usctrojancpa

Well-known member

NewtoIrvine1 said:USCTrojanCPA said:NewtoIrvine1 said:I work in an industry that deals with rates... won't mention which but the general belief is now that we are going to see an actual functioning government that will provide fiscal stimulus in the form of infrastructure spending and tax cuts

Those two factors paired together will provide a net boost to GDP of 1.5-3% a year in the short term as corporate taxes get shifted to 15% and infrastructure spending flow into the economy. At the end of the day that will also add 5 trillion more onto the national debt notionally and drive rates further upwards as we balloon out the deficit.

By also boosting GDP it will spark inflation especially with the anti trade talks trump has suggested during the campaign so with rising inflation and rising GDP the fed will be able to raise rates at a much faster pace than anticipated by the market and you can see the reaction the last few days. The Chinese will also be labeled a currency manipulator and overall that effect will be interesting to see what happens there.

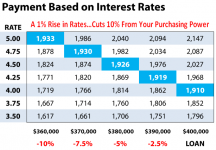

What does that mean for Irvine real estate.... Rates going up. We are already up 20 BP in the last 2 days and it will go much higher rates will probably go to the 5-6% area if i had to guess and that will put pressure on home prices as affordability collapses and incomes still hadn't caught up. The Chinese buying should also slow down as well especially if Trump's currency manipulator rhetoric come to fruition but we will see. I see this as a net drag on housing as the biggest effect will be interest rate going up faster than anyone expected. The base case was for lower for longer and slower rate hikes in washington gridlock and now we might actually have meaningful fiscal policy

To have sustainable inflation, you need wage inflation. No wage inflation = not enough dollars chasing the same goods to drive up prices. Don't expect a lot of get done, despite Trump winning. Unless the rest of the world's economies improve and move off of their zero interest rate policies, don't expect the fed funds rate to go that much higher. I expect growth to stay around 2-2.5% per year on average going forward.

That exactly is part of Trump's plan it will cause wage inflation. The USA has never embarked on large scale infrastructure spending when unemployment has been at 5% , that will put pressure on wages as construction job get created in en mass across the country. As i said it has been 6 year since we have actually seen meaningful fiscal policy and this time around it won't be in the middle of the biggest financial crisis since the great depression.

The fed will be forced to act to counteract the fiscal stimulus running inflation up. It's no coincidence that the market reacted the way it did. 20% tax cut to corporation=more profit for SP500 companies= equities rally. Part of Trump's plan is to borrow heavily to build infrastructure and lower taxes creating more debt thus selling off treasuries.

On top of that the Chinese have already started to devalue the Yuan in anticipation of tariff and headwinds which will put pressure on Irvine FCB as their cash devalues furtherhttp://finance.yahoo.com/quote/usdcny=x?ltr=1. The currency is now back to where it was before they removed the peg

Until I see large infrastructure spending bills passed, I won't hold my breathe. Remember that the Republican congress will keep Trump at bay. One thing I can see getting approved is the Keystone pipeline and that will put pressure on oil prices as it will increase supply. I also hardly doubt that they'll cut the corporate tax rate by 20%....maybe 10% or less is what I think will happen. What they'll push for is to bring back the cash that all these companies have sitting in other countries back here. Just because Trump said that he was going to do those things doesn't mean that he'll get his way with them...things have to be run through the congress.