You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How high will mortgage rates climb in the next 36 months?

- Thread starter OCtoSV

- Start date

NEW -> Contingent Buyer Assistance Program

Your larger point is also pretty weak because raw population numbers don't say anything about the number of people shopping for homes.

The median price in OC is $1.2M and that really just gets you a basic 1,200-1,400 sq ft home. With a 20% down payment, the PITIA is still between $7,500-$8,000.

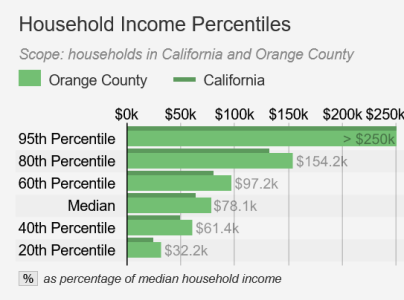

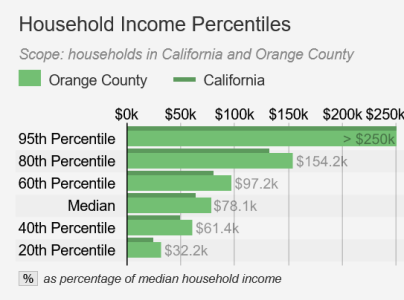

So you need a household income of at least $250k to buy this humble home. A $250k income puts you in the 95th percentile which means only the top 5% of households in OC can afford the median-priced small home.

If each household has 3 people that means just over 1M households, and if only 5% of households can afford to buy.... that only leaves 52,000 potential buyers for the median-priced home.

If no more than 4-5% of these people are searching for homes, then there is plenty of inventory at today's prices. If job losses lead to a spike in inventory, or higher prices/rates lead to less qualified buyers, then there will be a situation where we have too much inventory and sellers will either need to lower prices or pull their homes from the market.

Of course there will always be more people than homes available for sale. That is why I keep telling people to focus on how much inventory is on the market in terms of # of months of inventory. With the level of homes available for sale in Orange County today and given that there were about 1,800 sold in the past month, that means there is 1.5 months worth of homes on the market which equates to a strong sellers market. We need to get to 3+ months worth of homes in order for prices to flatten out.

Yet over 50% of homes in Irvine today are purchased for all cash. Your bar chart means very little today unfortunately. Also, not all financed buyers are only putting 20% down.

Does Kumon help with chart reading?

They ARE driving the market in Irvine today. When you see non-view, non-large lot homes closing for over $1,000/sf they are mostly purchased by cash buyers.

With both companies "loudly" setting up LO training programs for FHA/VA lending mastery, as well as advertising for FHA and VA focused loan officers. I have to ask "Why?"

But what does this all mean for buyers who are planning to use one of these loan types in the near future? That it will be easier to get these loan offers accepted because the companies are going to provide educational outreach on how "strong" these products are? Or what?

irvinehomeowner

Well-known member

Yeah... no inventory problems here.

Liar Loan

Well-known member

No, that was Danimal math there. Kumon could help with that.Sorry i used LL math. It should be 1.1k instead of 1.1 m

1 house for 1,000 people whether they can afford at high interest rate is super tight on the supply side.

Your larger point is also pretty weak because raw population numbers don't say anything about the number of people shopping for homes.

The median price in OC is $1.2M and that really just gets you a basic 1,200-1,400 sq ft home. With a 20% down payment, the PITIA is still between $7,500-$8,000.

So you need a household income of at least $250k to buy this humble home. A $250k income puts you in the 95th percentile which means only the top 5% of households in OC can afford the median-priced small home.

If each household has 3 people that means just over 1M households, and if only 5% of households can afford to buy.... that only leaves 52,000 potential buyers for the median-priced home.

If no more than 4-5% of these people are searching for homes, then there is plenty of inventory at today's prices. If job losses lead to a spike in inventory, or higher prices/rates lead to less qualified buyers, then there will be a situation where we have too much inventory and sellers will either need to lower prices or pull their homes from the market.

Last edited:

sleepy5136

Well-known member

you're right but that wasn't my point. point is there will always be more people than homes. even with the 2008 recession, inventory nationwide rose to 3m? It's now 1m I think? So using number of individuals in an area to show if there exists demand or not is not a good representation of market demand.Considering you have less than 3,000 homes even if 1/2% of those people are buyers in the market there's still more buyers than homes available.

usctrojancpa

Well-known member

you're right but that wasn't my point. point is there will always be more people than homes. even with the 2008 recession, inventory nationwide rose to 3m? It's now 1m I think? So using number of individuals in an area to show if there exists demand or not is not a good representation of market demand.

Of course there will always be more people than homes available for sale. That is why I keep telling people to focus on how much inventory is on the market in terms of # of months of inventory. With the level of homes available for sale in Orange County today and given that there were about 1,800 sold in the past month, that means there is 1.5 months worth of homes on the market which equates to a strong sellers market. We need to get to 3+ months worth of homes in order for prices to flatten out.

usctrojancpa

Well-known member

No, that was Danimal math there. Kumon could help with that.

Your larger point is also pretty weak because raw population numbers don't say anything about the number of people shopping for homes.

The median price in OC is $1.2M and that really just gets you a basic 1,200-1,400 sq ft home. With a 20% down payment, the PITIA is still between $7,500-$8,000.

So you need a household income of at least $250k to buy this humble home. A $250k income puts you in the 95th percentile which means only the top 5% of households in OC can afford the median-priced small home.

View attachment 9745

If each household has 3 people that means just over 1M households, and if only 5% of households can afford to buy.... that only leaves 52,000 potential buyers for the median-priced home.

If no more than 4-5% of these people are searching for homes, then there is plenty of inventory at today's prices. If job losses lead to a spike in inventory, or higher prices/rates lead to less qualified buyers, then there will be a situation where we have too much inventory and sellers will either need to lower prices or pull their homes from the market.

Yet over 50% of homes in Irvine today are purchased for all cash. Your bar chart means very little today unfortunately. Also, not all financed buyers are only putting 20% down.

Liar Loan

Well-known member

The all cash buyers are a valid thing to pay attention to, but they aren't what has driven the market historically, even for Irvine. In fact, Irvine has shown itself to be more sensitive to rates than other areas. The Irvine price declines in 2013-14, 2018-19, and 2022 all coincided with rapid spikes in interest rates. Maybe this time is different.Yet over 50% of homes in Irvine today are purchased for all cash. Your bar chart means very little today unfortunately. Also, not all financed buyers are only putting 20% down.

irvinehomeowner

Well-known member

LL correlation equals causation rule in full effect!The all cash buyers are a valid thing to pay attention to, but they aren't what has driven the market historically, even for Irvine. In fact, Irvine has shown itself to be more sensitive to rates than other areas. The Irvine price declines in 2013-14, 2018-19, and 2022 all coincided with rapid spikes in interest rates. Maybe this time is different.

Does Kumon help with chart reading?

usctrojancpa

Well-known member

The all cash buyers are a valid thing to pay attention to, but they aren't what has driven the market historically, even for Irvine. In fact, Irvine has shown itself to be more sensitive to rates than other areas. The Irvine price declines in 2013-14, 2018-19, and 2022 all coincided with rapid spikes in interest rates. Maybe this time is different.

They ARE driving the market in Irvine today. When you see non-view, non-large lot homes closing for over $1,000/sf they are mostly purchased by cash buyers.

sgip

Well-known member

Even areas outside of Irvine are dominated by cash buyers according to the Realtors I've spoken with lately. Investor buys come in second, with financed pulling up in third place.

As a note, VA and FHA loans have significant value to lenders, almost 3x the income of a conventional loan. Wells and loanDepot recently refocused some of their lending priorities on these loans.... for Borrowers who have little or no chance of seeing an offer being accepted in this present market. I take it as a sign of desperation for these (and many other) lenders.

As a note, VA and FHA loans have significant value to lenders, almost 3x the income of a conventional loan. Wells and loanDepot recently refocused some of their lending priorities on these loans.... for Borrowers who have little or no chance of seeing an offer being accepted in this present market. I take it as a sign of desperation for these (and many other) lenders.

Last edited:

What does this mean? Can you explain like I'm 5?As a note, VA and FHA loans have significant value to lenders, almost 3x the income of a conventional loan. Wells and loanDepot recently refocused some of their lending priorities on these loans.... for Borrowers who have little or no chance of seeing an offer being accepted in this present market. I take it as a sign of desperation for these (and many other) lenders.

Liar Loan

Well-known member

By 'refocus' do you mean they lowered minimum credit scores and other qualifying criteria?Even areas outside of Irvine are dominated by cash buyers according to the Realtors I've spoken with lately. Investor buys come in second, with financed pulling up in third place.

As a note, VA and FHA loans have significant value to lenders, almost 3x the income of a conventional loan. Wells and loanDepot recently refocused some of their lending priorities on these loans.... for Borrowers who have little or no chance of seeing an offer being accepted in this present market. I take it as a sign of desperation for these (and many other) lenders.

sgip

Well-known member

Government insured loans (FHA/VA) are essentially risk free to the lenders who write them. They are more valuable to investors and servicing companies who will pay a larger premium for this level of security of return. A bank might find 5k in value on a $100k conventional loan, but $15k or more in value for an FHA or VA loan.

Assume you want to sell your home, listed at $1m. You get 3 offers.

Offer 1 is $990k all cash, close in 48hrs. The buyer will give you a 30 day rent back at no cost.

Offer 2 is, $1M conventional financed 10% down, close in 15 days, appraisal and inspection are waived.

Offer 3 is $1.050, FHA or VA, 20% down close in 30 days.

The vast majority of sellers will take the path of least resistance - all cash or conventionally financed, rather than the FHA/VA.

Why? Well, let's first shoot the elephant in the room: the listing agent is probably inexperienced or just plain lazy. They think an appraisal and inspection will obviously be a problem. You'll ask for costly repairs that end up as a $20-$25k concession, lowering the sellers net. This realtor may have never closed an FHA/VA transaction before and has accepted as gospel other weak realtors whisperings about how FHA and VA deals are "costly" and "don't close." Finally, who doesn't want their cash in a hurry? Fast closes can be done in all 3 scenarios, but financed transactions still need a minimum of 1 week to close. The bottom line: All of this hoo-ha about FHA/VA loans being trouble are pure fiction. That said, a buyer should consider this fact: Perception IS reality so you will need to plan accordingly.

There are a precious few Realtors and Sellers who will take a good hard look at accepting an FHA/VA deal, but once counter offers are sent out both All Cash and Conventional buyers will often "over-sweeten" their terms beyond what an FHA/VA buyer can.

As it's been said by others "...Follow the money..." Why ramp up FHA/VA lending when LA/OC buyers have a statistically demonstrated .05% chance of having their offer accepted? It's not to show their benevolence, but as I believe, to grab cash, of which they are starving of, any way they can.

PS: Offers 1, 2, and 3 are roughly the same net to seller, give or take a very few thousands of dollars. Offer 2 and 3 may have appraisal issues, and both will still do inspections. Even though some buyers waive inspections, I've seen sellers still concede $$$ for repairs - merely "go away" money so the closing can occur. I would argue the financed offers of an owner occupied purchase are better for the neighborhood you're leaving, even if it means leaving $2-3k on the table.

Assume you want to sell your home, listed at $1m. You get 3 offers.

Offer 1 is $990k all cash, close in 48hrs. The buyer will give you a 30 day rent back at no cost.

Offer 2 is, $1M conventional financed 10% down, close in 15 days, appraisal and inspection are waived.

Offer 3 is $1.050, FHA or VA, 20% down close in 30 days.

The vast majority of sellers will take the path of least resistance - all cash or conventionally financed, rather than the FHA/VA.

Why? Well, let's first shoot the elephant in the room: the listing agent is probably inexperienced or just plain lazy. They think an appraisal and inspection will obviously be a problem. You'll ask for costly repairs that end up as a $20-$25k concession, lowering the sellers net. This realtor may have never closed an FHA/VA transaction before and has accepted as gospel other weak realtors whisperings about how FHA and VA deals are "costly" and "don't close." Finally, who doesn't want their cash in a hurry? Fast closes can be done in all 3 scenarios, but financed transactions still need a minimum of 1 week to close. The bottom line: All of this hoo-ha about FHA/VA loans being trouble are pure fiction. That said, a buyer should consider this fact: Perception IS reality so you will need to plan accordingly.

There are a precious few Realtors and Sellers who will take a good hard look at accepting an FHA/VA deal, but once counter offers are sent out both All Cash and Conventional buyers will often "over-sweeten" their terms beyond what an FHA/VA buyer can.

As it's been said by others "...Follow the money..." Why ramp up FHA/VA lending when LA/OC buyers have a statistically demonstrated .05% chance of having their offer accepted? It's not to show their benevolence, but as I believe, to grab cash, of which they are starving of, any way they can.

PS: Offers 1, 2, and 3 are roughly the same net to seller, give or take a very few thousands of dollars. Offer 2 and 3 may have appraisal issues, and both will still do inspections. Even though some buyers waive inspections, I've seen sellers still concede $$$ for repairs - merely "go away" money so the closing can occur. I would argue the financed offers of an owner occupied purchase are better for the neighborhood you're leaving, even if it means leaving $2-3k on the table.

Last edited:

sgip

Well-known member

In some ways. Wells for many years said they would fund FHA and VA loans at a 620 FICO minimum. In early 2023 that dropped to 580. (Not sure where they are today) loanDepot has always done FHA/VA loans with low FICO scores so why advertise your specialized training and concierge service for these loans?By 'refocus' do you mean they lowered minimum credit scores and other qualifying criteria?

With both companies "loudly" setting up LO training programs for FHA/VA lending mastery, as well as advertising for FHA and VA focused loan officers. I have to ask "Why?"

Last edited:

Government insured loans (FHA/VA) are essentially risk free to the lenders who write them. They are more valuable to investors and servicing companies who will pay a larger premium for this level of security of return. A bank might find 5k in value on a $100k conventional loan, but $15k or more in value for an FHA or VA loan.

Assume you want to sell your home, listed at $1m. You get 3 offers.

Offer 1 is $990k all cash, close in 48hrs. The buyer will give you a 30 day rent back at no cost.

Offer 2 is, $1M conventional financed 10% down, close in 15 days, appraisal and inspection are waived.

Offer 3 is $1.050, FHA or VA, 20% down close in 30 days.

The vast majority of sellers will take the path of least resistance - all cash or conventionally financed, rather than the FHA/VA.

Why? Well, let's first shoot the elephant in the room: the listing agent is probably a moron. They think an appraisal and inspection will come in low or ask for costly repairs, that end up being a $20-$25k concession that lowers the net to you. The realtor also has never closed an FHA/VA transaction before and has accepted other moron realtors whisperings about how FHA and VA deals are "costly" and "don't close." Finally, who doesn't want their cash in a hurry? Fast closes can be done in all 3 scenarios, but financed transactions still need a minimum of 1 week to close. The bottom line: All of this hoo-ha about FHA/VA loans being trouble are pure fiction. That said, a buyer should consider this fact: Perception IS reality so you will need to plan accordingly.

There are a precious few Realtors and Sellers who will take a good hard look at accepting an FHA/VA deal, but once counter offers are sent out both All Cash and Conventional buyers will often "over-sweeten" their terms beyond what an FHA/VA buyer can.

As it's been said by others "...Follow the money..." Why ramp up FHA/VA lending when LA/OC buyers have a statistically demonstrated .05% chance of having their offer accepted? It's not to show their benevolence, but as I believe, to grab cash, of which they are starving of, any way they can.

PS: Offers 1, 2, and 3 are roughly the same net to seller, give or take a very few thousands of dollars. Offer 2 and 3 may have appraisal issues, and both will still do inspections. Even though some buyers waive inspections, I've seen sellers still concede $$$ for repairs - merely "go away" money so the closing can occur.

But what does this all mean for buyers who are planning to use one of these loan types in the near future? That it will be easier to get these loan offers accepted because the companies are going to provide educational outreach on how "strong" these products are? Or what?

usctrojancpa

Well-known member

The sad truth is that in Irvine I can count the number of FHA and VA buyers in a month on one hand.

sgip

Well-known member

The

A fully underwritten and approved loan in hand is the second "must have". Pre-approvals or a Pre-qualified status just won't get the job done.

Perceptions can be overcome, as long as you have a seasoned fighter in your corner to begin with and a loan approval that's ready to fund quickly.

The only way forward is the quality of your Realtor. A strong, well connected Realtor through the crafting of a solid offer, one who pre-resolves stumbling blocks with the listing agent prior to your offer being submitted, can often get an FHA/VA, even a Bond Loan purchase accepted by a seller. It's all in the preparation, which few realtors know how to do.But what does this all mean for buyers who are planning to use one of these loan types in the near future? That it will be easier to get these loan offers accepted because the companies are going to provide educational outreach on how "strong" these products are? Or what?

A fully underwritten and approved loan in hand is the second "must have". Pre-approvals or a Pre-qualified status just won't get the job done.

Perceptions can be overcome, as long as you have a seasoned fighter in your corner to begin with and a loan approval that's ready to fund quickly.

Last edited:

Exactly. It sucks. New construction is pretty much the only option with these types of loans in Irvine, and new construction home prices are absolutely absurd at this point.The sad truth is that in Irvine I can count the number of FHA and VA buyers in a month on one hand.

Liar Loan

Well-known member

Ruh roh Shaggy.... higher rates lead to higher inventory.

Unsold inventory now is almost 32% higher than at this time last year — and it’s 90% higher compared to the end of April 2022. Two years ago, inventory was jumping along with mortgage rates.

The takeaway here is that inventory gains are happening pretty much everywhere but at a significantly higher rate in the Sun Belt states — from Florida to Texas and Arizona.

But there are more homes with price cuts now than in April of any recent year, so that’s a pretty weak signal.

www.housingwire.com

www.housingwire.com

Home sellers are returning to the market

In addition to a higher number of new listings, more new contracts were started this week than at any time in 2023Unsold inventory now is almost 32% higher than at this time last year — and it’s 90% higher compared to the end of April 2022. Two years ago, inventory was jumping along with mortgage rates.

The takeaway here is that inventory gains are happening pretty much everywhere but at a significantly higher rate in the Sun Belt states — from Florida to Texas and Arizona.

But there are more homes with price cuts now than in April of any recent year, so that’s a pretty weak signal.

Home sellers are returning to the market - HousingWire

The weekly volume of new listings is higher than at any time last year. And growth is happening in most places, with Florida and Texas leading the way.