You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Global Recession?

- Thread starter eyephone

- Start date

NEW -> Contingent Buyer Assistance Program

Well, if you don't have anything, you have nothing to fear, there's nothing to deflate.

Actually, deflation might not be a bad thing.

Or maybe just more QE.

http://www.marketwatch.com/story/feds-williams-says-qe-could-be-needed-if-economy-slides-2014-10-14

"Japan has languished in a deflationary cycle pretty much since the late 1990s, its once-booming economy reduced to ?lost decades? of stagnation. The country now lays claim to the world?s highest debt ? over 1 quadrillion yen ($9 trillion) ? more than twice the size of its total economic output.

Europe is now teetering on the edge.

Seventy-four per cent of global investors expressed fears the euro zone was slipping into deflation, according to a recent Bloomberg poll.

Nobel Prize-winning economist Paul Krugman says Europe?s economy is performing worse now than in the 1930s.

It?s not just the economics that are starting to resemble those dark times, he warned, looking to the rise of a new nationalism that threatens to undermine the post-WWII order ? when Europe?s former enemies came together in what became the European Union."

http://mobile.news.com.au/finance/e...fying-for-europe/story-e6frflo9-1227063772773

Agree with you that deflation is bad for the overall economy.

The article I posted just provides a different view to look at things. If you can maintain same level of income while everything else become cheaper, than its kind of like getting a raise and it's a chance to get ahead. Your hard earn dollar can go farther and you can keep more of it.

If one can just maintain same level of income during the deflation period, everything will be just fine.

Pentagon document lays out zombie battle plan

"From responses to natural disasters to a catastrophic attack on the homeland, the U.S. military has a plan of action ready to go if either incident occurs.

It has also devised an elaborate plan should a zombie apocalypse befall the country, according to a Defense Department document obtained by CNN.

In an unclassified document titled "CONOP 8888," officials from U.S. Strategic Command used the specter of a planet-wide attack by the walking dead as a training template for how to plan for real-life, large-scale operations, emergencies and catastrophes"

Source:http://www.cnn.com/2014/05/16/politics/pentagon-zombie-apocalypse/

Different world, but I'll say this...if Irvine goes down in price then all other cities around it will see bigger price declines just like we saw back in 2008-2010.

The Motor Court Company

Well-known member

dooms day scenario

1. ISIS grows much stronger, gaining weapons of mass destruction, even nuclear

2. Ukraine crisis resurfaces, a region war imminent

3. Ebola gets out of control as it spreads out in North America, Europe and Asia

4. HK protest catches fire in other China provinces; civil unrest everywhere in China

5. Military coup in North Korea; Korea penisula conflict imminent

6. Stock market correction and real estate slow down

7. Global warming causing droughts and food price spikes

8. Other natural disasters. The big one in California, Tsunamis in Asia, etc

1. ISIS grows much stronger, gaining weapons of mass destruction, even nuclear

2. Ukraine crisis resurfaces, a region war imminent

3. Ebola gets out of control as it spreads out in North America, Europe and Asia

4. HK protest catches fire in other China provinces; civil unrest everywhere in China

5. Military coup in North Korea; Korea penisula conflict imminent

6. Stock market correction and real estate slow down

7. Global warming causing droughts and food price spikes

8. Other natural disasters. The big one in California, Tsunamis in Asia, etc

irvinehomeowner

Well-known member

You forgot:

ALL Irvine Home Prices Drop 40%

ALL Irvine Home Prices Drop 40%

The Motor Court Company

Well-known member

OK.

and 10. Zombie Apocalypse. Patient zero is Qwerty, bitten by his mutated dog having too much TCE in its system.

and 10. Zombie Apocalypse. Patient zero is Qwerty, bitten by his mutated dog having too much TCE in its system.

eyephone said:Add global deflation fears.

Well, if you don't have anything, you have nothing to fear, there's nothing to deflate.

Actually, deflation might not be a bad thing.

http://www.forbes.com/sites/jonmatonis/2012/12/23/fear-not-deflation/Deflation is actually a good thing, because in a deflation prices drop and money becomes more valuable, so deflation encourages people to save money. Deflation rewards the prudent saver and punishes the profligate borrower. The way a society, like an individual, becomes wealthy is by producing more than it consumes. In other words, by saving, not borrowing. And during a deflation, when money becomes more valuable, everybody wants money. They want to save. Whereas during an inflation, you want to get rid of the money. You want to consume. You want to spend. But you don?t become wealthy by spending and consuming; you become wealthy by producing and saving.

Lower prices increase demand; they do not reduce or delay it. That?s why more and more people own flat-screen TVs, cellular telephones, and laptop computers: the prices of these goods have fallen, and people with lower incomes can afford them. And there are more low-income people than high-income people.

momopi

Well-known member

Day 1: Major earthquake hits LA region, knocks out California aquaduct, water pumps, and cause great many aging water pipes to break. Freeways, roads, bridges, rail, etc. are damaged disrupting transportation. Wide-area utility service outage. Hospitals are overwhelmed with injured.

Day 2: Supermarket shelves are emptied. FEMA and other emergency services are overwhelmed with their limited resources. Local law enforcement agencies go AWOL as police officers return home to attend to their families. Transporation system breaks down and delivery of groceries, medicine, petrol, and other necessirites are severely restricted.

Day 3: Looting breaks out across the Greater Los Angeles Area. Refugees flood into neighboring cities/countries. Armed survivalists and preppers flee into the mountains, only to find the guy next to them is armed with bigger guns.

Week 2: Refugees who are dumb enough to be evacuated to FEMA camps find living conditions far worse than the Superdome after Katrina, with overcrowding, limited resources, frequent riots over distribution of food and water, inadequate sanitation, with sh*t and trash littered across the landscape. Refugees drinking unfiltered water from the Los Angels and San Gabriel rivers & park lakes fall ill to dysentery.

p.s. this is my 666th post.

Day 2: Supermarket shelves are emptied. FEMA and other emergency services are overwhelmed with their limited resources. Local law enforcement agencies go AWOL as police officers return home to attend to their families. Transporation system breaks down and delivery of groceries, medicine, petrol, and other necessirites are severely restricted.

Day 3: Looting breaks out across the Greater Los Angeles Area. Refugees flood into neighboring cities/countries. Armed survivalists and preppers flee into the mountains, only to find the guy next to them is armed with bigger guns.

Week 2: Refugees who are dumb enough to be evacuated to FEMA camps find living conditions far worse than the Superdome after Katrina, with overcrowding, limited resources, frequent riots over distribution of food and water, inadequate sanitation, with sh*t and trash littered across the landscape. Refugees drinking unfiltered water from the Los Angels and San Gabriel rivers & park lakes fall ill to dysentery.

p.s. this is my 666th post.

irvinehomeowner

Well-known member

No apocalypse is complete without the zeds.momopi said:Refugees drinking unfiltered water from the Los Angels and San Gabriel rivers & park lakes fall ill to dysentery die and return as zombies.

Irvinecommuter

New member

Whatever...trying to refinance, need more people to buy US Treasuries

@Inc - previously you said, "deflation might not be a bad thing." I think it's the opposite.

"Prices go down, what?s not to like?

Yet the cold economic reality means that when prices fall people stop spending, hoping things will get even cheaper. In response, businesses cut production and lay off workers. That means even less demand, and prices drop further.

By then, your economy?s in a vicious downward spiral.

Making things worse, those falling prices bring declining wages and worsening debt burdens.

Anybody who doubts how bad it could get should look back to the last time the United States caught a serious dose of deflation, from 1929-33. They called that the Great Depression."

Source:http://mobile.news.com.au/finance/e...fying-for-europe/story-e6frflo9-1227063772773

"Prices go down, what?s not to like?

Yet the cold economic reality means that when prices fall people stop spending, hoping things will get even cheaper. In response, businesses cut production and lay off workers. That means even less demand, and prices drop further.

By then, your economy?s in a vicious downward spiral.

Making things worse, those falling prices bring declining wages and worsening debt burdens.

Anybody who doubts how bad it could get should look back to the last time the United States caught a serious dose of deflation, from 1929-33. They called that the Great Depression."

Source:http://mobile.news.com.au/finance/e...fying-for-europe/story-e6frflo9-1227063772773

Irvinecommuter said:Whatever...trying to refinance, need more people to buy US Treasuries

Or maybe just more QE.

http://www.marketwatch.com/story/feds-williams-says-qe-could-be-needed-if-economy-slides-2014-10-14

irvinehomeowner

Well-known member

@eyephone:

Deflation is not a Depression.

It's been shown that the Gub will pull out all the stops to prevent a downward spiral.

Regardless... I don't think we'll ever get to 1929 unless something catastrophic happens... like Zs, WWIII, a big flood or asteroids.

Deflation is not a Depression.

It's been shown that the Gub will pull out all the stops to prevent a downward spiral.

Regardless... I don't think we'll ever get to 1929 unless something catastrophic happens... like Zs, WWIII, a big flood or asteroids.

irvinehomeowner said:@eyephone:

Deflation is not a Depression.

It's been shown that the Gub will pull out all the stops to prevent a downward spiral.

Regardless... I don't think we'll ever get to 1929 unless something catastrophic happens... like Zs, WWIII, a big flood or asteroids.

"Japan has languished in a deflationary cycle pretty much since the late 1990s, its once-booming economy reduced to ?lost decades? of stagnation. The country now lays claim to the world?s highest debt ? over 1 quadrillion yen ($9 trillion) ? more than twice the size of its total economic output.

Europe is now teetering on the edge.

Seventy-four per cent of global investors expressed fears the euro zone was slipping into deflation, according to a recent Bloomberg poll.

Nobel Prize-winning economist Paul Krugman says Europe?s economy is performing worse now than in the 1930s.

It?s not just the economics that are starting to resemble those dark times, he warned, looking to the rise of a new nationalism that threatens to undermine the post-WWII order ? when Europe?s former enemies came together in what became the European Union."

http://mobile.news.com.au/finance/e...fying-for-europe/story-e6frflo9-1227063772773

irvinehomeowner

Well-known member

But this is 'Merica.

eyephone said:@Inc - previously you said, "deflation might not be a bad thing." I think it's the opposite.

Agree with you that deflation is bad for the overall economy.

The article I posted just provides a different view to look at things. If you can maintain same level of income while everything else become cheaper, than its kind of like getting a raise and it's a chance to get ahead. Your hard earn dollar can go farther and you can keep more of it.

If one can just maintain same level of income during the deflation period, everything will be just fine.

irvinehomeowner said:No apocalypse is complete without the zeds.momopi said:Refugees drinking unfiltered water from the Los Angels and San Gabriel rivers & park lakes fall ill to dysentery die and return as zombies.

Pentagon document lays out zombie battle plan

"From responses to natural disasters to a catastrophic attack on the homeland, the U.S. military has a plan of action ready to go if either incident occurs.

It has also devised an elaborate plan should a zombie apocalypse befall the country, according to a Defense Department document obtained by CNN.

In an unclassified document titled "CONOP 8888," officials from U.S. Strategic Command used the specter of a planet-wide attack by the walking dead as a training template for how to plan for real-life, large-scale operations, emergencies and catastrophes"

Source:http://www.cnn.com/2014/05/16/politics/pentagon-zombie-apocalypse/

Liar Loan

Well-known member

Remind me again... What happened to Irvine home prices in 1991?

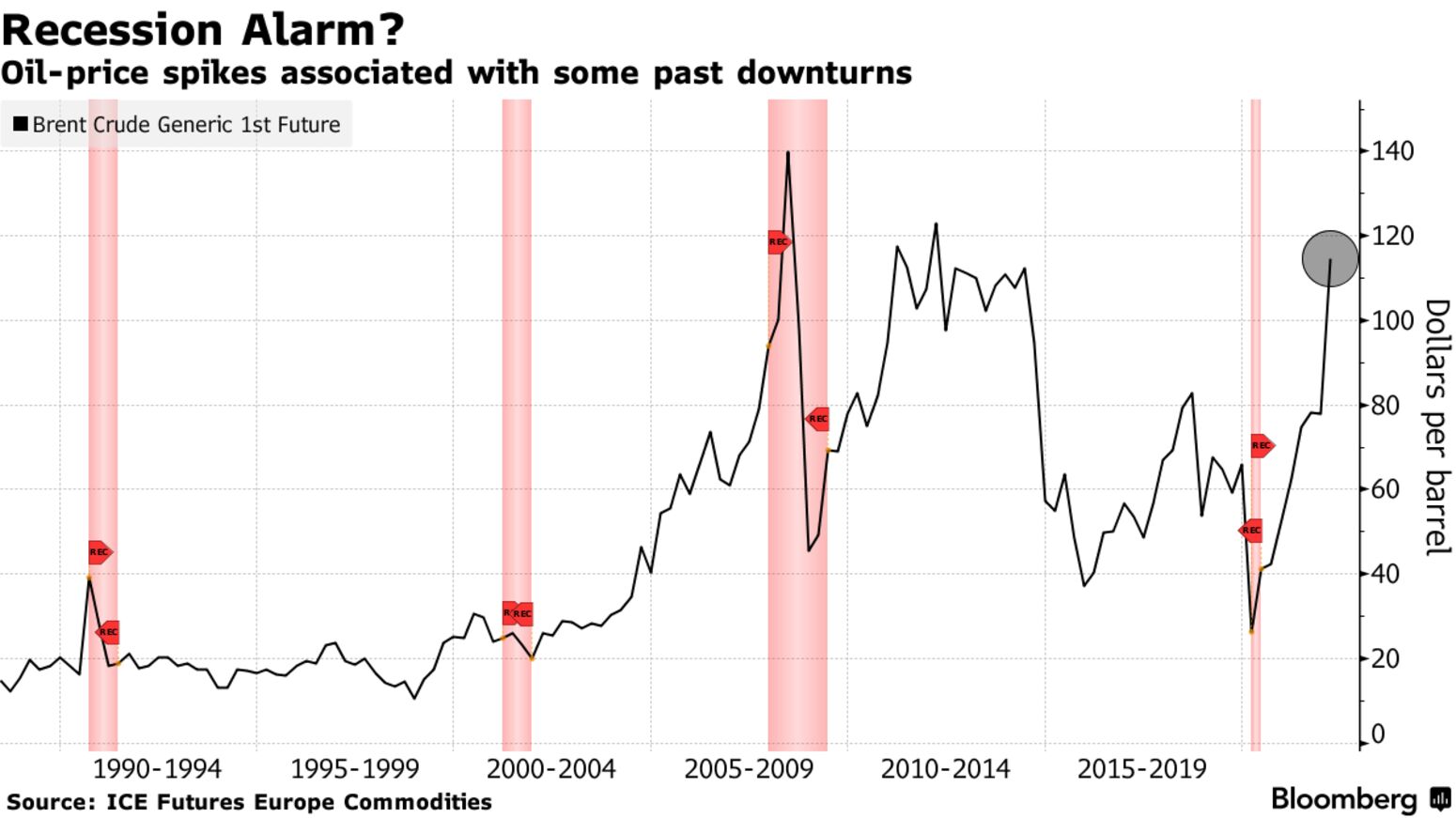

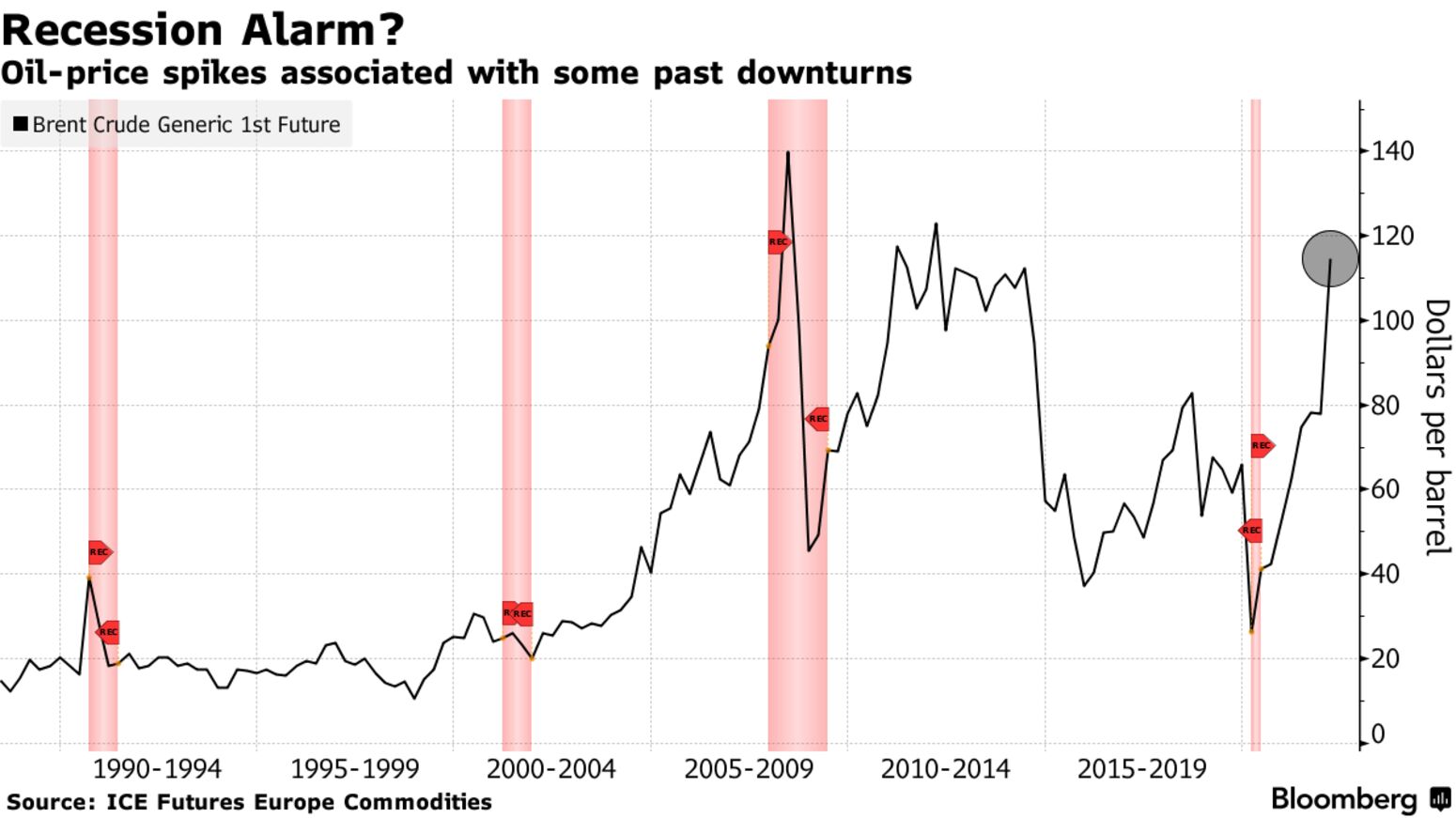

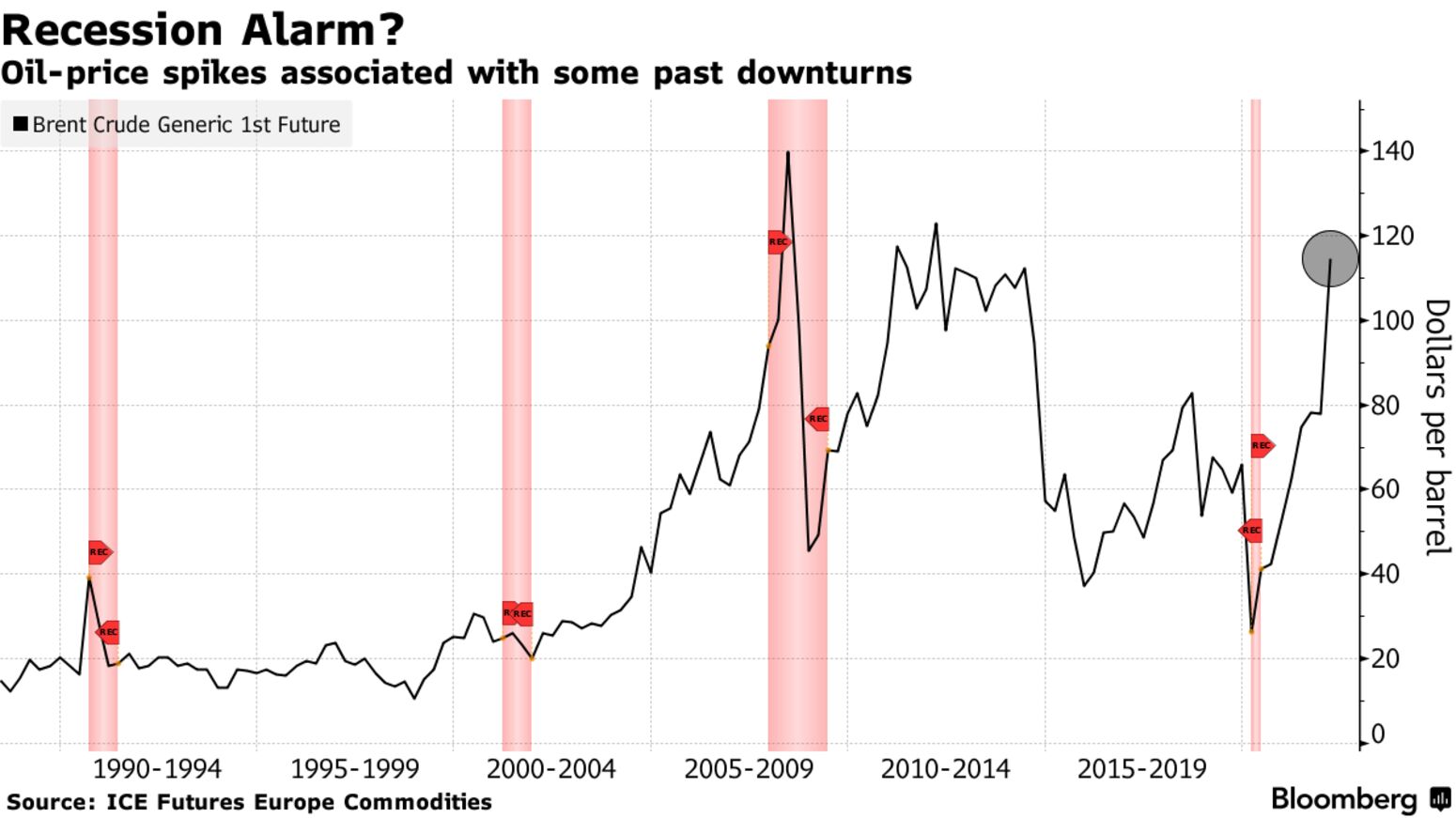

Dallas Fed: Recession Is Unavoidable Without Russian Oil

The global economy likely won?t be able to avoid a recession without a resumption of Russian energy exports this year, according to a study by Federal Reserve Bank of Dallas economists.

?If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,? economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. ?This slowdown could be more protracted than that in 1991.?

The authors drew a parallel to the 1991 global recession, set off by Iraq?s invasion of Kuwait in the year prior that caused an oil-supply shock.

https://www.bloomberg.com/news/arti...ble-without-russian-oil-dallas-fed-study-says

Dallas Fed: Recession Is Unavoidable Without Russian Oil

The global economy likely won?t be able to avoid a recession without a resumption of Russian energy exports this year, according to a study by Federal Reserve Bank of Dallas economists.

?If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,? economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. ?This slowdown could be more protracted than that in 1991.?

The authors drew a parallel to the 1991 global recession, set off by Iraq?s invasion of Kuwait in the year prior that caused an oil-supply shock.

https://www.bloomberg.com/news/arti...ble-without-russian-oil-dallas-fed-study-says

usctrojancpa

Well-known member

Liar Loan said:Remind me again... What happened to Irvine home prices in 1991?

Dallas Fed: Recession Is Unavoidable Without Russian Oil

The global economy likely won?t be able to avoid a recession without a resumption of Russian energy exports this year, according to a study by Federal Reserve Bank of Dallas economists.

?If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,? economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. ?This slowdown could be more protracted than that in 1991.?

The authors drew a parallel to the 1991 global recession, set off by Iraq?s invasion of Kuwait in the year prior that caused an oil-supply shock.

https://www.bloomberg.com/news/arti...ble-without-russian-oil-dallas-fed-study-says

Different world, but I'll say this...if Irvine goes down in price then all other cities around it will see bigger price declines just like we saw back in 2008-2010.