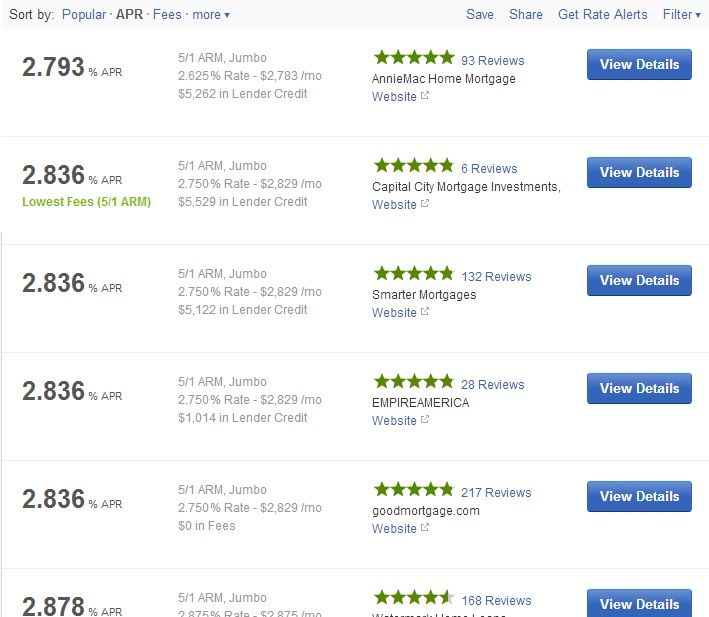

Those 2.875% "True Jumbo" 5/1 ARM rates are legitimate and you can get them from brick and mortar banks as well. Here's the difficulty:

1) Does a 760 credit score get me that rate? Perhaps not.

2) Is less than 24 months of cash reserves gonna get me that rate? Perhaps not.

3) Attached properties work at 2.875%? No, not at this time.

4) Want to pay your taxes and insurance on your own? Sorry, not at that 2.875% rate. How's 3.125%?

It takes a lot of weaving in and out while jumping up and down, like a running back heading down field against a strong defense for a borrower to get a rate like what's posted on line. These unbelievable terms exist, but not everyone has the superstar credentials to get them.

PS - Don't expect many of these refi-heavy lenders to stick around much longer. Case in point: CashCall filed a WARN notice with the State regarding 700+ workers to get the boot in December. Expect some of the others (GreenLight, Provident, etc) to do the same pretty soon.

My .02c