Liar Loan

Well-known member

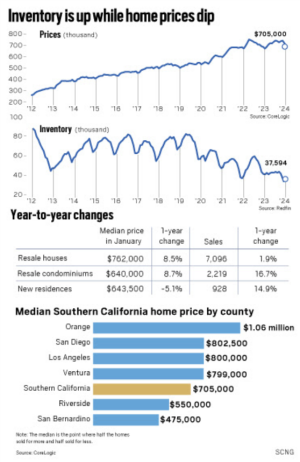

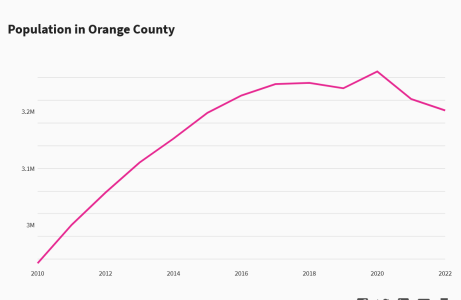

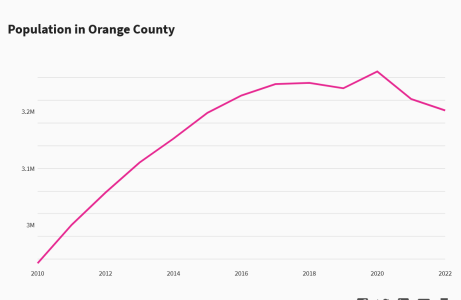

OC actually has fewer people now than it did in 2016 and the downward trend is only going to accelerate. This will continue until the cost of living comes down to the point that average families can afford to live here again. Irvine will not be immune from these trends, just as it has never been immune from the price trends affecting all of Orange County.

usafacts.org

usafacts.org

Orange County, CA population by year, race, & more

The ages, races, and population density of Orange County, California tell a story. Understand the shifts in demographic trends with these charts visualizing decades of population data.

Last edited: