You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Arizona Real Estate (Bubble)

- Thread starter Liar Loan

- Start date

NEW -> Contingent Buyer Assistance Program

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

Most stocks don't lose 90-95% of their value. The chart on AMD also looks horrific. You should at least wait until it shows some price stability, which could be a long time. Right now, it looks like a falling knife.

I fundamentally disagree with this statement.

This article purposely picked the year 2000 as the starting point to make their point. If they used 1990 as their starting point, the results would have been very different.

Here's why

Year - Average Annual Return

1989 - 1999: 15.9%

2000 - 2011: -0.95%

2011 - 2021: 11.5%

I also fundamentally disagree with your statement that time in market > timing the market.

We just have different investing philosophy.

Everyone has different level of risk tolerance. There's really no right or wrong, so no need to insult any TI lurkers

It's impossible for me to time the market right every single turn, but I still believe active investors should try to recognize market cycles.

Good to know! The city I'm going to is in white. What does that mean?

You are damn right that residential real estate has way too many non economic factors. Heck, take me for example....I'm looking for a single story 3-car wide garage view lot home with a pool south of the 405 or somewhat of a unicorn. You know how many homes I've made offers on in the 18 months? 3 because nothing else was of interest to me. I can wait for the market to dip but what happens when there's nothing that I like to buy? Am I supposed to buy something that I don't really want or settle? I don't think so.

Another great piece of advise from the sage Martin. Right before the craziness exploded my kid/spouse were looking to buy a starter home. They were actually looking for a home to live in and raise a family. We visited a lot of homes and almost all were pieces of shit and/or had structural defects. Many required repairs, hell most people didn't even bother doing a cursory cleaning of their properties. Their attitude was f*ck it, any piece of shit I put out there will receive multiple offers over list.

Whatever happened to "Location, location, location?" Properties that backed up to god knows what were selling like hotcakes. Think everyone who had a house they considered to be their "problem" or had major issues hit the jackpot - they could now unload their problems and make a $$$ killing at the same time. One of the last homes we saw was in the process of remodeling their kitchen... ahh kitchen remodels are noted for cost and time overruns and potential major plumbing/electrical issues. Don't even contemplate buying until after the remodel is complete and signed-off. The listing didn't show any interior shots but had a nifty artist rendering of the proposed kitchen. From a quick drive by, we noted termite and wood rot at the roof - god knows what else a licensed inspector would find if even allowed. The home sold for $200K over asking.

The kids gave up on their home search. WTF were people thinking?? FOMO>>>common sense. I'm so proud the kids didn't settle - sure they missed their chance to buy but how many people who bought homes in the past year will later regret their decisions and realize that just maybe they didn't really win the jackpot when the seller accepted their offer, that they got stuck with a problem house (and years of headaches) and are going to have a bitch of time unloading it during a "normal" market and no chance in hell in a buyer's market. Crazy markets like today's don't last forever - I'm seeing signs, but I can't predict the future - just like NOBODY else in this forum.

PS A great statement popularized by Mark Twain (Thomas MacKay probably started it) - there are three types of lies - Lies, damned lies, and statistics. We may have to update to include a fourth; Liar Loan's real estate analysis.

I agree 100%.

When my wife suddenly came up with the idea of buying in OC, we agreed that we would only buy if we saw something that we loved. When we first talked about it, we only wanted to consider something in the $800k-$1M range because we didn't want extra burden, even if the house, or most likely condo, was smaller. One criteria that my wife has. It has to be new. She would buy someone else's old home.

So we searched online. We looked at some floorplans at Serrano Summit. They weren't bad. We made an appointment to tour Soria. These are a little bit above the budge we set ($1.1M-$1.2M). We actually really like Soria 2, 3, and 4. The location wasn't ideal for us, though, since we wanted a nice quiet neighborhood and this is in the middle of a commercial area. But it was good enough that we decided we would buy.

The week after, we toured Bluffs, and that pretty much settled it. She loved PS and also Bluffs floorplan. Funny thing is we liked Bluffs 1 more than Bluffs 2 in the beginning. Perhaps because it was cheaper. We checked out Highland the week after. Although we liked Bluffs's floorplan more than Highland, but I still would have taken Highland because of the driveway.

In the end, we decided that we wanted the loft, so we chose Bluffs 2 over Bluffs 1. Bluffs offered us a buying opportunity before Highland, so we took it. We would have got Highland if we waited a week, but the bigger backyard of Bluffs 2 trumps the driveway of Highland 1, so we decided not to wait for Highland.

TL;DR version. We could wait for the price to dip, but by then PS has probably been built out. The only place left is GP, and we sure as hell are not going to buy there because of the MR and non-ideal location for us.

sleepy5136

Well-known member

Unless you?re telling me the internet is no longer going to exist, you will always have a high demand of chips. Companies are going to cloud and even if they are not, they have their own data centers. That all require chips. I?m sure during a recession that people will still go on the internet.

irvinehomeowner

Well-known member

LL predicting pain in chips?

Now it all makes sense.

Now it all makes sense.

Liar Loan

Well-known member

irvinehomeowner said:LL predicting pain in chips?

Now it all makes sense.

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

momopi said:Inland areas of California are subject to huge swings as well. Riverside County, Palm Springs, etc.

I've seen small SFR's in Riverside County area appreciate >400% from 2012-2022. I suspect it will crash hard in down cycle.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

sleepy5136

Well-known member

what stock doesn?t go down significantly during a recession?Liar Loan said:irvinehomeowner said:LL predicting pain in chips?

Now it all makes sense.

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

momopi said:Inland areas of California are subject to huge swings as well. Riverside County, Palm Springs, etc.

I've seen small SFR's in Riverside County area appreciate >400% from 2012-2022. I suspect it will crash hard in down cycle.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

Liar Loan

Well-known member

sleepy5136 said:what stock doesn?t go down significantly during a recession?Liar Loan said:irvinehomeowner said:LL predicting pain in chips?

Now it all makes sense.

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

momopi said:Inland areas of California are subject to huge swings as well. Riverside County, Palm Springs, etc.

I've seen small SFR's in Riverside County area appreciate >400% from 2012-2022. I suspect it will crash hard in down cycle.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

Most stocks don't lose 90-95% of their value. The chart on AMD also looks horrific. You should at least wait until it shows some price stability, which could be a long time. Right now, it looks like a falling knife.

irvinehomeowner

Well-known member

I don't think AMD is representative of the microchip market.

How have the other vendors done? Like Intel, etc.

How have the other vendors done? Like Intel, etc.

sleepy5136

Well-known member

time in market > timing the marketLiar Loan said:sleepy5136 said:what stock doesn?t go down significantly during a recession?Liar Loan said:irvinehomeowner said:LL predicting pain in chips?

Now it all makes sense.

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

momopi said:Inland areas of California are subject to huge swings as well. Riverside County, Palm Springs, etc.

I've seen small SFR's in Riverside County area appreciate >400% from 2012-2022. I suspect it will crash hard in down cycle.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

Most stocks don't lose 90-95% of their value. The chart on AMD also looks horrific. You should at least wait until it shows some price stability, which could be a long time. Right now, it looks like a falling knife.

Liar Loan

Well-known member

sleepy5136 said:time in market > timing the marketLiar Loan said:sleepy5136 said:what stock doesn?t go down significantly during a recession?Liar Loan said:irvinehomeowner said:LL predicting pain in chips?

Now it all makes sense.

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

momopi said:Inland areas of California are subject to huge swings as well. Riverside County, Palm Springs, etc.

I've seen small SFR's in Riverside County area appreciate >400% from 2012-2022. I suspect it will crash hard in down cycle.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

Most stocks don't lose 90-95% of their value. The chart on AMD also looks horrific. You should at least wait until it shows some price stability, which could be a long time. Right now, it looks like a falling knife.

I fundamentally disagree with this statement.

sleepy5136

Well-known member

Agree to disagree. Feel free to read this article and let me know how 'Peter Perfect' in the article fairs compared to 'Ashley Action'.https://www.schwab.com/resource-center/insights/content/does-market-timing-workLiar Loan said:sleepy5136 said:time in market > timing the marketLiar Loan said:sleepy5136 said:what stock doesn?t go down significantly during a recession?Liar Loan said:irvinehomeowner said:LL predicting pain in chips?

Now it all makes sense.

Not me. The stock market. AMD has a history of losing 90-95% of it's value during recessions.

momopi said:Inland areas of California are subject to huge swings as well. Riverside County, Palm Springs, etc.

I've seen small SFR's in Riverside County area appreciate >400% from 2012-2022. I suspect it will crash hard in down cycle.

I completely agree. This is why I sold my inland multi-families.

You can get rich quick during the upcycles - my properties more than doubled in price in five years while throwing off tons of cashflow - but you can also get absolutely destroyed during downturns.

Most stocks don't lose 90-95% of their value. The chart on AMD also looks horrific. You should at least wait until it shows some price stability, which could be a long time. Right now, it looks like a falling knife.

I fundamentally disagree with this statement.

irvinehomeowner

Well-known member

Or worse... Larry Linger which happens to many people.

Fundamentals are great for attempting to forecast... but housing has too many non-fundamental factors... especially in micro markets... so over the long haul, as the article says:

I forgot if it was Happy Days or Joanie Loves Chachi but someone said "One day, you will be bigger than the pain.".

Fundamentals are great for attempting to forecast... but housing has too many non-fundamental factors... especially in micro markets... so over the long haul, as the article says:

Long term, it?s almost always better to invest in stocks?even at the worst time each year?than not to invest at all.

I forgot if it was Happy Days or Joanie Loves Chachi but someone said "One day, you will be bigger than the pain.".

sleepy5136 said:Agree to disagree. Feel free to read this article and let me know how 'Peter Perfect' in the article fairs compared to 'Ashley Action'.https://www.schwab.com/resource-center/insights/content/does-market-timing-work

This article purposely picked the year 2000 as the starting point to make their point. If they used 1990 as their starting point, the results would have been very different.

Here's why

Year - Average Annual Return

1989 - 1999: 15.9%

2000 - 2011: -0.95%

2011 - 2021: 11.5%

I also fundamentally disagree with your statement that time in market > timing the market.

sleepy5136

Well-known member

The article is based on a 20 period timeline. Also, you do know its impossible to time the market right? I hope you don't feel that it's possible. So based off of that understanding, are you really going to tell me you would not have invested from 2000-2011? Or even worse, you are going to tell me you would have intelligently timed your stock purchases at the bottom of every major correction/dip and intelligently sell at the absolute top to get max ROI? If so, you are a genius and I would be shocked as to why you're lurking here.Kenkoko said:sleepy5136 said:Agree to disagree. Feel free to read this article and let me know how 'Peter Perfect' in the article fairs compared to 'Ashley Action'.https://www.schwab.com/resource-center/insights/content/does-market-timing-work

This article purposely picked the year 2000 as the starting point to make their point. If they used 1990 as their starting point, the results would have been very different.

Here's why

Year - Average Annual Return

1989 - 1999: 15.9%

2000 - 2011: -0.95%

2011 - 2021: 11.5%

I also fundamentally disagree with your statement that time in market > timing the market.

sleepy5136 said:The article is based on a 20 period timeline. Also, you do know its impossible to time the market right? I hope you don't feel that it's possible. So based off of that understanding, are you really going to tell me you would not have invested from 2000-2011? Or even worse, you are going to tell me you would have intelligently timed your stock purchases at the bottom of every major correction/dip and intelligently sell at the absolute top to get max ROI? If so, you are a genius and I would be shocked as to why you're lurking here.Kenkoko said:sleepy5136 said:Agree to disagree. Feel free to read this article and let me know how 'Peter Perfect' in the article fairs compared to 'Ashley Action'.https://www.schwab.com/resource-center/insights/content/does-market-timing-work

This article purposely picked the year 2000 as the starting point to make their point. If they used 1990 as their starting point, the results would have been very different.

Here's why

Year - Average Annual Return

1989 - 1999: 15.9%

2000 - 2011: -0.95%

2011 - 2021: 11.5%

I also fundamentally disagree with your statement that time in market > timing the market.

We just have different investing philosophy.

Everyone has different level of risk tolerance. There's really no right or wrong, so no need to insult any TI lurkers

It's impossible for me to time the market right every single turn, but I still believe active investors should try to recognize market cycles.

Ready2Downsize

Well-known member

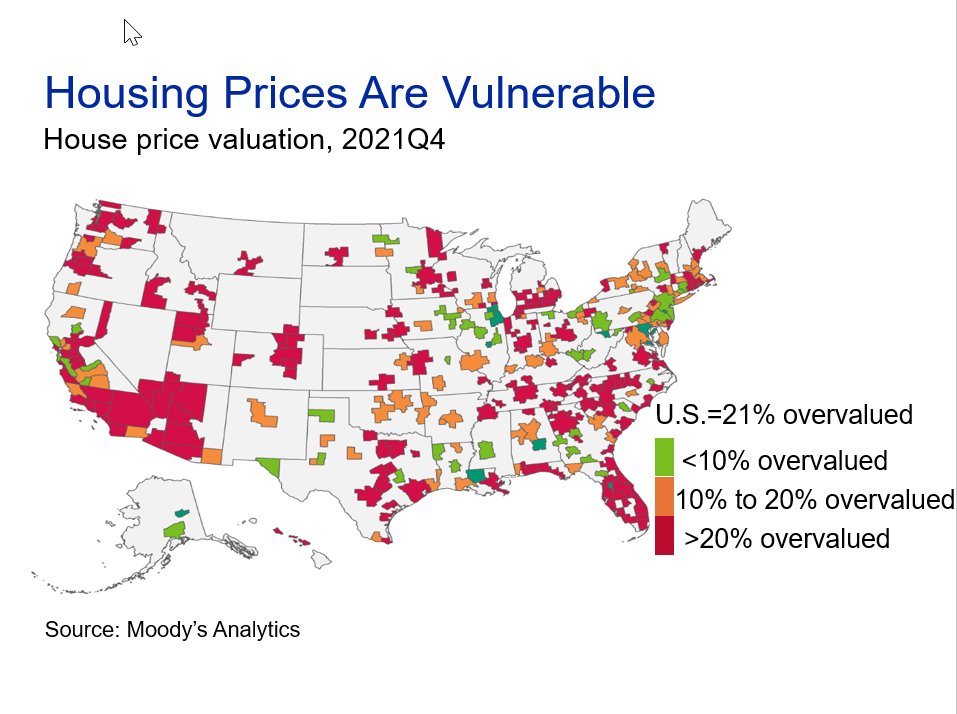

Liar Loan said:I'm seeing a lot of red in Arizona (not to mention SoCal).

Good to know! The city I'm going to is in white. What does that mean?

irvinebullhousing

Well-known member

That come to mind, pick Nevada for example. Completely white almost. Does that mean NV is now a good place that is not overvalue base on this map? I think this picture is not telling us anything that is substance.

For me if it is overvalue and to continue to have people buy and over bid for it is a telling that there must be abundant of good and services come to those area or sectors.

For me if it is overvalue and to continue to have people buy and over bid for it is a telling that there must be abundant of good and services come to those area or sectors.

usctrojancpa

Well-known member

irvinehomeowner said:Or worse... Larry Linger which happens to many people.

Fundamentals are great for attempting to forecast... but housing has too many non-fundamental factors... especially in micro markets... so over the long haul, as the article says:

Long term, it?s almost always better to invest in stocks?even at the worst time each year?than not to invest at all.

I forgot if it was Happy Days or Joanie Loves Chachi but someone said "One day, you will be bigger than the pain.".

You are damn right that residential real estate has way too many non economic factors. Heck, take me for example....I'm looking for a single story 3-car wide garage view lot home with a pool south of the 405 or somewhat of a unicorn. You know how many homes I've made offers on in the 18 months? 3 because nothing else was of interest to me. I can wait for the market to dip but what happens when there's nothing that I like to buy? Am I supposed to buy something that I don't really want or settle? I don't think so.

USCTrojanCPA said:You are damn right that residential real estate has way too many non economic factors. Heck, take me for example....I'm looking for a single story 3-car wide garage view lot home with a pool south of the 405 or somewhat of a unicorn. You know how many homes I've made offers on in the 18 months? 3 because nothing else was of interest to me. I can wait for the market to dip but what happens when there's nothing that I like to buy? Am I supposed to buy something that I don't really want or settle? I don't think so.

Another great piece of advise from the sage Martin. Right before the craziness exploded my kid/spouse were looking to buy a starter home. They were actually looking for a home to live in and raise a family. We visited a lot of homes and almost all were pieces of shit and/or had structural defects. Many required repairs, hell most people didn't even bother doing a cursory cleaning of their properties. Their attitude was f*ck it, any piece of shit I put out there will receive multiple offers over list.

Whatever happened to "Location, location, location?" Properties that backed up to god knows what were selling like hotcakes. Think everyone who had a house they considered to be their "problem" or had major issues hit the jackpot - they could now unload their problems and make a $$$ killing at the same time. One of the last homes we saw was in the process of remodeling their kitchen... ahh kitchen remodels are noted for cost and time overruns and potential major plumbing/electrical issues. Don't even contemplate buying until after the remodel is complete and signed-off. The listing didn't show any interior shots but had a nifty artist rendering of the proposed kitchen. From a quick drive by, we noted termite and wood rot at the roof - god knows what else a licensed inspector would find if even allowed. The home sold for $200K over asking.

The kids gave up on their home search. WTF were people thinking?? FOMO>>>common sense. I'm so proud the kids didn't settle - sure they missed their chance to buy but how many people who bought homes in the past year will later regret their decisions and realize that just maybe they didn't really win the jackpot when the seller accepted their offer, that they got stuck with a problem house (and years of headaches) and are going to have a bitch of time unloading it during a "normal" market and no chance in hell in a buyer's market. Crazy markets like today's don't last forever - I'm seeing signs, but I can't predict the future - just like NOBODY else in this forum.

PS A great statement popularized by Mark Twain (Thomas MacKay probably started it) - there are three types of lies - Lies, damned lies, and statistics. We may have to update to include a fourth; Liar Loan's real estate analysis.

CalBears96

Well-known member

USCTrojanCPA said:irvinehomeowner said:Or worse... Larry Linger which happens to many people.

Fundamentals are great for attempting to forecast... but housing has too many non-fundamental factors... especially in micro markets... so over the long haul, as the article says:

Long term, it?s almost always better to invest in stocks?even at the worst time each year?than not to invest at all.

I forgot if it was Happy Days or Joanie Loves Chachi but someone said "One day, you will be bigger than the pain.".

You are damn right that residential real estate has way too many non economic factors. Heck, take me for example....I'm looking for a single story 3-car wide garage view lot home with a pool south of the 405 or somewhat of a unicorn. You know how many homes I've made offers on in the 18 months? 3 because nothing else was of interest to me. I can wait for the market to dip but what happens when there's nothing that I like to buy? Am I supposed to buy something that I don't really want or settle? I don't think so.

I agree 100%.

When my wife suddenly came up with the idea of buying in OC, we agreed that we would only buy if we saw something that we loved. When we first talked about it, we only wanted to consider something in the $800k-$1M range because we didn't want extra burden, even if the house, or most likely condo, was smaller. One criteria that my wife has. It has to be new. She would buy someone else's old home.

So we searched online. We looked at some floorplans at Serrano Summit. They weren't bad. We made an appointment to tour Soria. These are a little bit above the budge we set ($1.1M-$1.2M). We actually really like Soria 2, 3, and 4. The location wasn't ideal for us, though, since we wanted a nice quiet neighborhood and this is in the middle of a commercial area. But it was good enough that we decided we would buy.

The week after, we toured Bluffs, and that pretty much settled it. She loved PS and also Bluffs floorplan. Funny thing is we liked Bluffs 1 more than Bluffs 2 in the beginning. Perhaps because it was cheaper. We checked out Highland the week after. Although we liked Bluffs's floorplan more than Highland, but I still would have taken Highland because of the driveway.

In the end, we decided that we wanted the loft, so we chose Bluffs 2 over Bluffs 1. Bluffs offered us a buying opportunity before Highland, so we took it. We would have got Highland if we waited a week, but the bigger backyard of Bluffs 2 trumps the driveway of Highland 1, so we decided not to wait for Highland.

TL;DR version. We could wait for the price to dip, but by then PS has probably been built out. The only place left is GP, and we sure as hell are not going to buy there because of the MR and non-ideal location for us.