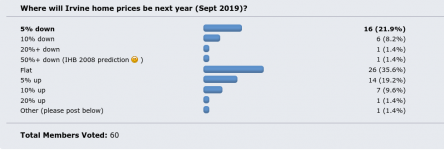

fortune11 said:So the distribution or consensus on the few data points we have is right around flat to down 5 percent

Which means if you are planning to buy for lifestyle change , timing it carefully is not as important as getting the right home (And perhaps the right deal)

And investors should not even bother at this point with the ?beta? . There is always the possibility you can find a fixer upper gem , but probably won?t in this day and age of informed (and way too optimistic in cases) sellers .

If this poll turns out to be correct and there is a 0-5% correct in the next year, timing the price decrease is not too important (although 50K saving is not chump change either). However, with rising inventories and decreasing demand the main benefit to waiting may not be a price saving but rather a higher chance of finding the best house in the best location.