morekaos

Well-known member

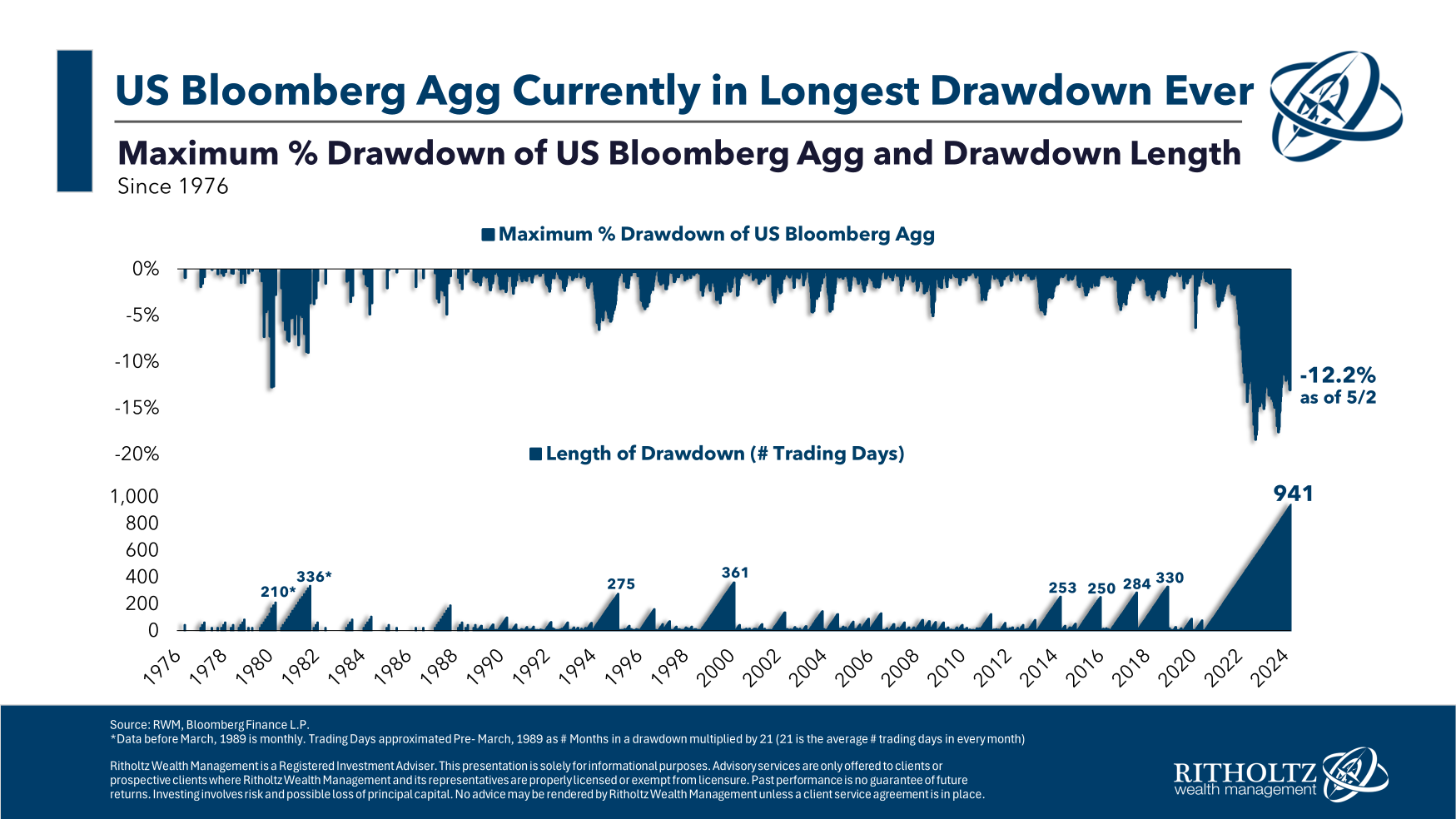

USCTrojanCPA said:Once the Fed is about done with raising rates, it might be a good time to buy 2-year bonds if they are offering 4.50% - 5.00% yields. If you get a Fed pivot within a year you can also get price appreciation on the bonds too and double dip.

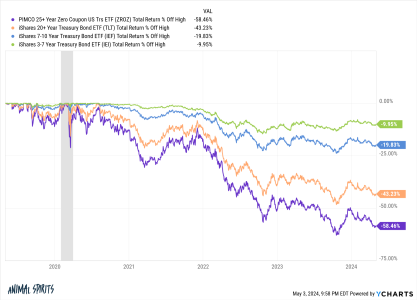

Use zero coupons and watch the yield curve? made a fortune in the 94-98 yield curve trade. Us gov Zero coupons are the most liquid and cheapest to trade