You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying as investment

- Thread starter arr164

- Start date

NEW -> Contingent Buyer Assistance Program

Where, oh where, is @usctrojancpa these days? He hasn't shown his face in these parts lately.

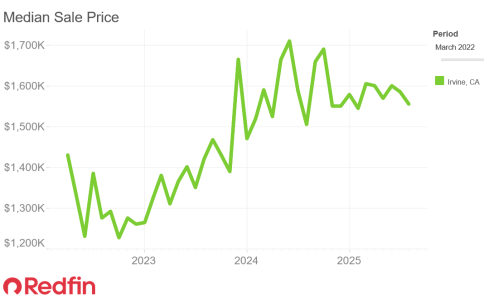

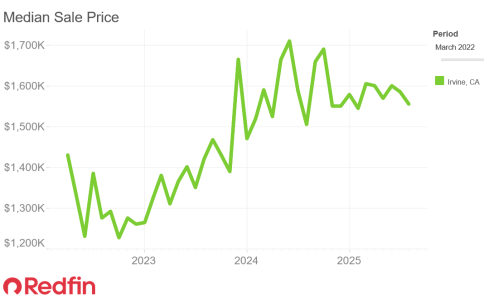

The pandemic peak for Irvine was in April 2022 and the median at that time was $1.43M. Fast forward to today, and the August 2025 median for Irvine is $1.56M (and dropping).

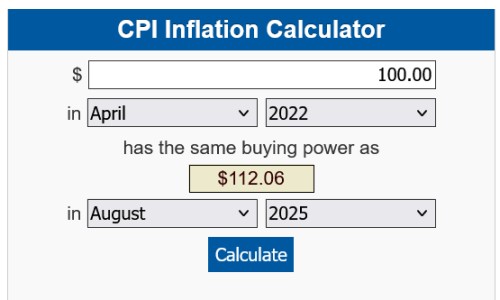

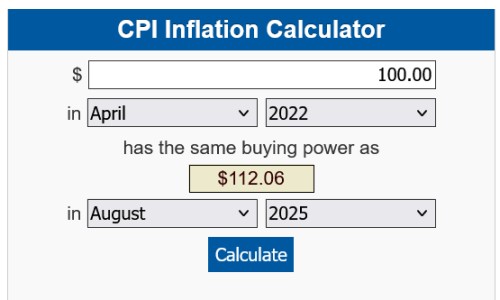

Doing the math, the nominal price increase for Irvine has been 9% over that time. Unfortunately, CPI inflation has been 12% over the same time. (Many people believe CPI understates inflation because of how it calculates things like housing and electronics.)

What this means is Irvine has not exceeded the rate of inflation over the past 2+ years. In fact, Irvine buyers have lost 3% in real terms since @usctrojancpa bought his place. So far, his prediction that Irvine would beat inflation and thus, be a good long term investment, has not proven true.

Since the title of this thread is "Buying as Investment", how would Irvine have compared to another mainstream investment? Well, the S&P 500 gained 63% from April 2022 to August 2025.

Since the cost of renting in Irvine is about half the cost of owning, clearly the best investment would have been to rent and place all the money saved (down payment + monthly housing cost savings) into the stock market these past 2+ years.

This is what I was trying to convince @CalBears96 and @usctrojancpa of when I told them starting in late 2021 that buying would be a major mistake.

They've both come out ahead nominally, but Irvine home prices are anemic at best, and that monthly housing alligator is eating up their wealth little by little. Better timing would have led to fantastic stock market gains, followed by a stronger entry point in the housing market.

Life happens and my father got sick earlier this year so my focus was on helping him get better since I'm the only child and he lives alone in Las Vegas. Now that he's doing well I'm getting back into the swing of things. I'll provide an update on the Irvine market through September later on this month.

Fortunately he's all better now and my full focus can get back onto real estate.

Liar Loan

Well-known member

Over the longer term Irvine will appreciate at a rate that will outpace the inflation rate.

Where, oh where, is @usctrojancpa these days? He hasn't shown his face in these parts lately.

The pandemic peak for Irvine was in April 2022 and the median at that time was $1.43M. Fast forward to today, and the August 2025 median for Irvine is $1.56M (and dropping).

Doing the math, the nominal price increase for Irvine has been 9% over that time. Unfortunately, CPI inflation has been 12% over the same time. (Many people believe CPI understates inflation because of how it calculates things like housing and electronics.)

What this means is Irvine has not exceeded the rate of inflation over the past 2+ years. In fact, Irvine buyers have lost 3% in real terms since @usctrojancpa bought his place. So far, his prediction that Irvine would beat inflation and thus, be a good long term investment, has not proven true.

Since the title of this thread is "Buying as Investment", how would Irvine have compared to another mainstream investment? Well, the S&P 500 gained 63% from April 2022 to August 2025.

Since the cost of renting in Irvine is about half the cost of owning, clearly the best investment would have been to rent and place all the money saved (down payment + monthly housing cost savings) into the stock market these past 2+ years.

This is what I was trying to convince @CalBears96 and @usctrojancpa of when I told them starting in late 2021 that buying would be a major mistake.

They've both come out ahead nominally, but Irvine home prices are anemic at best, and that monthly housing alligator is eating up their wealth little by little. Better timing would have led to fantastic stock market gains, followed by a stronger entry point in the housing market.

Last edited:

GrowthStateofMind

Active member

Look at stock market now! All-time high after all-time high since February of this year. Many deep discounts were had in 2022, especially on Mag7 stocks. Most of them are now baggers or even multibaggers ever since.In the pits of 2022 when stocks were at its lowest, I wish I had sold all stock @ beginning of 2022 and bought housing.

Instead I rode the roller coaster.

usctrojancpa

Well-known member

Where, oh where, is @usctrojancpa these days? He hasn't shown his face in these parts lately.

The pandemic peak for Irvine was in April 2022 and the median at that time was $1.43M. Fast forward to today, and the August 2025 median for Irvine is $1.56M (and dropping).

View attachment 10628

Doing the math, the nominal price increase for Irvine has been 9% over that time. Unfortunately, CPI inflation has been 12% over the same time. (Many people believe CPI understates inflation because of how it calculates things like housing and electronics.)

View attachment 10627

What this means is Irvine has not exceeded the rate of inflation over the past 2+ years. In fact, Irvine buyers have lost 3% in real terms since @usctrojancpa bought his place. So far, his prediction that Irvine would beat inflation and thus, be a good long term investment, has not proven true.

Since the title of this thread is "Buying as Investment", how would Irvine have compared to another mainstream investment? Well, the S&P 500 gained 63% from April 2022 to August 2025.

View attachment 10631

Since the cost of renting in Irvine is about half the cost of owning, clearly the best investment would have been to rent and place all the money saved (down payment + monthly housing cost savings) into the stock market these past 2+ years.

This is what I was trying to convince @CalBears96 and @usctrojancpa of when I told them starting in late 2021 that buying would be a major mistake.

They've both come out ahead nominally, but Irvine home prices are anemic at best, and that monthly housing alligator is eating up their wealth little by little. Better timing would have led to fantastic stock market gains, followed by a stronger entry point in the housing market.

Life happens and my father got sick earlier this year so my focus was on helping him get better since I'm the only child and he lives alone in Las Vegas. Now that he's doing well I'm getting back into the swing of things. I'll provide an update on the Irvine market through September later on this month.

OCLuvr

Active member

Hope he feels better soonLife happens and my father got sick earlier this year so my focus was on helping him get better since I'm the only child and he lives alone in Las Vegas. Now that he's doing well I'm getting back into the swing of things. I'll provide an update on the Irvine market through September later on this month.

usctrojancpa

Well-known member

Hope he feels better soon

Fortunately he's all better now and my full focus can get back onto real estate.

Liar Loan

Well-known member

I'm sorry to hear that, but glad to hear that he is doing better. I went through something similar a year ago and it was all consuming.Life happens and my father got sick earlier this year so my focus was on helping him get better since I'm the only child and he lives alone in Las Vegas. Now that he's doing well I'm getting back into the swing of things. I'll provide an update on the Irvine market through September later on this month.

Liar Loan

Well-known member

The financial media is catching on.

Home prices nationally rose 1.5% in August compared with the same month last year, down from the 1.6% annual gain recorded in July, according to the S&P Cotality Case-Shiller U.S. National Home Price NSA Index.

While home prices aren’t yet falling, they’re weakening — rising at a slower pace than the current 3% rate of inflation. That means that housing wealth eroded in real terms for the fourth consecutive month, according to the index.

Home prices lag inflation, meaning homeowners are losing out on their investment

Home prices nationally rose 1.5% in August compared with the same month last year, down from the 1.6% annual gain recorded in July, according to the S&P Cotality Case-Shiller U.S. National Home Price NSA Index.

While home prices aren’t yet falling, they’re weakening — rising at a slower pace than the current 3% rate of inflation. That means that housing wealth eroded in real terms for the fourth consecutive month, according to the index.