of black comes on this table.

Shelters on the other hand is not a gamble if you intend to live in it and plans for the long run. It?s a necessity.

Just my 2 cents

History, does have a story to tell. I would argue that we forecasted many times before about dooms and busts.

All indicators in the past two years tell us that corrections should have happened.

Not only it surpasses the high, it went on and on.

Betting on red to comes up after ten straight black on roulette table is still a guess. I saw 18 rolls of black comes on this table.

Shelters on the other hand is not a gamble if you intend to live in it and plans for the long run. It?s a necessity.

Just my 2 cents

irvinehomeowner

Well-known member

It's the non-fundamental aspects that mess up the data/historical indicators.

As CV said, data shows that much lower volumes should result in lower prices... yet here we are flattish and once again saying "this" year will be the real slowdown.

I agree on how knowledgeable Panda is, but history also shows me that all that knowledge can be wrong when it comes to unforeseeable factors (eg. the Dow).

As CV said, data shows that much lower volumes should result in lower prices... yet here we are flattish and once again saying "this" year will be the real slowdown.

I agree on how knowledgeable Panda is, but history also shows me that all that knowledge can be wrong when it comes to unforeseeable factors (eg. the Dow).

usctrojancpa

Well-known member

irvinehomeowner said:It's the non-fundamental aspects that mess up the data/historical indicators.

As CV said, data shows that much lower volumes should result in lower prices... yet here we are flattish and once again saying "this" year will be the real slowdown.

I agree on how knowledgeable Panda is, but history also shows me that all that knowledge can be wrong when it comes to unforeseeable factors (eg. the Dow).

As the saying goes, the market can stay irrational longer than you can stay liquid. There are so many variables, including human emotions, that go into housing that it's difficult to predict where the real estate market will go. That's why I always caveat my predictions with certain assumptions.