zubs

Well-known member

First it was toilet paper

Then it was dumb bells

Then it was bicycles

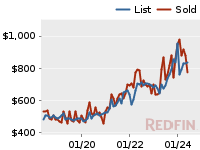

Now it's real-estate.

Also....cars...there are no cars for sale now!

Actually TP and dumb bells are back. I saw a lot of dumb bells at the Spectrum Target.

The other 3 not so much.

I bought a $1,000 computer 2 years ago. The same 2 year old computer goes for $1,500 today....weird right?

Then it was dumb bells

Then it was bicycles

Now it's real-estate.

Also....cars...there are no cars for sale now!

Actually TP and dumb bells are back. I saw a lot of dumb bells at the Spectrum Target.

The other 3 not so much.

I bought a $1,000 computer 2 years ago. The same 2 year old computer goes for $1,500 today....weird right?