You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

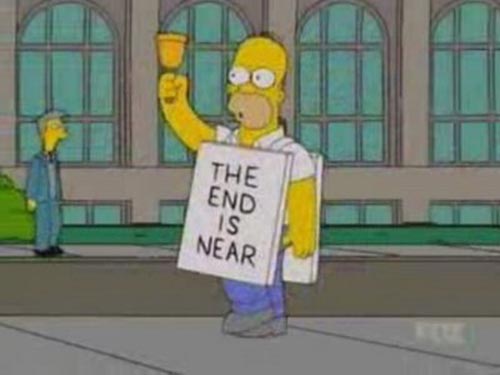

The end is nigh-- again?

- Thread starter O Hills

- Start date

Irvinecommuter

New member

I don't know where the top is. I don't think stocks will go up much more but the issue that there is nowhere else to park money. Europe is still a disaster. BRIC countries are extremely risky. Japan is still stagnant. That's why bond yield have fallen to 52-week lows and gold is off 40% from its highs.

The US have the best economic numbers now and in the near future. Jobs and GDP growth are steady and good. US is a mature market and no signs of a downturn.

The US have the best economic numbers now and in the near future. Jobs and GDP growth are steady and good. US is a mature market and no signs of a downturn.

irvinehomeowner

Well-known member

18k DOW?

Incontheevable!

Incontheevable!

irvinehomeowner said:18k DOW?

Incontheevable!

I remember last year when it was at 14k, I heard a talking head saying the Dow could hit 20K.

Shook my head and laughed.

Doesn't seem quite as outlandish now.

But this has been a long rally and we're well above pre-ressession levels.

I think a correction/pull back (remember those?) is a near certainty.

The only question is when.

The US economy will continue to grow, no recession in sight for 2015. However, stock market is such a drama queen and will overreact to every little things.

The market correction might happen Q1 or Q2 of 2015 due to QE is ending, possible of repeat government shoutdown, and economy is heating up and lead to the small increase of interest rate.

The question is which event will trigger the correction.

I'm waiting for the correction as well, planning to slash my stock/mutual fund holding significantly by year end.

The market correction might happen Q1 or Q2 of 2015 due to QE is ending, possible of repeat government shoutdown, and economy is heating up and lead to the small increase of interest rate.

The question is which event will trigger the correction.

I'm waiting for the correction as well, planning to slash my stock/mutual fund holding significantly by year end.

Irvinecommuter

New member

lnc said:The US economy will continue to grow, no recession in sight for 2015. However, stock market is such a drama queen and will overreact to every little things.

The market correction might happen Q1 or Q2 of 2015 due to QE is ending, possible of repeat government shoutdown, and economy is heating up and lead to the small increase of interest rate.

The question is which event will trigger the correction.

I'm waiting for the correction as well, planning to slash my stock/mutual fund holding significantly by year end.

I think the Fed has done a good job of warning the market about the end of free money and Fed stimulus. The market freaked out a little earlier this year but a lot of the impact had been taken out because the Fed warned about the end of QE like a year prior.

morekaos

Well-known member

If you really look at the numbers the Dow began the year around 16572. At the current level of 17128 it has only net gained around 556 points in 9 months. That is a little over 3.3%. Doesn't look so gangbusters when you look at it from that perspective. That 3.3% could disappear in a nono-moment of flash trading. Flat to down is where I still think we will end the year.

zubs

Well-known member

After all that's said and done, the only strategy I'm employing now is to buy and hold.

I had bought stock in MAR of 2009 when the S&P hit 666, and sold at the end of 2009. That was a mistake.

So now I just use Warren Buffets strategy, which is to buy a good company and hold it til I'm 70...I should be a billionaire by then.

By good company I mean one that will still be around in 50 years.

I had bought stock in MAR of 2009 when the S&P hit 666, and sold at the end of 2009. That was a mistake.

So now I just use Warren Buffets strategy, which is to buy a good company and hold it til I'm 70...I should be a billionaire by then.

By good company I mean one that will still be around in 50 years.

J

jmoney74

Guest

I think equities are still decent in the short term. The economy is actually normalizing. Not like there are huge gains anymore.

irvinehomeowner

Well-known member

GOOG?zubs said:So now I just use Warren Buffets strategy, which is to buy a good company and hold it til I'm 70...I should be a billionaire by then.

By good company I mean one that will still be around in 50 years.

qwerty

Well-known member

irvinehomeowner said:GOOG?zubs said:So now I just use Warren Buffets strategy, which is to buy a good company and hold it til I'm 70...I should be a billionaire by then.

By good company I mean one that will still be around in 50 years.

Nike, Walmart, Home Depot, Disney, Costco

J

jmoney74

Guest

qwerty said:irvinehomeowner said:GOOG?zubs said:So now I just use Warren Buffets strategy, which is to buy a good company and hold it til I'm 70...I should be a billionaire by then.

By good company I mean one that will still be around in 50 years.

Nike, Walmart, Home Depot, Disney, Costco

I bought some DIS for my kid.. should have bought more. That company is just a juggernaut and more money to come.

jmoney74 said:qwerty said:irvinehomeowner said:GOOG?zubs said:So now I just use Warren Buffets strategy, which is to buy a good company and hold it til I'm 70...I should be a billionaire by then.

By good company I mean one that will still be around in 50 years.

Nike, Walmart, Home Depot, Disney, Costco

I bought some DIS for my kid.. should have bought more. That company is just a juggernaut and more money to come.

SBUX, XOM, BAC, FB, GE

irvinehomeowner

Well-known member

In 50 years, when EV is ARMtime, won't XOM be dead too?

qwerty said:i dont know about FB, i doubt they will be around in 50 years.

It will take them more than 50 years to burn through the mountains of cash they're sitting on.