ChasingRainbows

Member

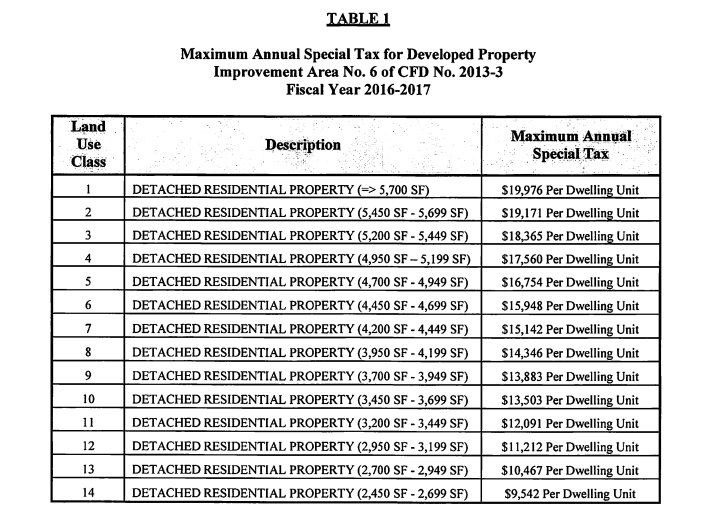

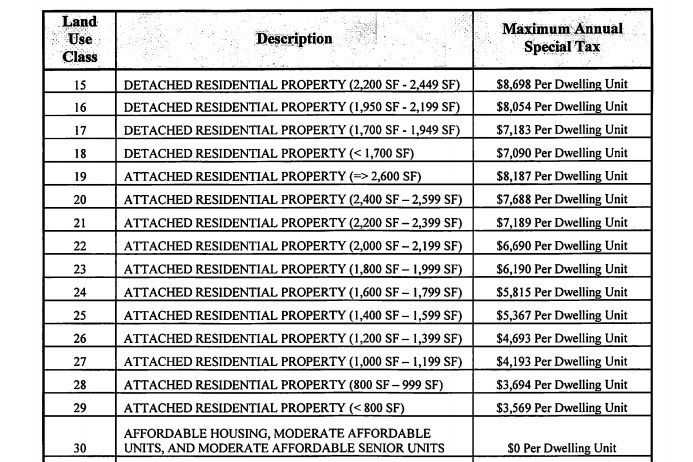

Does anyone know the R# of Orchard Hills Mello-Roos? Thanks.

ChasingRainbows said:Does anyone know the R# of Orchard Hills Mello-Roos? Thanks.

DrTravel said:I've attached the legal disclosure about the three Mello Roos components for Strada. No mention of any possible increase plus it gives dates when certain "taxes" go away.

Irvine Turtle said:OH Groves 1915 AD Bond Property Tax jumped 50% this year. Anyone on the non-gated side see similar jump?

That is because the other areas don't properly disclose the fact that mella roos can go up by 2%. It is a misnomer that only Great Park's compound at 2% per year. The other areas can also increase. That is all subject to obviously whomever is responsible / has approval to pull them up.Ready2Downsize said:I thought that mello didn't increase in OH and PP but looking at a random sample of homes that have info for more than a year it looks like they do go up 2% a year.