A similar one for the US was posted.

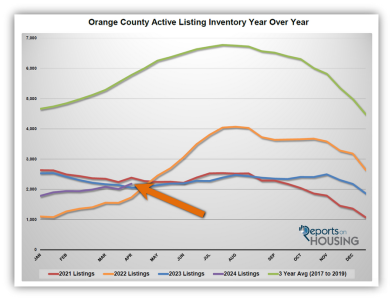

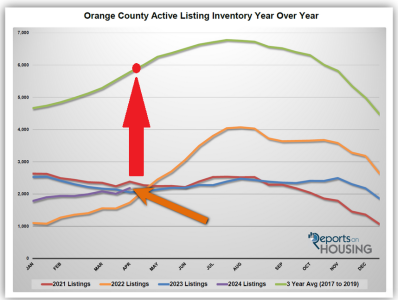

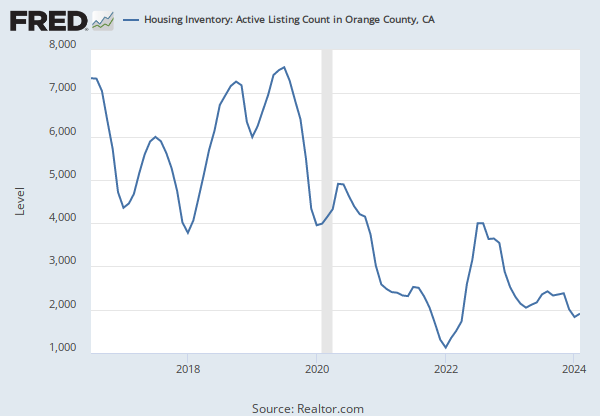

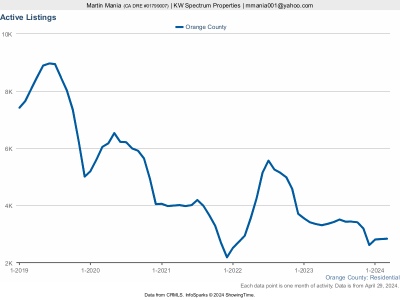

Shows the same trend, during non-Covid times, when rates were sub 5%, Inventory was average 5-6k. During Covid, it dropped and then in 2022 when rates rose, once they stabilized at higher interest (because you can still get jumbos cheap), inventory tapered off and if you can read the chart... current inventory levels are less than half of what they were prior to 2020.

But never mind those silly numbers... according to someone, higher rates are going to push inventory back up to 7k.

And just to be clear... I did not say higher rates will push inventory lower... I said inventory will probably reman at low levels compared to when we had lower rates pre-Covid because logically... anyone locked in to low rate will not want to sell and rebuy at higher prices and higher rates.